All About Money Mules

Portions Provided By: U.S. Department of Justice, Federal Bureau of Investigation, Money Laundering, Forfeiture, and Bank Fraud Unit

What Is a Money Mule?

A money mule is someone who transfers illegally acquired money on behalf of or at the direction of another person.

Criminals recruit mules to move money electronically through bank accounts, move physical currency, or assist the movement of money through a variety of other methods. Once received, the mule will wire the money into a third-party bank account; “cash out” the money received, possibly via several cashier’s checks; convert the money into a virtual currency; convert the money into a prepaid debit card; send the money through a money service business; or conduct a combination of these actions. Money mules are inherently dangerous, as they add layers to the money trail from a victim to a criminal actor.

Such An Ugly Term

The term “money mule” is thought to have originated in the early 2000s, when criminals began using unsuspecting people to launder money. The term is a reference to the fact that these people are essentially being used as pack animals to transport money, much like mules are used to transport goods.

The term “money mule” is often used interchangeably with the term “money laundering,” but there is a distinction between the two. Money laundering is the process of concealing the origins of illegally obtained money. Money mules are people who are used to facilitate money laundering by transferring money from one account to another.

Money mules can be recruited online or in person. They are often promised easy money or other incentives. However, they are unaware that they are helping criminals launder money. In some cases, money mules are even unaware that the money they are transferring is illegal.

Money muling is a serious crime. If you are caught being a money mule, you could face criminal charges. You could also be held liable for any financial losses that the other victims of the crime suffer.

However, we are here to support you. We know you are also a victim. Make sure you read this article completely, and other others we have available for money mules. You are also welcome to sign up for our Scam Victims Support & Recovery program at support.AgainstScams.org

Money Mule Indicators

You may be a money mule if….

- You received an unsolicited email or contact over social media which promises easy money for little or no effort.

- The “employer” you communicate with uses web-based services such as (Gmail, Yahoo, Hotmail, Outlook, etc.).

- You are asked to open a bank account in your own name, or in the name of a company you form, to receive and transfer money for someone else.

- As an employee, you are asked to receive funds in your bank account and then “process” or “transfer” funds via: wire transfer, ACH, mail, or money service business such as Western Union or MoneyGram.

- You are told to keep a portion of the money you transfer for yourself.

- Your duties have no specific job description.

- Your online companion, whom you have never met in person, asks you to receive money and then forward these funds to one or more individuals you do not know.

Where Are Money Mules Recruited?

- Online job websites

- Online dating websites

- Social networking websites

- Online classifieds

- Email Spam

- Darkweb Forums

Where Does The Money Come From?

Criminals obtain money through various illegal acts. These criminals then need someone (a money mule) to move this money at their direction.

Common Criminal Activities Involving Money Mules:

- Internet-enabled Frauds:

- Business Email Compromise

- Online Job Scam

- Work From Home Scam

- Romance Scam

- Mystery Shopper Scam

- Advance Fee Scheme

- Reshipping Scam

- Grandparent Scam

- Lottery Scam

- IRS or Law Enforcement Impersonation Scam

- Technical Support Scam

- Credit Card Fraud

- Drug Trafficking

- Human Trafficking

- Wildlife Trafficking

- Other Illegal Commerce

More details about the above-mentioned scams can be found on our website or www.FBI.gov

Money Mules Are Vital To Criminals

What to do if you are a Money Mule…

- STOP communication with any suspected criminals

- STOP transferring money or any other items of value

- MAINTAIN any receipts, contact information, and relevant communications (emails, chats, text messages)

- NOTIFY Law Enforcement immediately

- CONTACT a criminal defense attorney to review your situation and liability

Who is at Risk?

- College students

- Those new to the country

- Small business owners

- Elderly individuals

- Recent retirees

- Those looking for a job

- Those looking for a relationship

- Those with memory loss

- Anyone… Anywhere… Anytime!

How To Protect Yourself

- A legitimate company will not ask to use your own bank account to transfer their money. Do not accept any job offers asking you to do this.

- Be wary when an employer asks you to form a company in order to open up a new bank account.

- Never give your financial details to someone you do not know and trust, especially if you met them online.

- Be wary when job advertisements are poorly written with grammatical errors and spelling mistakes.

- Be suspicious when the boyfriend/girlfriend you met on a dating website wants to use your bank account for receiving and forwarding money.

- Conduct online searches to verify and corroborate any questionable information provided to you.

- Ask the employer, “Can you send a copy of the license/permit to conduct business in my county & state?”

The Money Mule’s Role In The Money Laundering Cycle

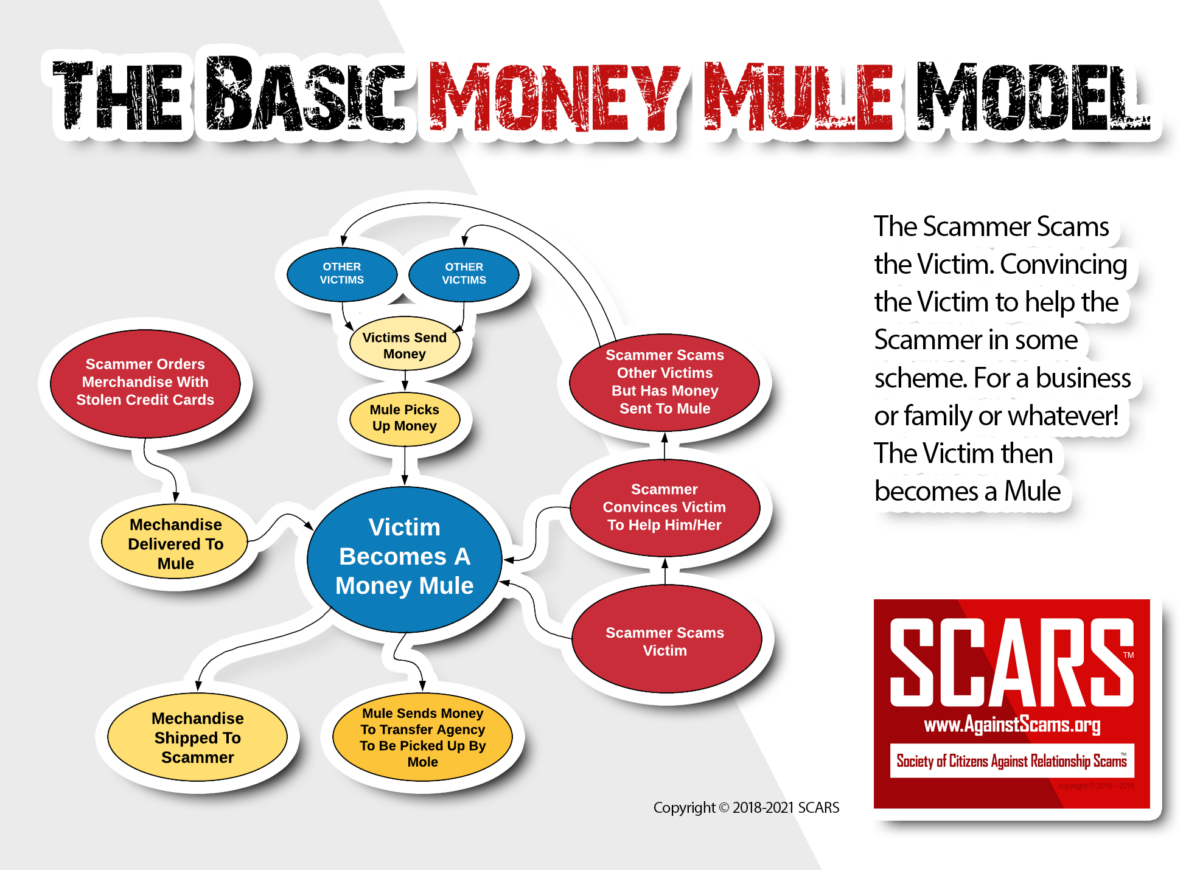

Placement

The movement of funds to a money mule, often by wire transfer deposit into the money mule’s bank account

-

- In this phase, a victim or a criminal provides money to the money mule to move, based on the criminal’s instruction.

- Some money mules never touch a computer.

Layering

Money is moved from the initial money mule account to other money mule accounts or other criminals involved in the scheme.

-

- In this phase, funds are moved among money mules and criminals and possibly split into multiple transactions or converted into additional forms of value. These might include:

- wire transfers

- cashier’s checks

- virtual currency

- or physical cash.

- In this phase, funds are moved among money mules and criminals and possibly split into multiple transactions or converted into additional forms of value. These might include:

Integration

The movement of laundered money back into the financial system.

Why Do Criminals Use Money Mules?

Money mules are used to facilitate the movement of criminal proceeds – whether from fraud, such as a Business Email Compromise or other crime – the mules are the commonality.

The money moved by money mules belongs to the victims – it does not belong to the criminals, the banks, or the money mules.

The role of a Money Mule is often very straightforward – with very little “cyber” expertise required.

- Speed – Criminals believe they can direct the movement of victim funds through money mules, faster than law enforcement can keep track. This is not always true.

- Low Cost – If the money mule takes a percentage of the money, this is victim money which never actually belonged to the criminal.

- Low Risk – Each money mule adds one more level of distance between the victim and criminal actors.

- Evolution of Crime – Criminals adapt their behaviors as necessary, based on the evolution of law enforcement and financial sector practices.

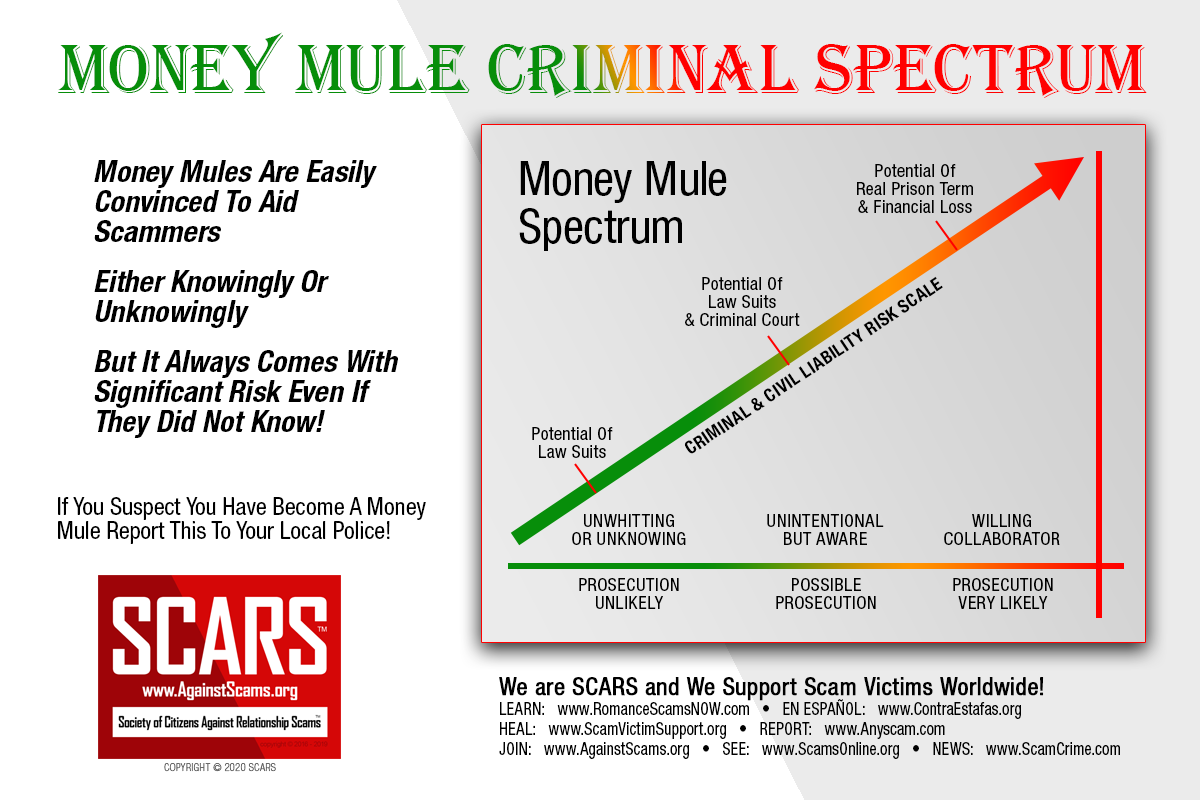

Classification Of Money Mules – The Money Mule Complicity Spectrum

Unwitting or Unknowing: Individuals unaware they are part of a larger criminal scheme

- Often solicited via an online romance scheme or online job scheme.

- Asked to use their established personal bank account or open a new account in their true name to receive money from someone they have never met in person.

- May be told to keep a portion of the money they transferred.

- Motivation: Trust in the actual existence of their romance or job position.

Witting: Individuals who choose to ignore obvious red flags or act willfully blind to their money movement activity

- They may have been warned by bank employees they were involved with fraudulent activity.

- They open accounts with multiple banks in their true name.

- They may have been unwitting at first but continued communication and participation.

- Motivation: Financial gain or an unwillingness to acknowledge their role (denial).

Complicit: Individuals aware of their role as a money mule and complicit in the larger criminal schemes

- Serially open bank accounts to receive money from a variety of individuals/businesses for criminal reasons.

- Advertise their services as a money mule, including what actions they offer and at what prices. This may also include a review and/or rating by other criminal actors on the money mule’s speed and reliability.

- Travel, as directed, to different countries to open financial accounts or register companies.

- Operate funnel accounts to receive fraud proceeds from multiple lower-level money mules.

- Recruit other money mules.

- Motivation: Financial gain or loyalty to a known criminal group.

Potential Consequences for Money Mules

Money mules help criminals launder their proceeds derived from criminal activities, by adding layers of recipients to the money trail. These layers complicate and negatively impact the FBI’s ability to accurately trace the money from a specific victim to a criminal actor.

If you are a money mule you could be charged as part of a criminal money laundering conspiracy and potentially face the following consequences:

- Prosecution and incarceration: Money mules may be prosecuted by law enforcement for participating in criminal activities and sentenced to jail time.

- Compromised personal identifiable information: Money mules’ own personally identifiable information may be stolen by the very criminals they are working for and used for other criminal activities.

- Personal liability: Money mules may be held personally liable for repaying the money lost by victims.

- Negative impact on credit: Money mule activities may result in negative credit ratings.

- Permanent inability to open bank accounts: Money mule activities may result in banks refusing to open bank accounts in the future.

This is why it is essential that you report the crime to your local police as an innocent victim.

U.S. Federal Violations And Penalties

The following applies to money mules in the United States, but Europe and other countries have similar laws.

Possible U.S. Criminal Charges:

- Mail Fraud | 18 USC § 1341

Maximum 20 years imprisonment and/or $250,000 Fine. If a financial institution is affected – maximum $1M fine or 30 years imprisonment or both - Wire Fraud | 18 USC § 1343

Maximum 20 years imprisonment. If a financial institution is affected – maximum $1 M fine or 30 years imprisonment or both - Bank Fraud | 18 USC § 1344

Maximum $1M fine or 30 years imprisonment or both - Money Laundering | 18 USC § 1956

Maximum $500,000 or maximum 20 years imprisonment or both - Transactional Money Laundering | 18 USC § 1957

Maximum $250,000 or maximum 10 years imprisonment or both - Prohibition of Unlicensed Money Transmitting Businesses | 18 USC § 1960

Maximum 5 years imprisonment - Aggravated Identity Theft | 18 USC § 1028A

Imprisonment of 2 years, in addition to other punishments

Resources:

- How Money Mules Can Get Free Legal Aid (romancescamsnow.com)

- Support for Money Mules – visit support.AgainstScams.org

- Trauma counseling for scam victims and money mules – visit counseling.AgainstScams.org

- Reporting the crime to law enforcement – visit reporting.AgainstScams.org

More:

- How Money Mules Can Get Free Legal Aid (romancescamsnow.com)

- Are You A Money Mule? A SCARS 5 Steps Guide (romancescamsnow.com)

- Sending Money By FedEx To Scammers (romancescamsnow.com)

- From Victim To Criminal (romancescamsnow.com)

- What Is The Difference Between A MULE and a MOLE (romancescamsnow.com)

- Money Mules Initiative by the United States Department of Justice (romancescamsnow.com)

- New Global Interpol Campaign Against Money Mules [VIDEOS] (romancescamsnow.com)

- Money Mules & Money Laundering – Article Catalog (romancescamsnow.com)

- Category: ♦ ABOUT MONEY MULES (romancescamsnow.com)

PLEASE SHARE OUR ARTICLES WITH YOUR FRIENDS & FAMILY

HELP OTHERS STAY SAFE ONLINE – YOUR KNOWLEDGE CAN MAKE THE DIFFERENCE!

THE NEXT VICTIM MIGHT BE YOUR OWN FAMILY MEMBER OR BEST FRIEND!

By the SCARS™ Editorial Team

Society of Citizens Against Relationship Scams Inc.

A Worldwide Crime Victims Assistance & Crime Prevention Nonprofit Organization Headquartered In Miami Florida USA & Monterrey NL Mexico, with Partners In More Than 60 Countries

To Learn More, Volunteer, or Donate Visit: www.AgainstScams.org

Contact Us: Contact@AgainstScams.org

Leave A Comment