SCARS Institute’s Encyclopedia of Scams™ Published Continuously for 25 Years

Law Enforcement Is Hunting Down Money Mules

Criminal Crack Down On Money Mules Worldwide

A SCARS™ Special Report

Now is the time to report this while you can still be innocent!

More and more, law enforcement is less likely to look the other way when it comes to Money Mules.

It depends on the circumstances but more and more Money Mules are being prosecuted and going to jail! Additionally, they have significantly high liability to being sued by the victims they helped rob or scam!

Europol and the FBI both are taking this deadly seriously. Here is a report on recent Europol activity against Mules!

Law enforcement authorities from 31 countries, supported by Europol, Eurojust, and the European Banking Federation (EBF), have stepped up their efforts to crack down on money mule schemes that rope in victims often unaware that the money they are sending is part of an elaborate money-laundering scheme.

The fifth European Money Mule Action (EMMA 5) took place between September – November 2019, resulting in the identification of 3833 money mules alongside 386 money mule recruiters, of which 228 were arrested. 1025 criminal investigations were open, many of them are still ongoing. More than 650 banks, 17 bank associations and other financial institutions helped to report 7520 fraudulent money mule transactions, preventing a total loss of €12.9 million.

This year, law enforcement, judicial and financial authorities from Austria, Belgium, Bulgaria, Czech Republic, Denmark, Estonia, Finland, Greece, Germany, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovenia, Slovakia, Spain, Sweden, Australia, Moldova, Norway, Switzerland, the United Kingdom, the United States, and Ukraine participated in this international swoop.

Europol and Eurojust organized various operational and coordination meetings in The Hague to discuss the unique approach of each Member State to tackle “money muling” (as it is now called) in their respective country. During the three-month action, Europol supported the operations by assisting the national authorities with cross-checks against Europol’s databases and intelligence gathering for further analysis, while Eurojust contributed to the swift forwarding and facilitation of the execution of European Investigation Orders.

UNSUSPECTING MONEY MULES

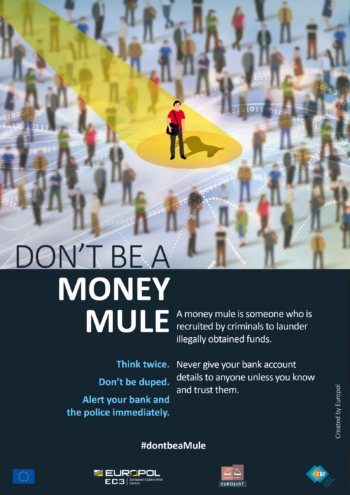

Money mules, unlike their drug-trade counterparts, are not shuffling illicit goods over a physical border. Instead, they take part – often unknowingly – in money laundering activities by receiving and transferring illegally obtained money between bank accounts and/or countries.

Recruiters of money mules are coming up with ingenious ways to lure in their candidates. This year, cases involving romance scams were reported on the rise, with criminals increasingly recruiting money mules on online dating sites, grooming their victims over a period of time to convince them to open bank accounts under the guise of sending or receiving funds. Criminals are also more and more turning to social media to recruit new accomplices through get-rich-quick online advertisements. This technique is particularly popular when it comes to targeting students and young adults.

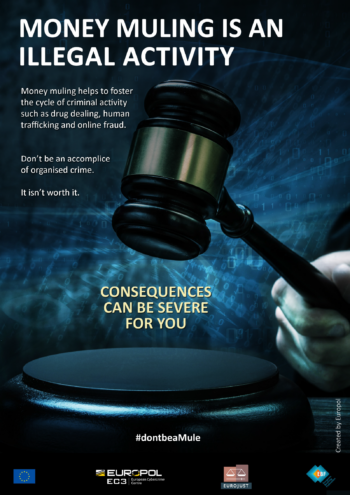

Even if money mules act unwittingly, they are committing a crime.

Law enforcement will turn first to whoever’s name features on the bank account, and the legal consequences can be severe. Depending on the country’s legal framework, mules may face lengthy imprisonments and acquire a criminal record that could seriously affect the rest of their lives, such as never being able to secure a mortgage or open a bank account.

What Is Money Muling?

#DONTBEAMULE

To raise awareness of this type of fraud, the money muling awareness campaign #DontbeaMule kicks off this month across Europe. With awareness-raising material, available for download in 25 languages, the campaign will inform the public about how these criminals operate, how they can protect themselves, and what to do if they become a victim.

For a few weeks, international partners from law enforcement and judicial authorities, together with financial institutions, will be supporting the campaign at the national level.

Do you think you might be used as a mule? Act now before it is too late: stop transferring money and notify your bank and your national police immediately.

HOW ARE MONEY MULES RECRUITED?

- Seemingly legitimate job offers (e.g. ‘money transfer agents’) announced via online job forums, emails, social media (e.g. Facebook posts in closed groups, Instagram, Snapchat) or pop-up ads.

- Direct messages sent through instant messaging apps (e.g. WhatsApp, Viber, Telegram) or by email.

- Directly in person, on the street.

WHO ARE THE MOST TARGETED INDIVIDUALS?

- Newcomers to the country (often targeted soon after arrival) and unemployed people, students, and those in economic hardship.

- The most likely targets are people under 35 years old. Recently, criminal groups have begun recruiting younger generations (from 12 to 21 years old).

WHAT ARE THE WARNING SIGNS?

The following characteristics do not necessarily indicate money mule solicitation, but they are commonly used.

FAKE JOB OFFERS

- Money mule adverts can copy a genuine company’s website and have a similar web address in order to make the scam seem authentic.

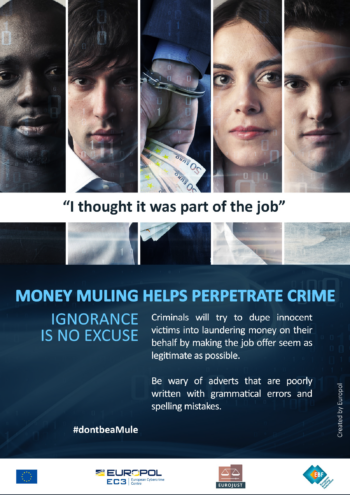

- Emails with fake job offers are often awkward and badly written. The sender’s email address is likely to be from a free web-based service (Gmail, Yahoo!, Windows Live Hotmail, etc.) which does not match the company name.

- Money mule adverts normally state that they are an overseas company seeking ‘local/national representatives’ or ‘agents’ to act on their behalf for a period of time, sometimes to avoid high transaction fees or local taxes.

- The position involves transferring money or goods.

- The specific job duties are not described.

- The position does not list educational or experience requirements.

- All interactions and transactions will be done online. The offer promises significant earning potential for little effort.

- The nature of the work of the fake company can vary, but the specifics of the job being advertised always include using your bank account to move money.

INSTANT CASH

- Someone you do not know asks you to move their money through your bank account and offers you a cut.

- The contact is established in person, through social media networks or instant messaging apps.

- The opportunity to make easy money is presented as having no risks, using expressions such as ‘legit money’, ‘100% guaranteed’, and ‘same day cash’.

- You are told what to do and how much others have already earned for doing the same.

- The reason why this is needed can vary, but you will always be requested to give your bank account number.

- ! Remember: illegal money will come and go through your bank account, but in the end the responsibility will stay with you.

HOW TO FIGHT MONEY LAUNDERING?

- Never give your bank account or any other personal details to anyone unless you know and trust them.

- Secure your bank cards. Do not disclose your online banking login details, PIN, CVV number, etc.

- Be very cautious of unsolicited emails or offers made over social media or in person, promising easy money.

- Ignore any job offer involving money transfers through your bank account, regardless of how authentic they may seem. If an opportunity sounds too good to be true, it probably is.

WHAT TO DO?

- If you have received emails of this type do not respond to them and do not click on any links they contain. Inform the police instead.

- Stay alert for job ads and social media posts that promise easy money. Always report the account to the platform provider in order to be taken down and prevent other people from falling for the scam.

- If you happen to receive an offer in person, decline it, and report it to the police.

- If you suspect that you are caught up in a money mule or money laundering scheme, stop transferring money immediately, notify your bank or payment provider, and report it to your national police. You could help prevent other people from becoming money mules and even help catch the criminals.

TAGS: SCARS, Important Article, Information About Scams, Anti-Scam, Scams, Scammers, Fraudsters, Cybercrime, Crybercriminals, Romance Scams, Scam Victims, Money Mule, Money Muling, Law Enforcement, Arresting Mules

PLEASE SHARE OUR ARTICLES WITH YOUR FRIENDS & FAMILY

HELP OTHERS STAY SAFE ONLINE – YOUR KNOWLEDGE CAN MAKE THE DIFFERENCE!

THE NEXT VICTIM MIGHT BE YOUR OWN FAMILY MEMBER OR BEST FRIEND!

By the SCARS™ Editorial Team

Society of Citizens Against Relationship Scams Inc.

A Worldwide Crime Victims Assistance & Crime Prevention Nonprofit Organization Headquartered In Miami Florida USA & Monterrey NL Mexico, with Partners In More Than 60 Countries

To Learn More, Volunteer, or Donate Visit: www.AgainstScams.org

Contact Us: Contact@AgainstScams.org

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment below!

Table of Contents

- Criminal Crack Down On Money Mules Worldwide

- Europol and the FBI both are taking this deadly seriously. Here is a report on recent Europol activity against Mules!

- UNSUSPECTING MONEY MULES

- Even if money mules act unwittingly, they are committing a crime.

- What Is Money Muling?

- #DONTBEAMULE

- HOW ARE MONEY MULES RECRUITED?

- WHO ARE THE MOST TARGETED INDIVIDUALS?

- WHAT ARE THE WARNING SIGNS?

- HOW TO FIGHT MONEY LAUNDERING?

- WHAT TO DO?

- PLEASE SHARE OUR ARTICLES WITH YOUR FRIENDS & FAMILY

- By the SCARS™ Editorial Team

Society of Citizens Against Relationship Scams Inc. - The Issue Of Race In Scam Reporting

Click Here To Learn More!

LEAVE A COMMENT?

Recent Comments

On Other Articles

- Arwyn Lautenschlager on Love Bombing And How Romance Scam Victims Are Forced To Feel: “I was love bombed to the point that I would do just about anything for the scammer(s). I was told…” Feb 11, 14:24

- on Dani Daniels (Kira Lee Orsag): Another Scammer’s Favorite: “You provide a valuable service! I wish more people knew about it!” Feb 10, 15:05

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “We highly recommend that you simply turn away form the scam and scammers, and focus on the development of a…” Feb 4, 19:47

- on The Art Of Deception: The Fundamental Principals Of Successful Deceptions – 2024: “I experienced many of the deceptive tactics that romance scammers use. I was told various stories of hardship and why…” Feb 4, 15:27

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “Yes, I’m in that exact situation also. “Danielle” has seriously scammed me for 3 years now. “She” (he) doesn’t know…” Feb 4, 14:58

- on An Essay on Justice and Money Recovery – 2026: “you are so right I accidentally clicked on online justice I signed an agreement for 12k upfront but cd only…” Feb 3, 08:16

- on The SCARS Institute Top 50 Celebrity Impersonation Scams – 2025: “Quora has had visits from scammers pretending to be Keanu Reeves and Paul McCartney in 2025 and 2026.” Jan 27, 17:45

- on Scam Victims Should Limit Their Exposure To Scam News & Scammer Photos: “I used to look at scammers photos all the time; however, I don’t feel the need to do it anymore.…” Jan 26, 23:19

- on After A Scam, No One Can Tell You How You Will React: “This article was very informative, my scams happened 5 years ago; however, l do remember several of those emotions and/or…” Jan 23, 17:17

- on Situational Awareness and How Trauma Makes Scam Victims Less Safe – 2024: “I need to be more observant and I am practicing situational awareness. I’m saving this article to remind me of…” Jan 21, 22:55

ARTICLE META

Important Information for New Scam Victims

- Please visit www.ScamVictimsSupport.org – a SCARS Website for New Scam Victims & Sextortion Victims

- Enroll in FREE SCARS Scam Survivor’s School now at www.SCARSeducation.org

- Please visit www.ScamPsychology.org – to more fully understand the psychological concepts involved in scams and scam victim recovery

If you are looking for local trauma counselors please visit counseling.AgainstScams.org or join SCARS for our counseling/therapy benefit: membership.AgainstScams.org

If you need to speak with someone now, you can dial 988 or find phone numbers for crisis hotlines all around the world here: www.opencounseling.com/suicide-hotlines

A Note About Labeling!

We often use the term ‘scam victim’ in our articles, but this is a convenience to help those searching for information in search engines like Google. It is just a convenience and has no deeper meaning. If you have come through such an experience, YOU are a Survivor! It was not your fault. You are not alone! Axios!

A Question of Trust

At the SCARS Institute, we invite you to do your own research on the topics we speak about and publish, Our team investigates the subject being discussed, especially when it comes to understanding the scam victims-survivors experience. You can do Google searches but in many cases, you will have to wade through scientific papers and studies. However, remember that biases and perspectives matter and influence the outcome. Regardless, we encourage you to explore these topics as thoroughly as you can for your own awareness.

Statement About Victim Blaming

SCARS Institute articles examine different aspects of the scam victim experience, as well as those who may have been secondary victims. This work focuses on understanding victimization through the science of victimology, including common psychological and behavioral responses. The purpose is to help victims and survivors understand why these crimes occurred, reduce shame and self-blame, strengthen recovery programs and victim opportunities, and lower the risk of future victimization.

At times, these discussions may sound uncomfortable, overwhelming, or may be mistaken for blame. They are not. Scam victims are never blamed. Our goal is to explain the mechanisms of deception and the human responses that scammers exploit, and the processes that occur after the scam ends, so victims can better understand what happened to them and why it felt convincing at the time, and what the path looks like going forward.

Articles that address the psychology, neurology, physiology, and other characteristics of scams and the victim experience recognize that all people share cognitive and emotional traits that can be manipulated under the right conditions. These characteristics are not flaws. They are normal human functions that criminals deliberately exploit. Victims typically have little awareness of these mechanisms while a scam is unfolding and a very limited ability to control them. Awareness often comes only after the harm has occurred.

By explaining these processes, these articles help victims make sense of their experiences, understand common post-scam reactions, and identify ways to protect themselves moving forward. This knowledge supports recovery by replacing confusion and self-blame with clarity, context, and self-compassion.

Additional educational material on these topics is available at ScamPsychology.org – ScamsNOW.com and other SCARS Institute websites.

Psychology Disclaimer:

All articles about psychology and the human brain on this website are for information & education only

The information provided in this article is intended for educational and self-help purposes only and should not be construed as a substitute for professional therapy or counseling.

While any self-help techniques outlined herein may be beneficial for scam victims seeking to recover from their experience and move towards recovery, it is important to consult with a qualified mental health professional before initiating any course of action. Each individual’s experience and needs are unique, and what works for one person may not be suitable for another.

Additionally, any approach may not be appropriate for individuals with certain pre-existing mental health conditions or trauma histories. It is advisable to seek guidance from a licensed therapist or counselor who can provide personalized support, guidance, and treatment tailored to your specific needs.

If you are experiencing significant distress or emotional difficulties related to a scam or other traumatic event, please consult your doctor or mental health provider for appropriate care and support.

Also read our SCARS Institute Statement about Professional Care for Scam Victims – click here to go to our ScamsNOW.com website.

Thank you for your comment. You may receive an email to follow up. We never share your data with marketers.