Money Mule Series: About Banking & Legal Responsibility

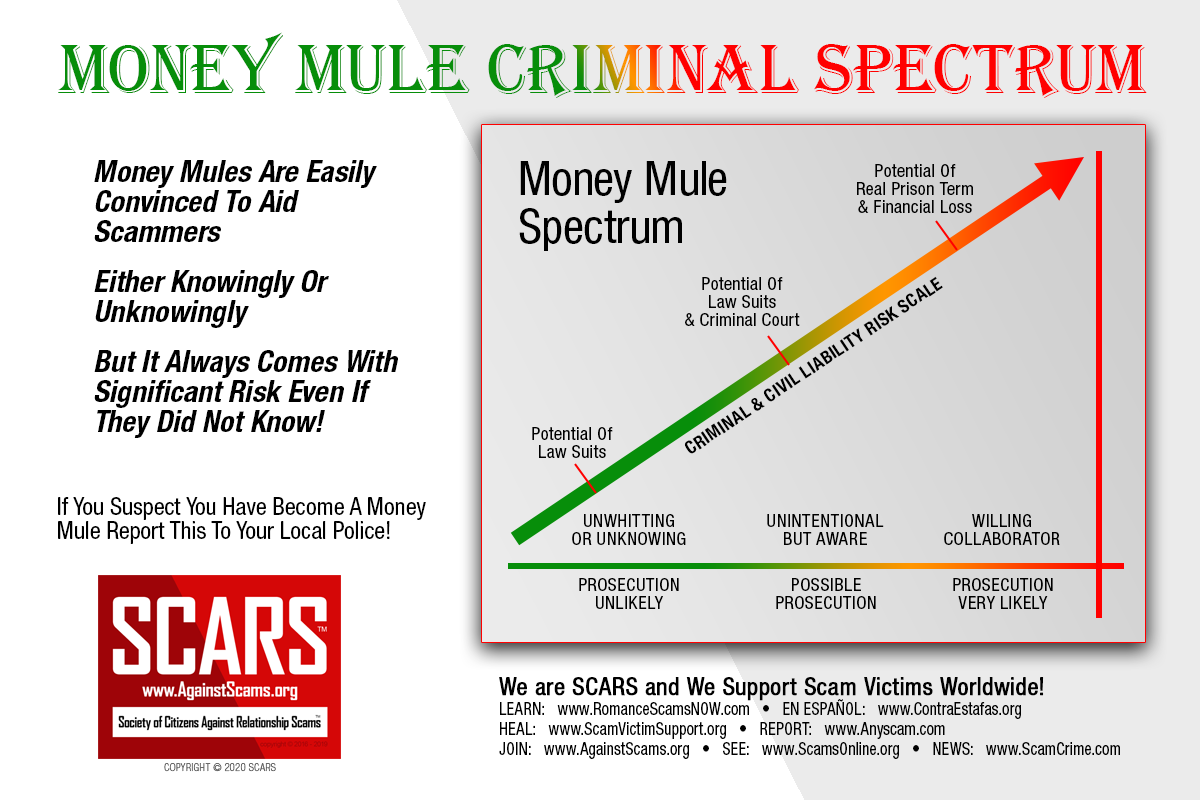

Engaging In Being A Money Mule Can Bring Serious Consequences

Understanding How To Protect Yourself Is Important

It Starts With Talking To The Police

Your Legal Responsibility

You Are Legally Responsible When You Cash Or Deposit A Draft Or Receive Funds Wired Into Any Of Your Accounts

YOU MAY BE BOTH CRIMINALLY AND CIVILLY LIABLE!

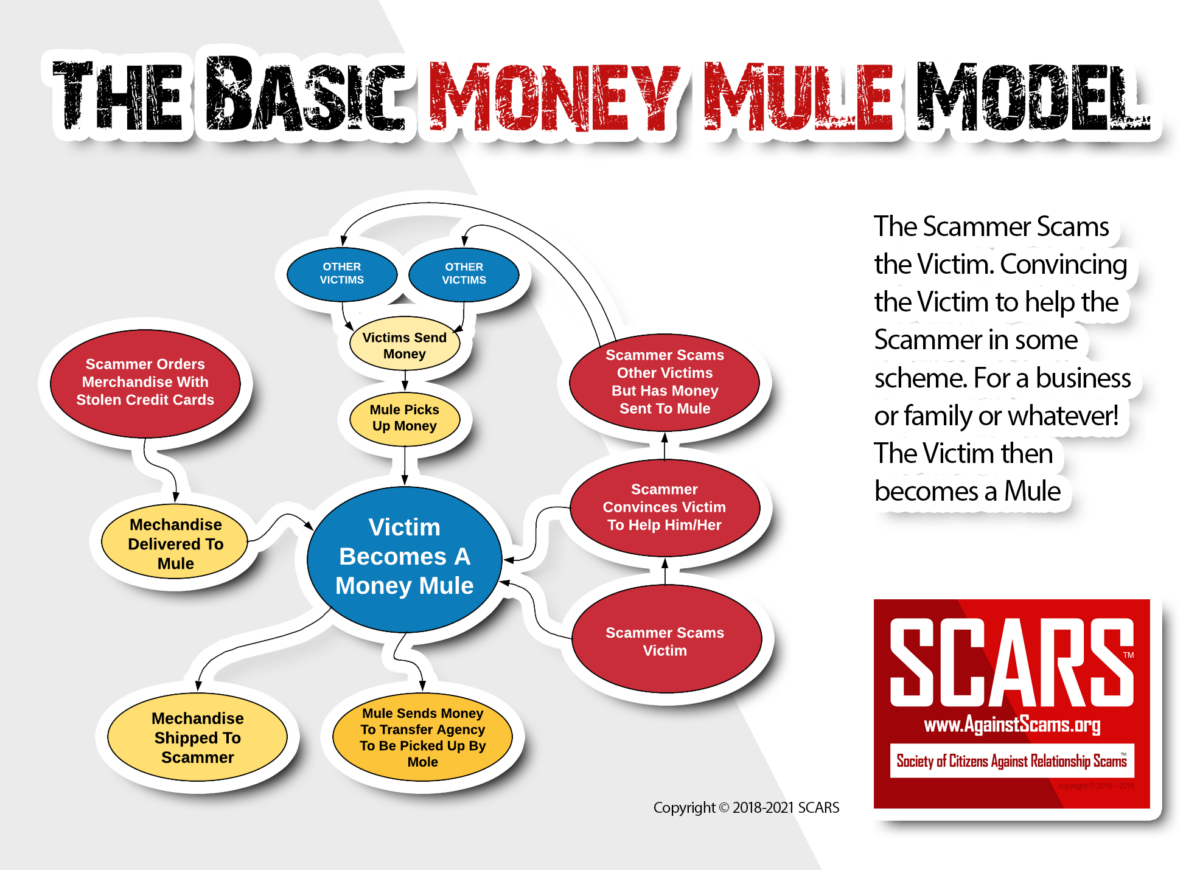

Nigerian (African), Asian, Indian, and Eastern European organized crime networks specialize in sending counterfeit checks and money orders to unsuspecting scam victims for the purpose of getting your money. They also have other victims send real money to their Mules for the purpose of making it easier to get that money – because the original victim is sending it to someone in their own country.

These same networks obtain the account information of their scam victims and wire money stolen from other account holders into the scam victim’s account.

In both instances, the scam victim is told to send a large portion of the money by Western Union or MoneyGram or bank wire transfers to false names, usually in foreign countries. The scam victim has now potentially engaged in money laundering, bank fraud, wire fraud, and other crimes. The victim who has become a mule will owe the entire amount of money she/he sent off to the scammers and is at high risk of being indicted for theft, forgery, and money laundering unless they come forward quickly to report to the police.

The Mechanics Of The Banking Process

As It Applies To Mules

One of the most common methods of scams is to send a check to a victim to be deposited and the money forwarded to the scammer’s account.

Never do this because you will be responsible on several levels both financially and legally.

Here is an explanation of how the process works so that you can better understand the dangers and how to avoid them if you do accept a check and deposit it.

What is A Draft?

A draft is a money order or any kind of check, including cashier’s checks and Treasury checks.

The check-cashing person and account holder responsibilities are the same in almost all countries:

You cannot rely on your bank, credit union, or check cashing store to protect you from counterfeit, stolen, or forged drafts.

It’s not their job to watch out for you, it is your job to watch out for them. Like you, merchants, banks, and credit unions have the rightful expectation of being given good money.

Depositing a bad-check can be a crime in limited cases if engaged in fraud.

By law, you are legally responsible and fully liable for any and all checks or money orders deposited into your bank account by you or someone else, and for any funds wired into any of your accounts by you or someone else.

You are 100% liable for any and all funds deposited into any of your accounts by any means whatsoever.

Funds wired into ANY of your accounts by a stranger may be stolen funds. This includes your checking, savings, credit card, portfolio, or any other account. You and your accounts can be used for money laundering.

What It Means When You Endorse A Draft:

When you endorse a draft (check/money order, etc.): You write your signature on the back of (a check, for example) as evidence of the legal transfer of its ownership, especially in return for the cash or credit indicated on its face.

When you sign your name on the back of any draft, you are signing a contract. Your signature means that you “endorse” the draft, which is to say that you are vouching for the trueness and creditworthiness of the draft and that you assume full responsibility for the draft plus any fees if there are any problems with it.

Verifying A Draft No Matter Where You Live:

The ONLY way to verify any draft, including Cashier’s Checks, is to contact the account holder’s bank and ask that the draft be verified against the account. You want to know if that draft was made out to you for that amount and if there are funds in the account to cover the check.

However, this does not mean the draft will “clear” meaning the money will be there when your bank presents the draft for payment. A draft may still “bounce” even if verified.

Caution: Do not call the phone number printed on the draft – these are often printed there by the counterfeiter. The phone number may is a phone used by scammers to verify counterfeit checks, usually an internet phone or prepaid, untraceable cell phone. Look up the bank’s information online and call them directly for “funds availability”

WARNING: NEVER TAKE THE MONEY OUT OF YOUR ACCOUNT UNTIL YOUR BANK TELLS YOU THE DRAFT HAS CLEARED. YOUR BANK WILL TYPICALLY ADVANCE YOU THE MONEY (GIVE YOU AN INTEREST-FREE LOAN) UNTIL IT CLEARS. BUT IF IT DOESN’T YOU HAVE TO PAY BACK THE MONEY YOU WERE ADVANCED. IN SOME PLACES THIS CAN BE CONSIDERED FRAUD AS WELL.

How To Verify:

IN ALL CASES LOOK THEM UP ONLINE – DO NOT SIMPLY USE THE INFORMATION PROVIDED BY THE SCAMMER

- Cashier’s checks: contact the issuing bank

- Corporate checks: contact the corporation; for large corporations, ask for the Accounting Department

- Money orders: contact the seller

- Treasury or Central Bank Checks: contact the office of issue

- Traveler’s Checks: contact the seller/issuer

- Electronic or ACH Checks: instruct your bank to send for Collection

- Foreign Drafts: instruct your bank to send for Collection.

Clearing Drafts:

Normal Same-Country checks clear in about 10 business days. Ask your bank how long it will take to clear a deposit and make sure you do no spend the money in any way. If a deposit bounces YOU will have to pay “Bad-Check” Fees to your bank of up to $150 per bad check – local laws control the amount of the fee.

Foreign Drafts can take up to 60 days to clear. Again, ask YOUR bank for how long it will take to clear.

You can ask your bank to put a hold on the money until it clears, and also ask if they hold it if they will waive any fees if it does not clear.

Traveler’s Checks:

A Traveler’s Check is a certified bank draft that travelers may use the same way they use regular paper currency. Traveler’s checks may be used in place of cash for purposes other than travel. Banks typically charge a small fee and require that individuals order travelers’ checks prior to when they will need them. American

Traveler’s checks are issued with a set of instructions, which you should read carefully as soon as you receive them. Generally, there are two places on every check for the buyer’s signature. The buyer should immediately sign on the first line (on American Express Traveler’s Cheques this line is at the top left corner) on every single check. They do not sign on the second line (usually at the bottom right, left or center) until they are cashing or spending the check (transferring it to someone).

Traveler’s check warning: You cannot accept any Traveler’s check made payable to you unless BOTH signature lines on the face of the check have been signed by the maker (and are the SAME).

Under no circumstances are you to ever sign the front of a Traveler’s check unless you are personally buying one from the issuer. To do otherwise will void the Traveler’s Check or may be considered fraud.

Only the person who buys a Traveler’s check may sign on the two signature lines on the front (you sign on the back when cashing or depositing it).

Typically the buyer signs the top and bottom on the face of check (some traveler’s check designs may be different).

One line is signed in front of the clerk selling the Traveler’s check, the other line is called a countersignature and is signed in front of the payee (that would be you). Both signatures must match.

If you take a stolen or fake Traveler’s check to a CASINO, BANK, or CHECK CASHING STORE you can be accused of fraud.

What “Clear” Really Means:

“The check has cleared” does not mean the money in your account belongs to you. It only means that the clearinghouse has not sent the draft back for non-sufficient funds, closed accounts, or flag instructions on the account. It does not mean the draft was written by the account holder. It only means that it was funded.

Depending on the size or purpose of the account, the account holder may not notice the absence of funds for several days after the draft has reached his bank. In fact, an account holder may have up to one full year to report an unauthorized draft.

Read That Again: A Check May Be Reported Up To One Full Year (Based Upon Local Laws) To Report An Unauthorized Draft

Bank statements are usually sent out on the 1st or 15th of the month. If the transaction took place near one of those dates, the account holder may be unaware of the unauthorized transaction until statements are sent out the following month and time is taken to balance the statement, unless they are looking at online daily transactions.

What “Available Funds” Really Means:

“Available funds” does not mean the money in your account belongs to you, even if a hold has been taken off the draft.

When you deposit a check into your bank account, your bank advances (loans) you the money for that check to keep the wheels of commerce moving. Of the millions and millions of checks processed every day, a relatively small number are returned because of a problem; because of this, banks and credit unions must automatically credit depositor accounts within a certain number of days.

A bank or credit union can make an exception to the rule and wait for a longer period of time on any given deposit before crediting the depositor account, but apart from such an exception, the credit is automatic.

This credit to your account is called a “provisional loan” and is actually a no-signature loan from your bank to you. It does not mean that your bank has been credited by the account holder’s bank.

The only time the money in your account really belongs to you is when the check or money order has been HONORED, meaning your bank has been credited (paid) by the account holder’s bank.

ALWAYS ask your bank if the draft has been honored and DO NOT TOUCH THE MONEY until it has.

When in doubt about a draft, tell your bank to send the draft for COLLECTION.

If you treat the draft as suspect and share this information with your bank you may be able to avoid fees and also the loss of your account for bad deposits.

Sending A Draft For Collection:

When you send a draft for Collection, it means that your bank or credit union will not put any money in your account until the draft has been paid, i.e. your bank has received the credit from the account holder bank.

Your bank or credit union will charge you a fee and give you an approximate time before the draft is honored. This time period may be as long as 6 to 8 weeks depending on the location of the account holder bank.

Some banks and credit unions will provide the collection service even if you do not have an account with them, so long as you pay the service charge. Remember, banks are businesses and nothing is free in business.

Accepting A Draft Made Out To Someone Else:

NEVER accept 3rd party drafts. A 3rd party draft is one where someone else’s name is on the Payee line on the front of the check. It doesn’t matter if your son, daughter, parent, or best friend asks you to deposit his or her check into your account, don’t do it even if it’s a cashier’s check. You are completely liable for the draft the moment you endorse it.

Accepting Payment In Your Name For The Services Or Products Of Another, No Matter Where You Live:

You are placing yourself at enormous risk by accepting payment in your name for the products and services provided by another.

For one thing, you are accepting responsibility for those products or services. If the product doesn’t show up, the buyer will come to you for redress or refund. You are also accepting to pay all the taxes, and if you have placed the funds in your personal account you will be expected to add the amount to your personal income taxes.

NOTE: If you are the victim of a Payment Processing Scam, please know that your name may be used to open fake eBay accounts and Classified ads selling non-existent products. The payments you are receiving may be from people who believe you are selling a product on the Internet or through a local newspaper and they will be waiting for delivery.

Receiving Funds Wired Directly Into Your Account:

Funds wired into your account are your responsibility. If the money that was transferred into your account is stolen, your bank has the right to sweep your account and to hold you criminally liable.

You can prevent this from happening to you by placing instructions on your account that no money is to be wired into your account without your specific written approval.

Never, ever allow strangers (people you are not in business with and know, or people you have never met) to wire funds into any of your accounts. This act could make you an accessory to money laundering or other criminal activity.

Sending Money Out Of The Country By Western Union Or MoneyGram Or Other Transfer Services:

When you send money by Western Union or MoneyGram, the money is gone the moment it is picked up and there is no money trail. Meaning it cannot be recovered. The only way to recover money sent this way is if it has not yet been picked up.

Scammer fraud gangs know that they are untraceable once they pick up the money, which is why they want their victims to use these money-wiring services. Additionally, in many countries, they either have their own people in the Transfer Agency or own a franchise agency, so they do not even need to verify the identity of the person picking it up!

If you are processing payments for a foreign employer, please know that no legitimate employer would ever ask you to wire funds this way, nor would they ask you to process payments for them. There are firms that specialize in this type of service that know the legalities required by US and foreign tax collection agencies, the accounting required to be compliant with accounting practices laws, and understands the required banking procedures.

If you have received an overpayment, lottery payment, drafts from an online relationship, or any kind of draft as the result of any association you have developed locally or on the Internet in which you are asked to accept a draft and transfer a portion of the funds via Western Union or MoneyGram, please understand that you are placing yourself at great risk. Follow the instructions above to verify the draft. Better yet, refuse to comply.

If you are receiving money by Western Union and are being asked to transfer it on by Western Union or MoneyGram, then it is probable that you are being used as a mule (courier in an illegal operation) in a money-laundering scheme.

How To Handle Counterfeit, Stolen, Or Forged Drafts:

Here is a list of the types of counterfeit drafts you may be sent:

- Postal Money Orders

- Personal Checks

- International Money Orders

- Company Checks

- Walmart Money Orders

- Us Treasury Checks

- Central Bank Checks

- Corporate Checks

- City Government Checks

- County Government Checks

- Province Government Checks

- State Government Checks

- Chex (or similar system)

- ACH Checks

- Cashier’s Checks

- Certified Checks

- Payment Processing Center Checks

- Bank Checks (drawn on the bank’s corp. acct.)

- Township Government Checks

- Traveler’s Checks

Any type of check or money order you can think of can be fake!

U.S./Canadian Residents:

If you are a resident of the United States or Canada, any letters or packages you receive, by whatever method, foreign or domestic, fall under the jurisdiction of the US Postal Service and may be investigated by them or the FBI in the U.S. or R.C.M.P. in Canada.

If you receive a fake draft:

- Print VOID across the face of each draft

- Place the drafts and any enclosures back in the envelope

- On the back of the envelope (outer envelope if you have placed it in another envelope) print [NAME OF SCAM], COUNTERFEIT DRAFT, ATTN: US POSTAL INSPECTOR

- Drop the envelope off at any Post Office, backside up so they can see what you are handing them.

If you wish to file an enforcement report to go with the above, please click HERE for the U.S. Post Office Mail Fraud Form

International Residents:

If you are not in the United States or Canada, please contact your postal service to see if they have a Mail Fraud division.

If your postal service does not have a Mail Fraud Division, and if you cannot drop the voided drafts and envelope(s) off with your local police, contact your National Police for assistance. If the police cannot help you we recommend scanning or photographing the drafts and envelopes, letters, etc., and report them on this website or on www.Anyscam.com so that they are distributed through the SCARS|CDN™ Cybercrime Data Network.

Remember:

You Are Legally Responsible When You Cash Or Deposit A Draft Or Receive Funds Wired Into Any Of Your Accounts!

PLEASE SHARE OUR ARTICLES WITH YOUR FRIENDS & FAMILY

HELP OTHERS STAY SAFE ONLINE – YOUR KNOWLEDGE CAN MAKE THE DIFFERENCE!

THE NEXT VICTIM MIGHT BE YOUR OWN FAMILY MEMBER OR BEST FRIEND!

By the SCARS™ Editorial Team

Society of Citizens Against Relationship Scams Inc.

A Worldwide Crime Victims Assistance & Crime Prevention Nonprofit Organization Headquartered In Miami Florida USA & Monterrey NL Mexico, with Partners In More Than 60 Countries

To Learn More, Volunteer, or Donate Visit: www.AgainstScams.org

Contact Us: Contact@AgainstScams.org

Please Leave A Comment - Tell Us What You Think About This!