SCARS Institute’s Encyclopedia of Scams™ Published Continuously for 25 Years

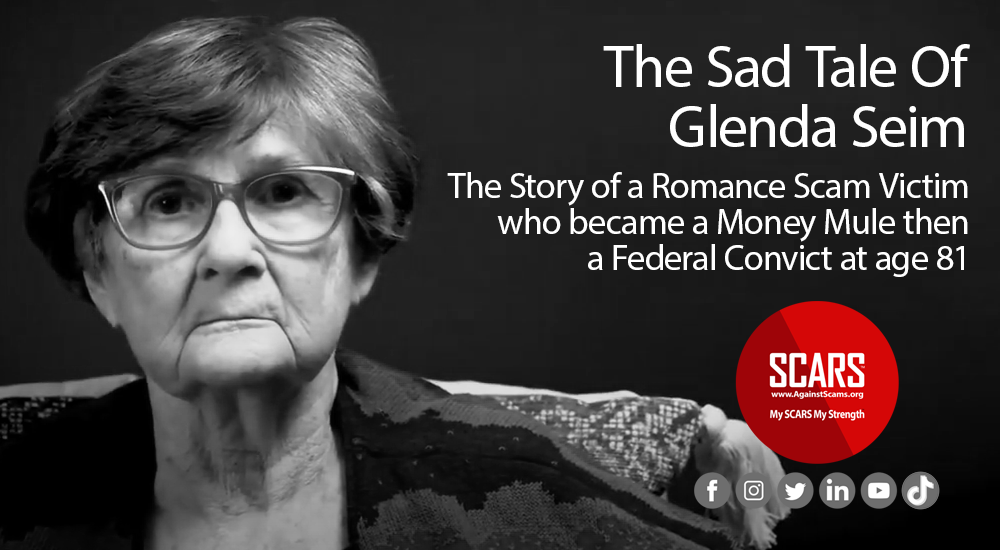

Glenda Seim, Convicted Money Mule!

An 81-Year-Old Kirkwood Woman Pleaded Guilty To Being A “Money Mule” For An Online Scammer

81-year-old Kirkwood, Missouri woman pleads guilty to being “money mule”

An 81-year-old Kirkwood woman pleaded guilty to being a “money mule” for an online scammer.

Glenda Seim made the plea to U. S. District Court Judge Stephen Clark on November 2 for two counts of identity theft.

In a release from the Department of Justice, Eastern District of Missouri, a “money mule” is described as a person who receives stolen money and merchandise for a scammer and then sends the proceeds to the scammer.

In 2014, Seim started an online relationship with a person who claimed to be an American citizen with business interests in Nigeria. The scammer would ask her to send him money for what he claimed were fees, taxes, and penalties for the Nigerian government or business associates.

Seim also began sending him her Social Security retirement benefits and pension.

The scammer also had Seim pawn electronic equipment he mailed to her, and she sent the money back.

Seim also began receiving MoneyGram wire transfers from people she did not know, depositing counterfeit and stolen checks, allowing the scammer to transfer stolen money to her, and accepting unemployment benefits for people she did not know.

Seim also deposited a $100,000 check stolen in a romance fraud scheme.

Officials say Seim continued to give the scammer money, despite warnings from wire transfer agencies, law enforcement officials, bank officials, and even though her financial accounts were forcibly closed.

Between June 2014 and February 2021, Seim tried to conduct transactions between $550,000 and $1,500,000.

81-Year-Old Woman Helped Online Scammers Steal As Much As USD$1.5M

According to the United States Department of Justice:

United States District Court Judge Stephen R. Clark accepted a plea of guilty from Glenda Seim, 81 years old of Kirkwood, Missouri on November 2, 2021 for two counts of identity theft related to her participation as a “money mule” in various fraudulent schemes on behalf of her online romantic interest. A grand jury in the Eastern District of Missouri previously indicted Seim for the charges.

A “money mule” is a person who receives fraudulently obtained money and merchandise on behalf of a scammer, and then forwards the proceeds to the scammer.

Sometime during 2014, Seim began an online relationship with an individual who claimed to be a United States citizen with business interests in Nigeria. Throughout the years, Seim’s purported romantic interest would ask for her assistance in paying fees, taxes, and penalties to the Nigerian government or his business associates. He claimed that he could not leave Nigeria unless he paid those funds. Despite having never met her romantic interest in person or communicated with him in any form other than texting, Seim began sending him money from her Social Security retirement benefits and pension. He later asked her to pawn electronic equipment that he had others send to her in the mail and forward the funds to him.

Because the return was not as high as he wanted, Seim began participating in other fraudulent schemes including: receiving MoneyGram wire transfers from senders she did not know; depositing counterfeit and fraudulently obtained checks into financial accounts she opened; allowing her romantic interest to fraudulently transfer funds from the financial accounts of various businesses into her financial accounts; and accepting unemployment insurance benefit payments on behalf of individuals she did not know. A check drawn on the retirement account of a romance fraud victim in the amount of $100,000 was among Seim’s fraudulent deposits. Seim kept a portion of the funds fraudulently obtained before providing the balance to her online romantic partner.

Despite warnings by wire transfer agencies, local police officers, federal law enforcement representatives, and bank representatives and the forced closing of her financial accounts, Seim continued to facilitate the transfer of funds on behalf of her online romantic interest. Between June 2014 and February 2021, Seim attempted to conduct fraudulent transactions between $550,000 and $1,500,000.

Seim is scheduled to be sentenced on February 10, 2022.

The case was investigated by the Federal Bureau of Investigation and the United States Secret Service.

This Is A Particularly Sad Case

Glenda was clearly manipulated and controlled by the scammers engineering the romance scam and the subsequent activities.

As we know, romance scams are especially powerful both in their psychology and in the level of manipulation that can be employed against a victim. And while clearly, this victim was warned by authorities, she was powerless to stop. However, instead of a proper psychiatric determination, the government decided to prosecute.

To make a determination from a distance is very hard, but seeing the above video leads to an inescapable conclusion that she still exists in substantial denial. She shows hallmarks of trauma in her demeanor as well.

As we have written about many times, the level of manipulation that victims go through is extraordinary. Significant trauma can result with the ending of a romance scam and it is natural for a victim to avoid that ending by living in a state of denial.

LEARN MORE ABOUT MONEY MULES HERE!

What is especially striking in this case, and in most others of elderly victims that were converted into money mules or even accomplices, is that they did this will under the full control of the criminals. Putting someone like this through a trial and conviction and sentencing is cruel and unnecessary. This is a mental health issue not a criminal justice issue.

In no way do we condone her actions, but these were not the actions of a person who had otherwise led a life of morality and integrity. These were the actions of someone under the control and manipulation of professional criminals focused only on their own gain.

Unfortunately, this is the model that law enforcement is increasingly turning to, to stop money mules. Arresting and prosecuting them, instead of institutional mental healthcare.

As long as there are romance scams, and as long as there are romance scam victims, there will be money mules who live in such denial that they cannot accept reality. But we need to find a better way to end their activities with greater compassion because the difference between a normal scam victim and someone like this is the slimmest of margins.

Resources

To learn more about money mules and how to stop or help them we suggest the following:

- 5 Steps Guide For Money Mules

- Find a trauma counselor or therapist: https://www.psychologytoday.com/us/therapists/trauma-and-ptsd

- Find a criminal law attorney: Criminal Law – FindLaw

SCARS RSN Articles About Mules:

- What Is A Money Mule? – An Overview

- Money Laundering Presents Grave Dangers For Scam Victims & Mules

- Money Mule Series: About Banking & Legal Responsibility

- All About Money Mules

- Scam Victims & Violating The Law

- Giving Out Your Banking Information – SCARS™ Scam Warning

- What Are Scammer Money Mules?

- Understanding and Protecting Yourself Against Money Mule Schemes

- The Difference Between A Scammer’s MULE and a MOLE

- Landmark Case Changes Everything For Money Mules

- Criminal Crack Down On Money Mules Worldwide

- Europe Continues The Global Crackdown On Money Mules

- Missouri Money/Parcel Mule Convicted

- Another Senior Faces Jail As A Scammer Drug Mule

- Scam Basics: From Victim To Criminal

- FBI Warning About Scammers Recruiting Mules

- Rubberband Bank Wire Transfer Scams [Infographic]

- Why Reporting Matters?

- Editorial: Attitudes Are Changing

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment below!

Table of Contents

- The Story of a Romance Scam Victim who became a Money Mule then a Federal Convict at age 81

- An 81-Year-Old Kirkwood Woman Pleaded Guilty To Being A “Money Mule” For An Online Scammer

- 81-Year-Old Woman Helped Online Scammers Steal As Much As USD$1.5M

- According to the United States Department of Justice:

- This Is A Particularly Sad Case

- LEARN MORE ABOUT MONEY MULES HERE!

- Resources

- SCARS RSN Articles About Mules:

LEAVE A COMMENT?

Thank you for your comment. You may receive an email to follow up. We never share your data with marketers.

Recent Comments

On Other Articles

- on Finally Tax Relief for American Scam Victims is on the Horizon – 2026: “I just did my taxes for 2025 my tax account said so far for romances scam we cd not take…” Feb 25, 19:50

- on Reporting Scams & Interacting With The Police – A Scam Victim’s Checklist [VIDEO]: “Yes, this is a scam. For your own sanity, just block them completely.” Feb 25, 15:37

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “She goes by the name of Sanrda John now” Feb 25, 10:26

- on Reporting Scams & Interacting With The Police – A Scam Victim’s Checklist [VIDEO]: “So far I have not been scam out of any money because I was aware not to give the money…” Feb 25, 07:46

- on Love Bombing And How Romance Scam Victims Are Forced To Feel: “I was love bombed to the point that I would do just about anything for the scammer(s). I was told…” Feb 11, 14:24

- on Dani Daniels (Kira Lee Orsag): Another Scammer’s Favorite: “You provide a valuable service! I wish more people knew about it!” Feb 10, 15:05

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “We highly recommend that you simply turn away form the scam and scammers, and focus on the development of a…” Feb 4, 19:47

- on The Art Of Deception: The Fundamental Principals Of Successful Deceptions – 2024: “I experienced many of the deceptive tactics that romance scammers use. I was told various stories of hardship and why…” Feb 4, 15:27

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “Yes, I’m in that exact situation also. “Danielle” has seriously scammed me for 3 years now. “She” (he) doesn’t know…” Feb 4, 14:58

- on An Essay on Justice and Money Recovery – 2026: “you are so right I accidentally clicked on online justice I signed an agreement for 12k upfront but cd only…” Feb 3, 08:16

ARTICLE META

Important Information for New Scam Victims

- Please visit www.ScamVictimsSupport.org – a SCARS Website for New Scam Victims & Sextortion Victims

- Enroll in FREE SCARS Scam Survivor’s School now at www.SCARSeducation.org

- Please visit www.ScamPsychology.org – to more fully understand the psychological concepts involved in scams and scam victim recovery

If you are looking for local trauma counselors please visit counseling.AgainstScams.org or join SCARS for our counseling/therapy benefit: membership.AgainstScams.org

If you need to speak with someone now, you can dial 988 or find phone numbers for crisis hotlines all around the world here: www.opencounseling.com/suicide-hotlines

A Note About Labeling!

We often use the term ‘scam victim’ in our articles, but this is a convenience to help those searching for information in search engines like Google. It is just a convenience and has no deeper meaning. If you have come through such an experience, YOU are a Survivor! It was not your fault. You are not alone! Axios!

A Question of Trust

At the SCARS Institute, we invite you to do your own research on the topics we speak about and publish, Our team investigates the subject being discussed, especially when it comes to understanding the scam victims-survivors experience. You can do Google searches but in many cases, you will have to wade through scientific papers and studies. However, remember that biases and perspectives matter and influence the outcome. Regardless, we encourage you to explore these topics as thoroughly as you can for your own awareness.

Statement About Victim Blaming

SCARS Institute articles examine different aspects of the scam victim experience, as well as those who may have been secondary victims. This work focuses on understanding victimization through the science of victimology, including common psychological and behavioral responses. The purpose is to help victims and survivors understand why these crimes occurred, reduce shame and self-blame, strengthen recovery programs and victim opportunities, and lower the risk of future victimization.

At times, these discussions may sound uncomfortable, overwhelming, or may be mistaken for blame. They are not. Scam victims are never blamed. Our goal is to explain the mechanisms of deception and the human responses that scammers exploit, and the processes that occur after the scam ends, so victims can better understand what happened to them and why it felt convincing at the time, and what the path looks like going forward.

Articles that address the psychology, neurology, physiology, and other characteristics of scams and the victim experience recognize that all people share cognitive and emotional traits that can be manipulated under the right conditions. These characteristics are not flaws. They are normal human functions that criminals deliberately exploit. Victims typically have little awareness of these mechanisms while a scam is unfolding and a very limited ability to control them. Awareness often comes only after the harm has occurred.

By explaining these processes, these articles help victims make sense of their experiences, understand common post-scam reactions, and identify ways to protect themselves moving forward. This knowledge supports recovery by replacing confusion and self-blame with clarity, context, and self-compassion.

Additional educational material on these topics is available at ScamPsychology.org – ScamsNOW.com and other SCARS Institute websites.

Psychology Disclaimer:

All articles about psychology and the human brain on this website are for information & education only

The information provided in this article is intended for educational and self-help purposes only and should not be construed as a substitute for professional therapy or counseling.

While any self-help techniques outlined herein may be beneficial for scam victims seeking to recover from their experience and move towards recovery, it is important to consult with a qualified mental health professional before initiating any course of action. Each individual’s experience and needs are unique, and what works for one person may not be suitable for another.

Additionally, any approach may not be appropriate for individuals with certain pre-existing mental health conditions or trauma histories. It is advisable to seek guidance from a licensed therapist or counselor who can provide personalized support, guidance, and treatment tailored to your specific needs.

If you are experiencing significant distress or emotional difficulties related to a scam or other traumatic event, please consult your doctor or mental health provider for appropriate care and support.

Also read our SCARS Institute Statement about Professional Care for Scam Victims – click here to go to our ScamsNOW.com website.

![About Sextortion Scams - Documentary - A Victim's Story - 2024 [VIDEO] Teen Sextortion Scams 2024 About Sextortion Scams - Documentary - A Victim's Story - 2024 [VIDEO] - on SCARS RomanceScamsNOW.com - The Encyclopedia of Scams](https://romancescamsnow.com/wp-content/uploads/2024/06/Teen-Sextortion-Scams-2024.png)

![A Romance Scam Victim's Story: The Story of a Romance Scam Victim [Video] - 2019/2024 A romance Scam Victims Story 2024 A Romance Scam Victims Story 2024 - on SCARS RomanceScamsNOW.com](https://romancescamsnow.com/wp-content/uploads/2019/11/A-romance-Scam-Victims-Story-2024.png)

![Telling Your Story - Especially When It Is Hard [VIDEO] 2023 What Every Victim Need To Understand What Every Scam Victims Need To Understand - a SCARS Series on RomanceScamsNOW.com The Basics For New Victims Scam Victim Recovery - A SCARS Insight](https://romancescamsnow.com/wp-content/uploads/2023/01/2023-What-Every-Victim-Need-To-Understand.png)

I wouldn’t fall for that, as soon as money is mentioned, I would treat it as a scam and cut them off, once I wasted their time.

Famous last words! Everyone can be scammed. Believing that you cannot makes you an ideal candidate. This is not about pride or what you know, those are just cognitive biases, it is about behaviors. But yes, this is a more extreme case, but also very common. Thousands are no being held to account each year.