Scam Basics: Understanding Synthetic Identity Fraud

A Type Of Identity Theft

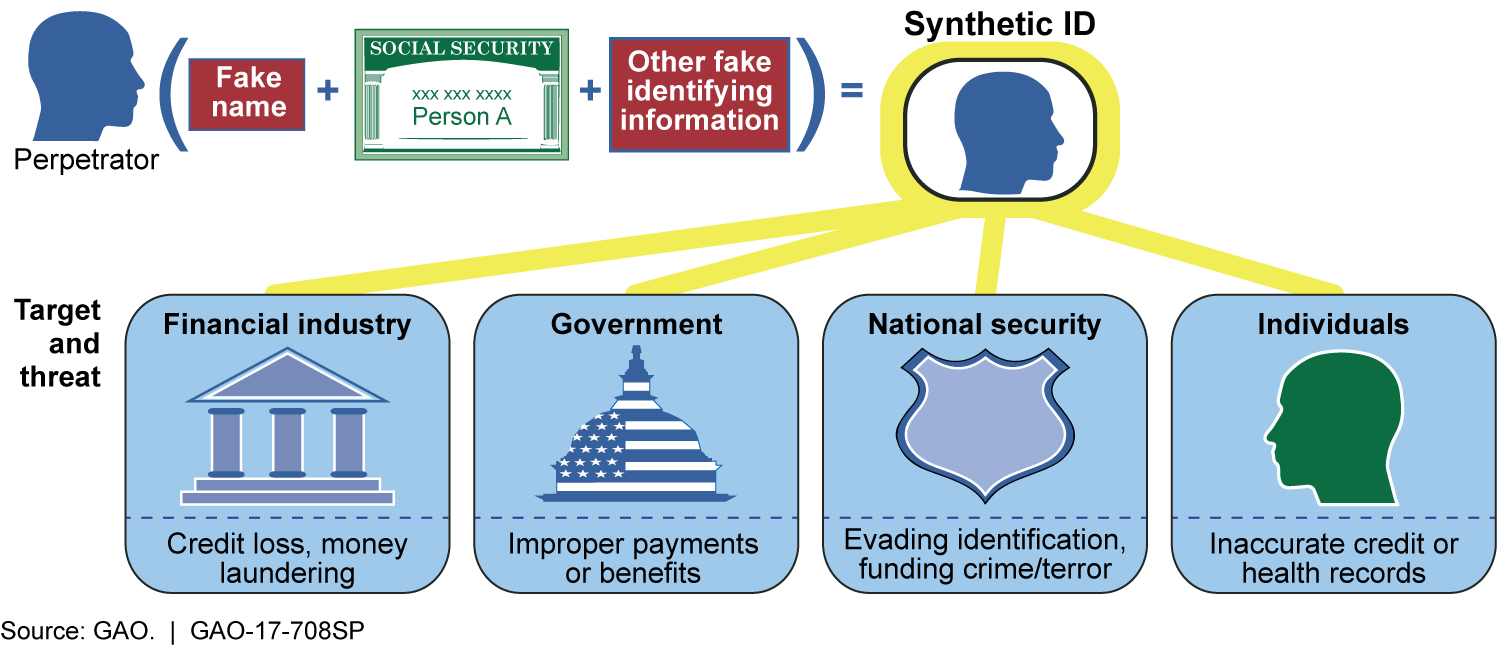

Synthetic Identity Fraud is a type of financial crime in which a criminal (or group of criminals) creates a false identity by combining both real and fabricated information to obtain credit, loans, or other financial products. This crime has been on the rise in recent years, and it poses a significant threat to financial institutions, consumers, and businesses. In this article, we will explore how Synthetic Identity Fraud works, who is behind it, how to detect and investigate it, and how to avoid it.

How Does Synthetic Identity Fraud Work?

Synthetic Identity Fraud is a complex and sophisticated crime that involves the creation of a fictitious identity that can be used to apply for credit or other financial products. The criminals behind this fraud usually combine real and fabricated information to create a new identity that can be used to obtain credit. They may use a real social security number, for example, but combine it with a fake name and address.

Once they have created a synthetic identity, the criminals then use it to open bank accounts or apply for credit cards, loans, or other financial products. They may use these accounts to establish a credit history for the synthetic identity, which they can then use to obtain larger loans or credit lines.

The criminals behind Synthetic Identity Fraud can be individuals or organized crime groups that are well-versed in financial fraud. They often use sophisticated techniques, such as creating multiple synthetic identities, to avoid detection.

Who Are The Typical Criminals Behind Synthetic Identity Fraud?

The criminals behind Synthetic Identity Fraud can be anyone from individuals to organized crime groups. However, they tend to be individuals with a background in financial fraud or organized crime groups that specialize in this type of crime.

Individuals involved in Synthetic Identity Fraud may include those with poor credit scores or a criminal history that makes it difficult for them to obtain credit. They may also include those who are trying to evade creditors or financial institutions. However, most often they are professional cybercriminals in it for the potential financial rewards.

Organized crime groups involved in Synthetic Identity Fraud are often highly sophisticated and organized. They may have access to large amounts of personal information, including social security numbers and other identifying information. They can buy the information that originated from major data breaches on the dark web, or obtain enough information from harvesting data from people’s social media profiles.

They may also have the resources to create multiple synthetic identities and establish credit histories for each one.

How To Detect And Investigate Synthetic Identity Fraud?

Detecting and investigating Synthetic Identity Fraud can be challenging, as the criminals behind this type of fraud are often skilled at covering their tracks. However, there are several methods that can be used to detect and investigate this type of fraud.

One of the most effective methods for detecting Synthetic Identity Fraud is to use data analytics and machine learning algorithms to identify patterns and anomalies in credit applications and transactions. These algorithms can help identify suspicious activity, such as the use of multiple identities or the sudden appearance of a large number of new accounts.

Another method for detecting Synthetic Identity Fraud is to use identity verification tools to verify the identity of individuals applying for credit or other financial products. These tools can help verify that the identity being used is legitimate and reduce the risk of fraud.

Once Synthetic Identity Fraud has been detected, it can be investigated using traditional forensic techniques, such as analyzing financial records and conducting interviews with individuals involved in the fraud. Law enforcement agencies may also work with financial institutions to track down the individuals behind the fraud and bring them to justice.

How To Avoid Synthetic Identity Fraud?

There are several steps that individuals and businesses can take to avoid becoming victims of Synthetic Identity Fraud.

Individuals can protect themselves by monitoring their credit reports regularly and reporting any suspicious activity to credit reporting agencies. They can also protect their personal information by using strong passwords, avoiding sharing personal information online and being cautious about providing personal information over the phone or through email.

Businesses can protect themselves by using identity verification tools and conducting thorough background checks on individuals applying for credit or other financial products. They can also implement robust fraud detection and prevention systems that use data analytics and machine learning algorithms to identify suspicious activity.

Synthetic Identity Fraud is a growing problem that can cause significant financial damage to individuals and businesses. It occurs when criminals use a combination of real and fake information to create a new identity that they can use to apply for credit or other financial products. To avoid becoming a victim of Synthetic Identity Fraud, individuals and businesses need to take proactive steps to protect their personal information and implement robust fraud prevention measures.

Here are some tips on how to avoid Synthetic Identity Fraud:

1. Protect your personal information

One of the most important steps you can take to avoid Synthetic Identity Fraud is to protect your personal information. This includes your social security number, date of birth, and other identifying information. Never share this information online or over the phone unless you are certain that you are dealing with a reputable organization.

2. Monitor your credit report

Regularly monitoring your credit report can help you identify any suspicious activity that could indicate Synthetic Identity Fraud. You can obtain a free copy of your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) once a year. Review your report carefully for any errors or fraudulent activity.

3. Use strong passwords

Using strong passwords can help prevent criminals from gaining access to your online accounts and stealing your personal information. Use a combination of upper and lowercase letters, numbers, and symbols to create a password that is difficult to guess.

4. Be cautious about providing personal information

Be cautious when providing personal information online, over the phone, or through email. Only provide personal information to reputable organizations that you trust. If you receive a phone call or email asking for personal information, verify the legitimacy of the request before providing any information.

5. Implement identity verification tools

Businesses can implement identity verification tools to help prevent Synthetic Identity Fraud. These tools can verify the identity of individuals applying for credit or other financial products, reducing the risk of fraud.

6. Conduct thorough background checks

Businesses should conduct thorough background checks on individuals applying for credit or other financial products. This can help identify any red flags that could indicate Synthetic Identity Fraud, such as a history of financial fraud or a criminal record.

7. Implement fraud detection and prevention systems

Implementing fraud detection and prevention systems can help businesses identify suspicious activity and prevent Synthetic Identity Fraud. These systems can use data analytics and machine learning algorithms to identify patterns and anomalies that could indicate fraud.

Essentially, Synthetic Identity Fraud is a serious problem that can cause significant financial damage to individuals and businesses. However, by taking proactive steps to protect your personal information and implementing robust fraud prevention measures, you can significantly reduce the risk of becoming a victim of this type of fraud. Regularly monitoring your credit report, using strong passwords, being cautious about providing personal information, and implementing identity verification tools and fraud detection and prevention systems are all effective strategies for avoiding Synthetic Identity Fraud.

More About Synthetic Identity Fraud

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment below!

Do You Need Support?

Get It Now!

SCARS provides the leading Support & Recovery program for relationship scam victims – completely FREE!

Our managed peer support groups allow victims to talk to other survivors and recover in the most experienced environment possible, for as long as they need. Recovery takes as long as it takes – we put no limits on our support!

SCARS is the most trusted support & education provider in the world. Our team is certified in trauma-informed care, grief counseling, and so much more!

To apply to join our groups visit support.AgainstScams.org

We also offer separate support groups for family & friends too.

Become a

SCARS STAR™ Member

SCARS offers memberships in our STAR program, which includes many benefits for a very low annual membership fee!

SCARS STAR Membership benefits include:

- FREE Counseling or Therapy Benefit from our partner BetterHelp.com

- Exclusive members-only content & publications

- Discounts on SCARS Self-Help Books Save

- And more!

To learn more about the SCARS STAR Membership visit membership.AgainstScams.org

To become a SCARS STAR Member right now visit join.AgainstScams.org

To Learn More Also Look At Our Article Catalogs

Scam & Crime Types

More SCARS

- ScamsNOW Magazine – ScamsNOW.com

- ContraEstafas.org

- ScammerPhotos.com

- AnyScam.com – reporting

- AgainstScams.org – SCARS Corporate Website

- SCARS YouTube Video Channel

Leave A Comment