Law Enforcement Is Hunting Down Money Mules

Criminal Crack Down On Money Mules Worldwide

A SCARS™ Special Report

Now is the time to report this while you can still be innocent!

More and more, law enforcement is less likely to look the other way when it comes to Money Mules.

It depends on the circumstances but more and more Money Mules are being prosecuted and going to jail! Additionally, they have significantly high liability to being sued by the victims they helped rob or scam!

Europol and the FBI both are taking this deadly seriously. Here is a report on recent Europol activity against Mules!

Law enforcement authorities from 31 countries, supported by Europol, Eurojust, and the European Banking Federation (EBF), have stepped up their efforts to crack down on money mule schemes that rope in victims often unaware that the money they are sending is part of an elaborate money-laundering scheme.

The fifth European Money Mule Action (EMMA 5) took place between September – November 2019, resulting in the identification of 3833 money mules alongside 386 money mule recruiters, of which 228 were arrested. 1025 criminal investigations were open, many of them are still ongoing. More than 650 banks, 17 bank associations and other financial institutions helped to report 7520 fraudulent money mule transactions, preventing a total loss of €12.9 million.

This year, law enforcement, judicial and financial authorities from Austria, Belgium, Bulgaria, Czech Republic, Denmark, Estonia, Finland, Greece, Germany, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovenia, Slovakia, Spain, Sweden, Australia, Moldova, Norway, Switzerland, the United Kingdom, the United States, and Ukraine participated in this international swoop.

Europol and Eurojust organized various operational and coordination meetings in The Hague to discuss the unique approach of each Member State to tackle “money muling” (as it is now called) in their respective country. During the three-month action, Europol supported the operations by assisting the national authorities with cross-checks against Europol’s databases and intelligence gathering for further analysis, while Eurojust contributed to the swift forwarding and facilitation of the execution of European Investigation Orders.

UNSUSPECTING MONEY MULES

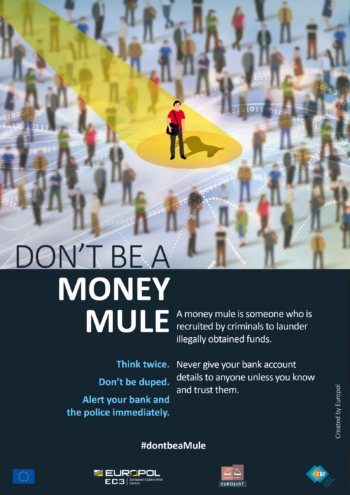

Money mules, unlike their drug-trade counterparts, are not shuffling illicit goods over a physical border. Instead, they take part – often unknowingly – in money laundering activities by receiving and transferring illegally obtained money between bank accounts and/or countries.

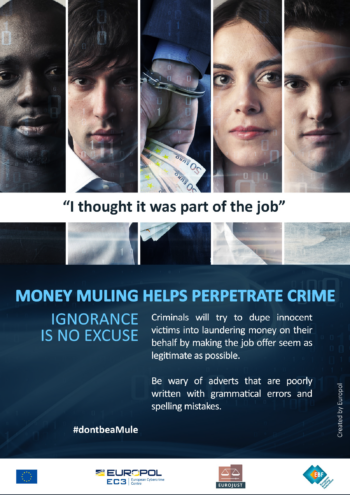

Recruiters of money mules are coming up with ingenious ways to lure in their candidates. This year, cases involving romance scams were reported on the rise, with criminals increasingly recruiting money mules on online dating sites, grooming their victims over a period of time to convince them to open bank accounts under the guise of sending or receiving funds. Criminals are also more and more turning to social media to recruit new accomplices through get-rich-quick online advertisements. This technique is particularly popular when it comes to targeting students and young adults.

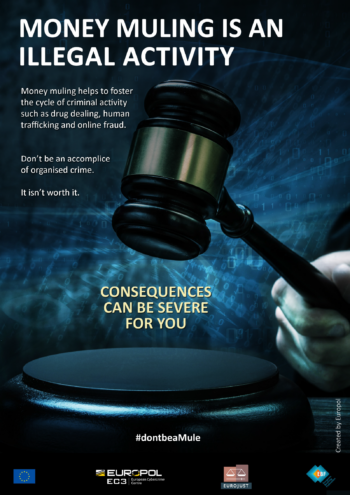

Even if money mules act unwittingly, they are committing a crime.

Law enforcement will turn first to whoever’s name features on the bank account, and the legal consequences can be severe. Depending on the country’s legal framework, mules may face lengthy imprisonments and acquire a criminal record that could seriously affect the rest of their lives, such as never being able to secure a mortgage or open a bank account.

What Is Money Muling?

#DONTBEAMULE

To raise awareness of this type of fraud, the money muling awareness campaign #DontbeaMule kicks off this month across Europe. With awareness-raising material, available for download in 25 languages, the campaign will inform the public about how these criminals operate, how they can protect themselves, and what to do if they become a victim.

For a few weeks, international partners from law enforcement and judicial authorities, together with financial institutions, will be supporting the campaign at the national level.

Do you think you might be used as a mule? Act now before it is too late: stop transferring money and notify your bank and your national police immediately.

HOW ARE MONEY MULES RECRUITED?

- Seemingly legitimate job offers (e.g. ‘money transfer agents’) announced via online job forums, emails, social media (e.g. Facebook posts in closed groups, Instagram, Snapchat) or pop-up ads.

- Direct messages sent through instant messaging apps (e.g. WhatsApp, Viber, Telegram) or by email.

- Directly in person, on the street.

WHO ARE THE MOST TARGETED INDIVIDUALS?

- Newcomers to the country (often targeted soon after arrival) and unemployed people, students, and those in economic hardship.

- The most likely targets are people under 35 years old. Recently, criminal groups have begun recruiting younger generations (from 12 to 21 years old).

WHAT ARE THE WARNING SIGNS?

The following characteristics do not necessarily indicate money mule solicitation, but they are commonly used.

FAKE JOB OFFERS

- Money mule adverts can copy a genuine company’s website and have a similar web address in order to make the scam seem authentic.

- Emails with fake job offers are often awkward and badly written. The sender’s email address is likely to be from a free web-based service (Gmail, Yahoo!, Windows Live Hotmail, etc.) which does not match the company name.

- Money mule adverts normally state that they are an overseas company seeking ‘local/national representatives’ or ‘agents’ to act on their behalf for a period of time, sometimes to avoid high transaction fees or local taxes.

- The position involves transferring money or goods.

- The specific job duties are not described.

- The position does not list educational or experience requirements.

- All interactions and transactions will be done online. The offer promises significant earning potential for little effort.

- The nature of the work of the fake company can vary, but the specifics of the job being advertised always include using your bank account to move money.

INSTANT CASH

- Someone you do not know asks you to move their money through your bank account and offers you a cut.

- The contact is established in person, through social media networks or instant messaging apps.

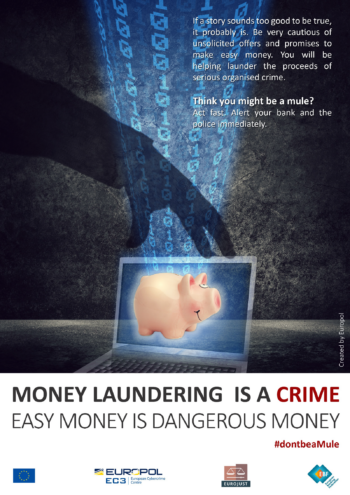

- The opportunity to make easy money is presented as having no risks, using expressions such as ‘legit money’, ‘100% guaranteed’, and ‘same day cash’.

- You are told what to do and how much others have already earned for doing the same.

- The reason why this is needed can vary, but you will always be requested to give your bank account number.

- ! Remember: illegal money will come and go through your bank account, but in the end the responsibility will stay with you.

HOW TO FIGHT MONEY LAUNDERING?

- Never give your bank account or any other personal details to anyone unless you know and trust them.

- Secure your bank cards. Do not disclose your online banking login details, PIN, CVV number, etc.

- Be very cautious of unsolicited emails or offers made over social media or in person, promising easy money.

- Ignore any job offer involving money transfers through your bank account, regardless of how authentic they may seem. If an opportunity sounds too good to be true, it probably is.

WHAT TO DO?

- If you have received emails of this type do not respond to them and do not click on any links they contain. Inform the police instead.

- Stay alert for job ads and social media posts that promise easy money. Always report the account to the platform provider in order to be taken down and prevent other people from falling for the scam.

- If you happen to receive an offer in person, decline it, and report it to the police.

- If you suspect that you are caught up in a money mule or money laundering scheme, stop transferring money immediately, notify your bank or payment provider, and report it to your national police. You could help prevent other people from becoming money mules and even help catch the criminals.

TAGS: SCARS, Important Article, Information About Scams, Anti-Scam, Scams, Scammers, Fraudsters, Cybercrime, Crybercriminals, Romance Scams, Scam Victims, Money Mule, Money Muling, Law Enforcement, Arresting Mules

PLEASE SHARE OUR ARTICLES WITH YOUR FRIENDS & FAMILY

HELP OTHERS STAY SAFE ONLINE – YOUR KNOWLEDGE CAN MAKE THE DIFFERENCE!

THE NEXT VICTIM MIGHT BE YOUR OWN FAMILY MEMBER OR BEST FRIEND!

By the SCARS™ Editorial Team

Society of Citizens Against Relationship Scams Inc.

A Worldwide Crime Victims Assistance & Crime Prevention Nonprofit Organization Headquartered In Miami Florida USA & Monterrey NL Mexico, with Partners In More Than 60 Countries

To Learn More, Volunteer, or Donate Visit: www.AgainstScams.org

Contact Us: Contact@AgainstScams.org

Leave A Comment