SCARS Institute’s Encyclopedia of Scams™ Published Continuously for 25 Years

SCARS™ Insight: Cybercrime – It’s Worse Than We Thought – 2020

A United States Government Analysis Of How Bad Cybercrime Has Become

Reprinted from NIST For Scam Awareness. Authored by Douglas S. Thomas

The cyber-world is relatively new, and unlike other types of assets, cyber assets are potentially accessible to criminals in far-off locations. This distance provides the criminal with significant protections from getting caught; thus, the risks are low, and with cyber assets and activities being in the trillions of dollars, the payoff is high.

When we talk about cybercrime, we often focus on the loss of privacy and security. But cybercrime also results in significant economic losses. Yet the data and research on this aspect of cybercrime are unfortunately limited. Data collection often relies on small sample sizes or has other challenges that bring accuracy into question.

In a recent NIST report (see PDF below), I looked at losses in the U.S. manufacturing industry due to cybercrime by examining an underutilized dataset from the Bureau of Justice Statistics, which is the most statistically reliable data that I can find. I also extended this work to look at the losses in all U.S. industries. The data is from a 2005 survey of 36,000 businesses with 8,079 responses, which is also by far the largest sample that I could identify for examining aggregated U.S. cybercrime losses.

Using this data, combined with methods for examining uncertainty in data, I extrapolated upper and lower bounds, putting 2016 U.S. manufacturing losses to be between 0.4% and 1.7% of manufacturing value-added or between $8.3 billion and $36.3 billion. The losses for all industries are between 0.9% and 4.1% of total U.S. gross domestic product (GDP), or between $167.9 billion and $770.0 billion. The lower bound is 40% higher than the widely cited, but largely unconfirmed, estimates from McAfee.

What makes the estimates startling is that, despite being higher than commonly cited values, the assumptions I used to calculate losses pushed the lower bound estimate down significantly, meaning the true loss may be much higher. I calculated the low value assuming that those who did not respond to the Bureau of Justice Statistics survey did not experience any losses. This amounted to 77% of the 36,000 businesses surveyed being presumed as having no loss; thus, the true loss is most likely higher than the low estimate.

Additionally, the 2005 data from the Bureau of Justice Statistics comes from a time when cybercrime was considered to be less of a problem and the digital economy was smaller. If the Bureau of Justice Statistics data is representative, that is, if the average losses of the respondents’ companies equals the actual average U.S. losses per company, then the losses approach the high estimate of $36.3 billion for manufacturing and $770 billion for all industries. This would make total cybercrime losses greater than the GDP of many U.S. industries, including construction, mining and agriculture. If the losses per company have increased faster than inflation, which is likely, then the losses would be even higher.

Most other estimates, including widely cited values, tend not to present technical details of data collection and analysis. Also, some estimates assume that the ceiling of cybercrime losses doesn’t exceed the cost of car crashes or petty theft in a given year. However, cybercrime is not comparable to other types of property crime or losses. Typical property losses require physical presence, which limits the loss or damage. For instance, a burglar must be physically present to steal an object from a home or business. Cyber assets, however, are potentially accessible to any would-be criminals on the planet without them needing to leave their homes.

The removal of this obstacle (the need for physical presence) is a game-changing factor for criminal activity, making cybercrime more prevalent. For example, my personal information (e.g., Social Security number) has been stolen countless times and my credit card information has been stolen and used on numerous occasions, but my house has never been burglarized and my car has only been broken into once. If I wanted to engage with a cybercriminal, I would only need to look in my email inbox, but I have no idea where I could find a burglar.

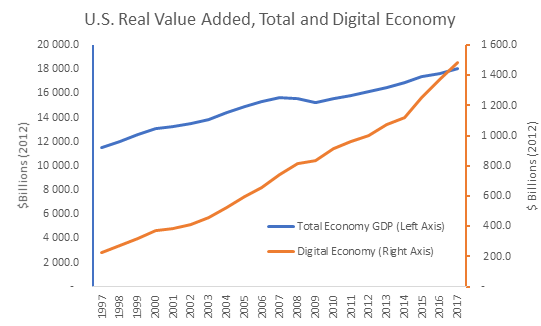

My report describes methods in detail, uses public data, and doesn’t assume the losses are similar to other types of crime. Since the data I used from the Bureau of Justice Statistics is from 2005, these estimates are likely low. The digital economy, measured in real dollars, grew 129% between 2005 and 2016, and I did not adjust for this increase. Additionally, the number of businesses, which is used for estimation, was lower in 2016, according to the Census Bureau’s Annual Survey of Entrepreneurs. This pushes my low estimate for losses down even further.

Economic growth in recent years for the U.S. has been between 2% and 3%, at least prior to the COVID-19 pandemic. While this is considered a healthy growth rate, my estimates show that the economy could be growing even faster if not for cybercrime. With the U.S. being a wealthy country and having a commonly spoken language that increases the number of potential offenders (it’s difficult to send phishing emails in an unfamiliar language), it’s a prime target for cybercrime.

Businesses And Government Underestimate The Risk

If businesses and government underestimate the risk, they might underinvest in strategies for mitigating it. For instance, they might hire fewer IT security experts, take unnecessary risks with data/information, or disregard a recommended security measure. The result is unnecessary losses that may be quite substantial. If these losses are in the area of intellectual property, they can also reduce incentives for investing in research and development, limiting economic growth even more. For these reasons, it’s critical to gain a better understanding of cybercrime loss.

The implication from my report is that widely accepted estimates of cybercrime loss may severely underestimate the true value of losses. One of the first steps in addressing a problem such as cybercrime is to understand the magnitude of the loss, what types of losses occur, and the circumstances under which they occur. Without further data collection, we are in the dark as to how much we are losing. But the evidence suggests it’s more than we thought.

Cybercrime Losses: An Examination of U.S. Manufacturing and the Total Economy

[pdf-embedder url=”https://romancescamsnow.com/wp-content/uploads/2020/07/NIST.AMS_.100-32.pdf” title=”Cybercrime Losses: An Examination of U.S. Manufacturing and the Total Economy “]

TAGS: SCARS, NIST, Government Report, Cybercrime Loses, Scams, Scammers, Fraudsters, Cybercrime, Crybercriminals, Romance Scams, Scam Victims, United States Government Analysis,

SCARS™ Team

Society of Citizens Against Relationship Scams Inc.

A Worldwide Crime Victims Assistance Nonprofit Organization

Visit: www.AgainstScams.org

Contact Us: Contact@AgainstScams.org

PLEASE SHARE OUR ARTICLES WITH YOUR FRIENDS & FAMILY

HELP OTHERS STAY SAFE ONLINE – YOUR KNOWLEDGE CAN MAKE THE DIFFERENCE!

The Latest SCARS Posts:

FIND MORE SCAM NEWS

«SCAMCRIME.COM»

JOIN US ON FACEBOOK

«CLICK HERE»

END

MORE INFORMATION

– – –

Tell us about your experiences with Romance Scammers in our

« Scams Discussion Forum on Facebook »

– – –

FAQ: How Do You Properly Report Scammers?

It is essential that law enforcement knows about scams & scammers, even though there is nothing (in most cases) that they can do.

Always report scams involving money lost or where you received money to:

- Local Police – ask them to take an “informational” police report – say you need it for your insurance

- U.S. State Police (if you live in the U.S.) – they will take the matter more seriously and provide you with more help than local police

- Your National Police or FBI « www.IC3.gov »

- The SCARS|CDN™ Cybercriminal Data Network – Worldwide Reporting Network on « www.Anyscam.com »

This helps your government understand the problem, and allows law enforcement to add scammers on watch lists worldwide.

– – –

To learn more about SCARS visit « www.AgainstScams.org »

Please be sure to report all scammers

on « www.Anyscam.com »

Disclaimer:

SCARS IS A DIGITAL PUBLISHER AND DOES NOT OFFER HEALTH OR MEDICAL ADVICE, LEGAL ADVICE, FINANCIAL ADVICE, OR SERVICES THAT SCARS IS NOT LICENSED OR REGISTERED TO PERFORM.

IF YOU’RE FACING A MEDICAL EMERGENCY, CALL YOUR LOCAL EMERGENCY SERVICES IMMEDIATELY, OR VISIT THE NEAREST EMERGENCY ROOM OR URGENT CARE CENTER. YOU SHOULD CONSULT YOUR HEALTHCARE PROVIDER BEFORE FOLLOWING ANY MEDICALLY RELATED INFORMATION PRESENTED ON OUR PAGES.

ALWAYS CONSULT A LICENSED ATTORNEY FOR ANY ADVICE REGARDING LEGAL MATTERS.

A LICENSED FINANCIAL OR TAX PROFESSIONAL SHOULD BE CONSULTED BEFORE ACTING ON ANY INFORMATION RELATING TO YOUR PERSONAL FINANCES OR TAX RELATED ISSUES AND INFORMATION.

This content and other material contained on the website, apps, newsletter, and products (“Content”), is general in nature and for informational purposes only and does not constitute medical, legal, or financial advice; the Content is not intended to be a substitute for licensed or regulated professional advice. Always consult your doctor or other qualified healthcare provider, lawyer, financial, or tax professional with any questions you may have regarding the educational information contained herein. SCARS makes no guarantees about the efficacy of information described on or in SCARS’ Content. The information contained is subject to change and is not intended to cover all possible situations or effects. SCARS does not recommend or endorse any specific professional or care provider, product, service, or other information that may be mentioned in SCARS’ websites, apps, and Content unless explicitly identified as such.

The disclaimers herein are provided on this page for ease of reference. These disclaimers supplement and are a part of SCARS’ website’s Terms of Use.

Legal Notices:

All original content is Copyright © 1991 – 2020 Society of Citizens Against Relationship Scams Inc. (D.B.A SCARS) All Rights Reserved Worldwide & Webwide. Third-party copyrights acknowledge.

SCARS, SCARS|INTERNATIONAL, SCARS, SCARS|SUPPORT, SCARS, RSN, Romance Scams Now, SCARS|INTERNATION, SCARS|WORLDWIDE, SCARS|GLOBAL, SCARS, Society of Citizens Against Relationship Scams, Society of Citizens Against Romance Scams, SCARS|ANYSCAM, Project Anyscam, Anyscam, SCARS|GOFCH, GOFCH, SCARS|CHINA, SCARS|CDN, SCARS|UK, SCARS|LATINOAMERICA, SCARS|MEMBER, SCARS|VOLUNTEER, SCARS Cybercriminal Data Network, Cobalt Alert, Scam Victims Support Group, are all trademarks of Society of Citizens Against Relationship Scams Inc., All Rights Reserved Worldwide

Contact the law firm for the Society of Citizens Against Relationship Scams Incorporated by email at legal@AgainstScams.org

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment below!

Table of Contents

- A United States Government Analysis Of How Bad Cybercrime Has Become

- Businesses And Government Underestimate The Risk

- Cybercrime Losses: An Examination of U.S. Manufacturing and the Total Economy

- U.S. Veterans Benefits Scams – 2026

- New AI Voice Cloning Phone Scams – 2026

- An Essay on Justice and Money Recovery – 2026

- Virtual Kidnapping & Extortion – Proof of Life Images or Videos – 2026

- Fake Money Recovery Law Firms – 2026

- Money Laundering Drop Accounts – 2026

LEAVE A COMMENT?

Recent Comments

On Other Articles

- Arwyn Lautenschlager on Love Bombing And How Romance Scam Victims Are Forced To Feel: “I was love bombed to the point that I would do just about anything for the scammer(s). I was told…” Feb 11, 14:24

- on Dani Daniels (Kira Lee Orsag): Another Scammer’s Favorite: “You provide a valuable service! I wish more people knew about it!” Feb 10, 15:05

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “We highly recommend that you simply turn away form the scam and scammers, and focus on the development of a…” Feb 4, 19:47

- on The Art Of Deception: The Fundamental Principals Of Successful Deceptions – 2024: “I experienced many of the deceptive tactics that romance scammers use. I was told various stories of hardship and why…” Feb 4, 15:27

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “Yes, I’m in that exact situation also. “Danielle” has seriously scammed me for 3 years now. “She” (he) doesn’t know…” Feb 4, 14:58

- on An Essay on Justice and Money Recovery – 2026: “you are so right I accidentally clicked on online justice I signed an agreement for 12k upfront but cd only…” Feb 3, 08:16

- on The SCARS Institute Top 50 Celebrity Impersonation Scams – 2025: “Quora has had visits from scammers pretending to be Keanu Reeves and Paul McCartney in 2025 and 2026.” Jan 27, 17:45

- on Scam Victims Should Limit Their Exposure To Scam News & Scammer Photos: “I used to look at scammers photos all the time; however, I don’t feel the need to do it anymore.…” Jan 26, 23:19

- on After A Scam, No One Can Tell You How You Will React: “This article was very informative, my scams happened 5 years ago; however, l do remember several of those emotions and/or…” Jan 23, 17:17

- on Situational Awareness and How Trauma Makes Scam Victims Less Safe – 2024: “I need to be more observant and I am practicing situational awareness. I’m saving this article to remind me of…” Jan 21, 22:55

ARTICLE META

Important Information for New Scam Victims

- Please visit www.ScamVictimsSupport.org – a SCARS Website for New Scam Victims & Sextortion Victims

- Enroll in FREE SCARS Scam Survivor’s School now at www.SCARSeducation.org

- Please visit www.ScamPsychology.org – to more fully understand the psychological concepts involved in scams and scam victim recovery

If you are looking for local trauma counselors please visit counseling.AgainstScams.org or join SCARS for our counseling/therapy benefit: membership.AgainstScams.org

If you need to speak with someone now, you can dial 988 or find phone numbers for crisis hotlines all around the world here: www.opencounseling.com/suicide-hotlines

A Note About Labeling!

We often use the term ‘scam victim’ in our articles, but this is a convenience to help those searching for information in search engines like Google. It is just a convenience and has no deeper meaning. If you have come through such an experience, YOU are a Survivor! It was not your fault. You are not alone! Axios!

A Question of Trust

At the SCARS Institute, we invite you to do your own research on the topics we speak about and publish, Our team investigates the subject being discussed, especially when it comes to understanding the scam victims-survivors experience. You can do Google searches but in many cases, you will have to wade through scientific papers and studies. However, remember that biases and perspectives matter and influence the outcome. Regardless, we encourage you to explore these topics as thoroughly as you can for your own awareness.

Statement About Victim Blaming

SCARS Institute articles examine different aspects of the scam victim experience, as well as those who may have been secondary victims. This work focuses on understanding victimization through the science of victimology, including common psychological and behavioral responses. The purpose is to help victims and survivors understand why these crimes occurred, reduce shame and self-blame, strengthen recovery programs and victim opportunities, and lower the risk of future victimization.

At times, these discussions may sound uncomfortable, overwhelming, or may be mistaken for blame. They are not. Scam victims are never blamed. Our goal is to explain the mechanisms of deception and the human responses that scammers exploit, and the processes that occur after the scam ends, so victims can better understand what happened to them and why it felt convincing at the time, and what the path looks like going forward.

Articles that address the psychology, neurology, physiology, and other characteristics of scams and the victim experience recognize that all people share cognitive and emotional traits that can be manipulated under the right conditions. These characteristics are not flaws. They are normal human functions that criminals deliberately exploit. Victims typically have little awareness of these mechanisms while a scam is unfolding and a very limited ability to control them. Awareness often comes only after the harm has occurred.

By explaining these processes, these articles help victims make sense of their experiences, understand common post-scam reactions, and identify ways to protect themselves moving forward. This knowledge supports recovery by replacing confusion and self-blame with clarity, context, and self-compassion.

Additional educational material on these topics is available at ScamPsychology.org – ScamsNOW.com and other SCARS Institute websites.

Psychology Disclaimer:

All articles about psychology and the human brain on this website are for information & education only

The information provided in this article is intended for educational and self-help purposes only and should not be construed as a substitute for professional therapy or counseling.

While any self-help techniques outlined herein may be beneficial for scam victims seeking to recover from their experience and move towards recovery, it is important to consult with a qualified mental health professional before initiating any course of action. Each individual’s experience and needs are unique, and what works for one person may not be suitable for another.

Additionally, any approach may not be appropriate for individuals with certain pre-existing mental health conditions or trauma histories. It is advisable to seek guidance from a licensed therapist or counselor who can provide personalized support, guidance, and treatment tailored to your specific needs.

If you are experiencing significant distress or emotional difficulties related to a scam or other traumatic event, please consult your doctor or mental health provider for appropriate care and support.

Also read our SCARS Institute Statement about Professional Care for Scam Victims – click here to go to our ScamsNOW.com website.

Thank you for your comment. You may receive an email to follow up. We never share your data with marketers.