Explosion Of Unemployment Fraud In the U.S.

During the Pandemic, the United States is experiencing a Massive upsurge in Unemployment Fraud!

According to the U.S. Secret Service: “Massive Fraud” Against State Unemployment Insurance Programs

A well-organized Nigerian crime ring is exploiting the COVID-19 crisis by committing large-scale fraud against multiple state unemployment insurance programs, with potential losses in the hundreds of millions of dollars, according to a new alert issued by the U.S. Secret Service.

A Real Warning Of Massive Unemployment Fraud!

During the current pandemic, the problem of Unemployment Fraud has exploded.

Scammers are also using other kinds of compromised relationships (from relationship scams) to use identity information from their victims, and even access to financial accounts, to create new fraudulent accounts.

From our SCARS Partner Shannon Slaughter

We have been notified by fraudulent unemployment claim victims that deposit accounts are being opened for the purpose of receiving these benefits.

I suspect it is because state agencies are getting wise to the money mule activity we are used to seeing with this fraud and the fraudsters are now opening deposit accounts in the names of the victims in order to make it look legitimate.

What tips them off is the welcome letter and/or debit card they receive.

I also suspect (no confirmation yet) the fraudsters are transferring the money out via P2P or A2A and that’s why the fraudsters don’t need the debit cards. Fraudsters are currently targeting fintechs and large FIs [financial institutions] to open these accounts.

If you are a victim of a fraudulent unemployment benefit claim, KEEP A CLOSE EYE ON YOUR CREDIT REPORT.

FIs [financial institutions] do not hard hit the credit bureaus anymore for deposit accounts so the only way you will find out is if the account charges off and goes to collection.

I highly recommend placing an alert or freeze on ChexSystems if you have been notified of a fraudulent unemployment claim as it is currently the most widely used product for new customer/member deposit account openings. PLEASE SHARE!

FBI Sees Spike in Fraudulent Unemployment Insurance Claims Filed Using Stolen Identities

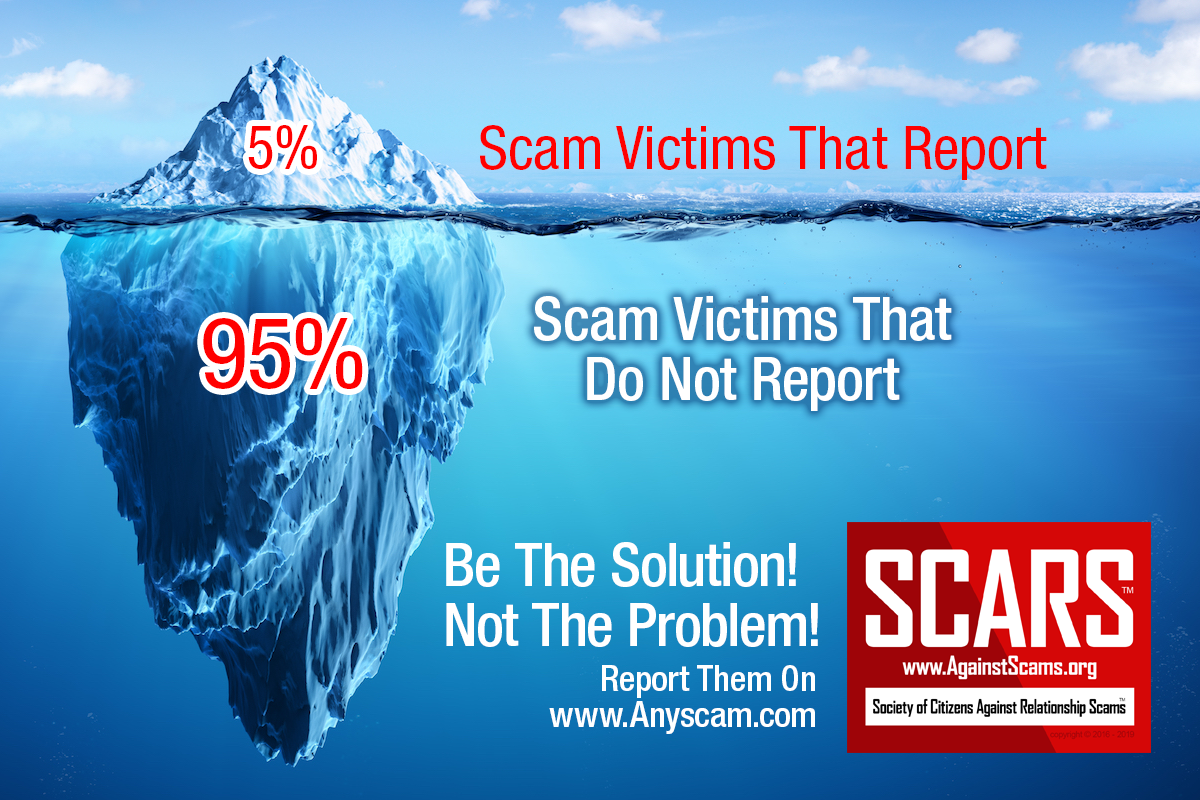

The FBI has seen a spike in fraudulent unemployment insurance claims complaints related to the ongoing COVID-19 pandemic involving the use of stolen personally identifiable information (PII).

U.S. citizens from several states have been victimized by criminal actors impersonating the victims and using the victims’ stolen identities to submit fraudulent unemployment insurance claims online. The criminals obtain the stolen identity using a variety of techniques, including the online purchase of stolen PII, previous data breaches, computer intrusions, cold-calling victims while using impersonation scams, email phishing schemes, physical theft of data from individuals or third parties, and from public websites and social media accounts, among other methods. Criminal actors will use third parties or persuade individuals who are victims of other scams or frauds to transfer fraudulent funds to accounts controlled by criminals.

Many victims of identity theft related to unemployment insurance claims do not know they have been targeted until they try to file a claim for unemployment insurance benefits, receive a notification from the state unemployment insurance agency, receive an IRS Form 1099-G showing the benefits collected from unemployment insurance, or get notified by their employer that a claim has been filed while the victim is still employed.

The FBI Advises The Public To Be On The Lookout For The Following Suspicious Activities:

- Receiving communications regarding unemployment insurance forms when you have not applied for unemployment benefits

- Unauthorized transactions on your bank or credit card statements related to unemployment benefits

- Any fees involved in filing or qualifying for unemployment insurance

- Unsolicited inquires related to unemployment benefits

- Fictitious websites and social media pages mimicking those of government agencies

Tips On How To Protect Yourself:

- Be wary of telephone calls and text messages, letters, websites, or emails that require you to provide your personal information or other sensitive information, especially birth dates and Social Security numbers. Be cautious with attachments and embedded links within email, especially from an unknown email sender.

- Make yourself aware of methods fraudsters are using to obtain PII and how to combat them by following security tips issued by the Cybersecurity and Infrastructure Security Agency, including:

- Avoiding Social Engineering and Phishing Attacks

- Protecting Against Malicious Code

- Preventing and Responding to Identity Theft

- Monitor your bank accounts on a regular basis and request your credit report at least once a year to look for any fraudulent activity. If you believe you are a victim, review your credit report more frequently.

- Immediately report unauthorized transactions to your financial institution or credit card provider.

- If you suspect you are a victim, immediately contact the three major credit bureaus to place a fraud alert on your credit records. Additionally, notify the Internal Revenue Service by filing an Identity Theft Affidavit (IRS Form 14039) through irs.gov or identitytheft.gov.

If you believe you have been a victim of identity theft related to fraudulent unemployment insurance claims, report the fraud to law enforcement, state unemployment insurance agencies, the IRS, credit bureaus, and your employer’s human resources department. The FBI encourages victims to report fraudulent or any suspicious activities to the Internet Crime Complaint Center at ic3.gov. You may consult identitytheft.gov for help in reporting and recovering from identity theft.

U.S. Secret Services ties explosion in Unemployment Fraud to Nigerian criminal cartel!

A well-organized Nigerian crime ring is exploiting the COVID-19 crisis by committing large-scale fraud against multiple state unemployment insurance programs, with potential losses in the hundreds of millions of dollars, according to a new alert issued by the U.S. Secret Service.

“a substantial amount of the fraudulent benefits submitted have used PII from first responders, government personnel and school employees.”

“It is assumed the fraud ring behind this possesses a substantial PII database to submit the volume of applications observed thus far,” the Secret Service warned. “The primary state targeted so far is Washington, although there is also evidence of attacks in North Carolina, Massachusetts, Rhode Island, Oklahoma, Wyoming and Florida.”

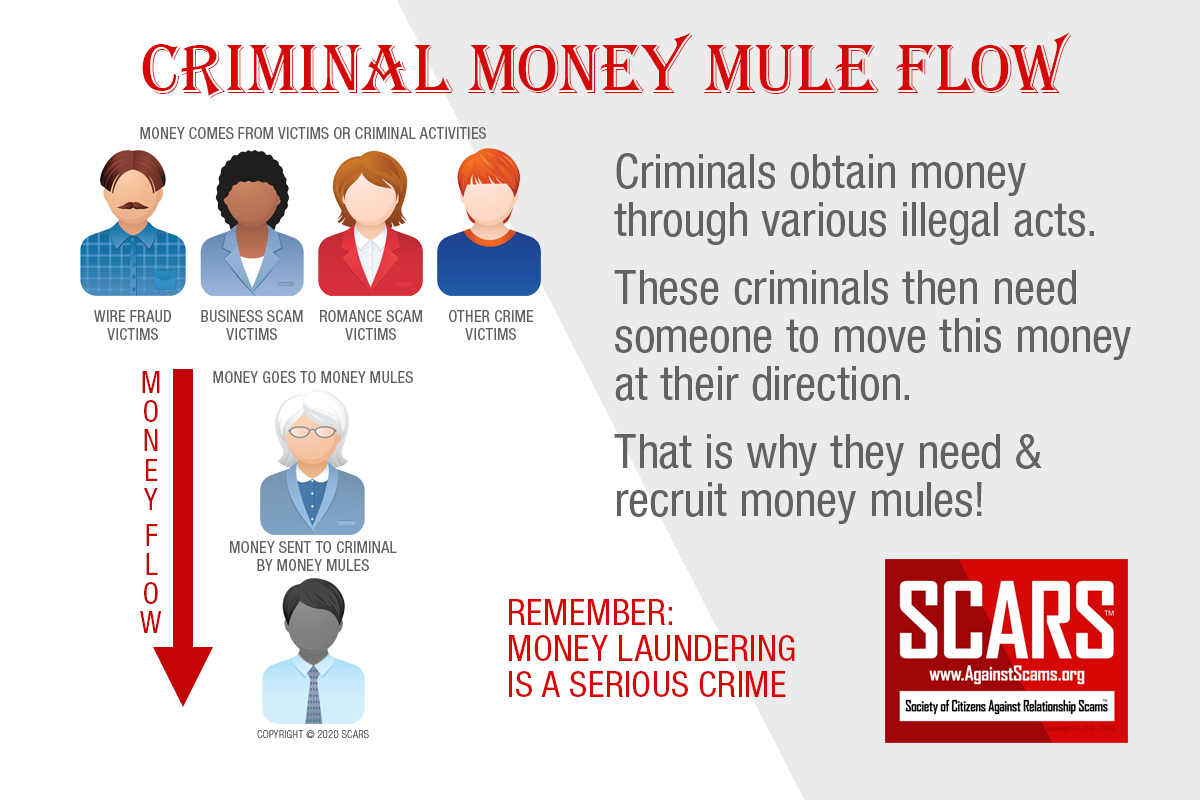

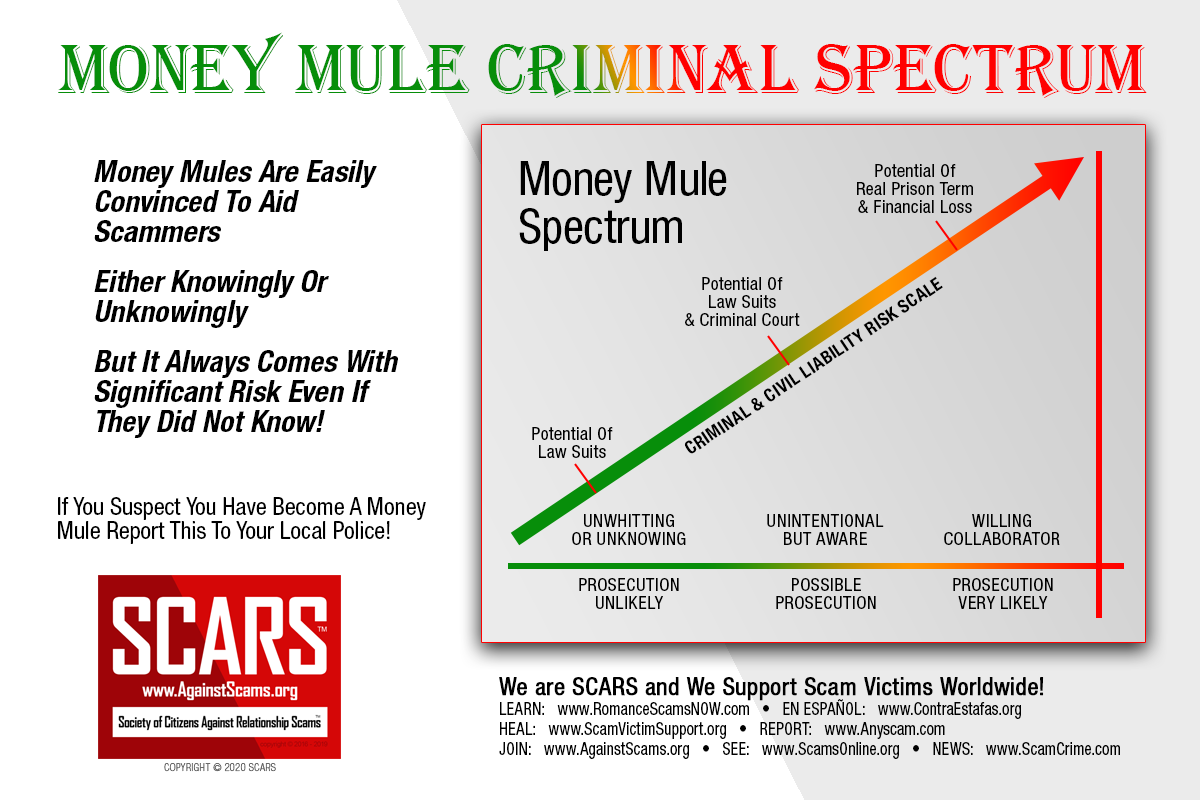

The Secret Service indicates that the fraud network is believed to consist of hundred of “mules,” a term used to describe willing or unwitting individuals who are recruited to help launder the proceeds of fraudulent financial transactions.

“In the state of Washington, individuals residing out-of-state are receiving multiple ACH deposits from the State of Washington Unemployment Benefits Program, all in different individuals’ names with no connection to the account holder”.

The Secret Service suggests the crime ring is operating in much the same way as crooks who specialize in filing fraudulent income tax refund requests with the states and the U.S. Internal Revenue Service (IRS), a problem that costs the states and the U.S. Treasury hundreds of millions of dollars in revenue each year.

In those schemes, the scammers typically recruit people — often victims of online romance scams or those who also are out of work and looking for any source of income — to receive direct deposits from the fraudulent transactions, and then forward the bulk of the illicit funds to the perpetrators.

PLEASE SHARE OUR ARTICLES WITH YOUR FRIENDS & FAMILY

HELP OTHERS STAY SAFE ONLINE – YOUR KNOWLEDGE CAN MAKE THE DIFFERENCE!

THE NEXT VICTIM MIGHT BE YOUR OWN FAMILY MEMBER OR BEST FRIEND!

By the SCARS™ Editorial Team

Society of Citizens Against Relationship Scams Inc.

A Worldwide Crime Victims Assistance & Crime Prevention Nonprofit Organization Headquartered In Miami Florida USA & Monterrey NL Mexico, with Partners In More Than 60 Countries

To Learn More, Volunteer, or Donate Visit: www.AgainstScams.org

Contact Us: Contact@AgainstScams.org

TAGS: SCARS, Information About Scams, Anti-Scam, Scams, Scammers, Fraudsters, Cybercrime, Crybercriminals, Romance Scams, Scam Victims, Online Fraud, Online Crime Is Real Crime, Scam Avoidance, Unemployment Fraud, Money Mules, Account Access, Criminal, Money Laundering, Financial Responsibility

Leave A Comment