SCARS Institute’s Encyclopedia of Scams™ Published Continuously for 25 Years

Breaking News: Scam Victim Turned Into Money Mule Arrested In West Virginia

Huntington Woman Indicted as Part of International Nigerian Fraud Scheme for Laundering Funds

This Elderly Scam Victim Being Made An Example By Prosecutors To Deter Others From Becoming Mules

As we have reported before, the U.S. Government is beginning to crack down on scam victims that are converted into money mules. This is especially true if they are in such profound denial that they refuse to stop once told by the police to end it. This is just the latest example of an elderly scam victim that supported Nigerian scammers and exploited other scam victims.

Breaking News: Scam Victim Turned Into Money Mule Arrested In West Virginia

CHARLESTON, West Virginia — United States Attorney Mike Stuart announced that a federal grand jury has indicted a Huntington woman in connection with laundering funds from an international fraud scheme that scammed money from individuals, many of whom were elderly, in several states and foreign countries.

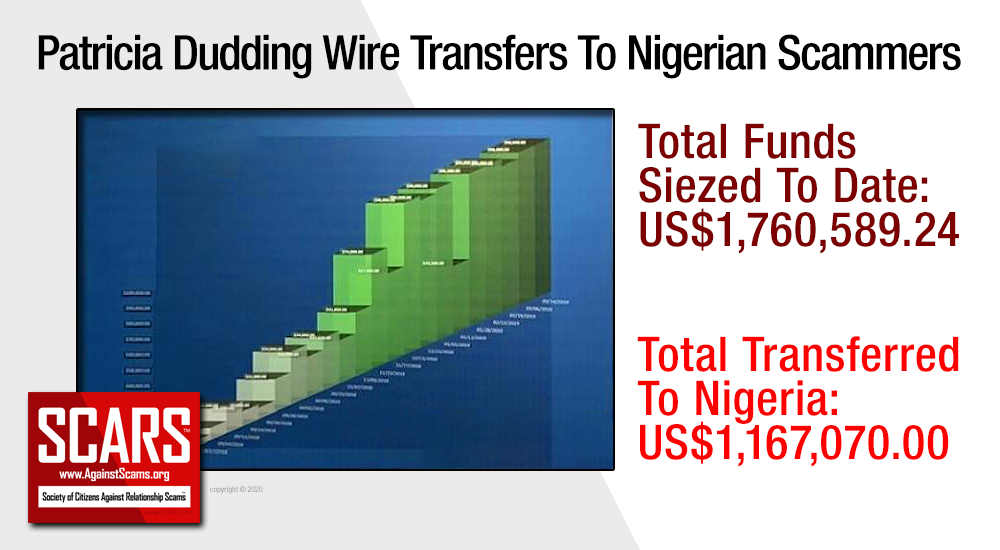

A twelve count indictment was returned against Patricia Dudding, 68, of Huntington, charging her with conspiracy to commit money laundering, bank fraud and unlawful money transactions. The indictment alleges that Dudding acted as a money mule for a Nigerian scammer. According to the indictment, Dudding met “Lucas” online in the early spring of 2018, and although they never actually met in person, Dudding and Lucas communicated frequently by email and text messages. The indictment alleges that Dudding set up numerous bank accounts in her name at over 10 different banks and that she would use these bank accounts to wire and receive fraudulent funds. Dudding received numerous deposits in those bank accounts from more than two dozen individuals located in the United States and abroad. She, and unnamed co-conspirators, would then transfer these funds to bank accounts located in Nigeria. To further the scheme, Dudding admittedly would make false and fraudulent representations to the financial institutions to make it appear that the wire transfers were being sent for legitimate purposes.

“Egregious. This is the largest elder fraud scheme ever prosecuted in the history of West Virginia and our work continues. This case is significant on a national and international level,” said United States Attorney Mike Stuart. “Elder fraud is an important priority for Attorney General Barr and me. Elder fraud is a diabolical crime that preys on the vulnerabilities of some of the most vulnerable among us. By all outward appearances, Mrs. Dudding was just an ordinary neighbor but, instead, the indictment alleges she was what we call a “money mule” actively engaged in facilitating a money laundering scheme that left many, many victims in its wake. The stories of the victims are tragic. Our goal is to hold those responsible accountable and to do our best to make victims of these despicable crimes whole. This investigation is on-going.”

“The exploitation of both a vulnerable population as well as our financial systems is a particular evil,” said U.S. Secret Service Charleston Resident Agent in Charge Wade Fleming. “These criminals may not hide behind false identities and fraudulent accounts, and our skilled investigators will continue to pursue and bring these malicious actors before our justice system.”

Money mules play critical roles in the commission and facilitation of fraudulent schemes including elder fraud. A money mule is someone who transfers illegally acquired money on behalf of or at the direction of another party. Criminal enterprises recruit what is referred to as a “mule” to move money electronically through bank accounts, move physical currency, or assist in the movement of money through a variety of other methods. Money mules are inherently dangerous, as they add layers to the money trail from a victim to a criminal and launder money illegally to aid a criminal actor.

The indictment alleges that Dudding used over $100,000 of victim funds for her personal benefit over the course of the scheme. Dudding used those funds to pay her utility bills, satellite television service, groceries, drug store purchases, gasoline purchases, department store purchases, restaurants and took numerous cash withdrawals. Her total cash withdrawals amounted to nearly $42,000. The total loss contributed to the fraudulent scheme is $3.2 million. Over $3 million was transferred or deposited into Dudding’s accounts during the scheme and she attempted to transfer over $1.6 million to Nigeria during this period.

During the course of the investigation, warrants were issued for the seizure of nearly $1.9 million related to the alleged scheme. The indictment seeks forfeiture of those funds.

The victims in this case that have been identified are from six (6) countries including the United States, Australia, Canada, Nevis, Poland, and Sweden as well as twenty (20) states including Alaska, Arkansas, California, Connecticut, Florida, Georgia, Indiana, Kansas, Louisiana, Maryland, Massachusetts, Minnesota, Missouri, Montana, New Jersey, North Carolina, Pennsylvania, Ohio, Texas, and Washington.

The investigation was conducted by the United States Secret Service, the Federal Deposit Insurance Corporation (FDIC) – Office of Inspector General and the South Charleston Police Department. Assistant United States Attorney Kathleen Robeson is handling the matter.

“Elder fraud and financial fraud are complex frauds. I want to commend the excellent, detailed work of the Secret Service, the FDIC-OIG and the South Charleston Police Department, and my team, including AUSA Robeson and my remarkable investigators, Steve Rowley and Tony Hussion. This was a team effort and I’m proud of their work,” continued Stuart.

If convicted on all counts, Dudding faces up to 20 years in prison. The investigation is ongoing and could result in additional federal and state charges in the future.

Since President Trump signed the bipartisan Elder Abuse Prevention and Prosecution Act (EAPPA) into law, the Department of Justice has participated in hundreds of enforcement actions in criminal and civil cases that targeted or disproportionately affected seniors. In particular, in March 2019, the department announced the largest elder fraud enforcement action in American history, charging more than 260 defendants in a nationwide elder fraud sweep. The department has likewise conducted hundreds of trainings and outreach sessions across the country since the passage of the Act.

More information about the department’s efforts to help American seniors is available at its Elder Justice Initiative webpage. Elder fraud complaints may be filed with the FTC at www.ftccomplaintassistant.gov or at 877-FTC-HELP. The Department of Justice provides a variety of resources relating to elder fraud victimization through its Office for Victims of Crime, which can be reached at https://www.ovc.gov.

Please Note: An indictment is merely an allegation and the defendant is presumed innocent unless and until proven guilty beyond a reasonable doubt in a court of law.

TAGS: SCARS, Important Article, Information About Scams, Anti-Scam, Scams, Scammers, Fraudsters, Cybercrime, Crybercriminals, Romance Scams, Scam Victims, Breaking News, Scam Victim, Money Mule Arrested, West Virginia, Patricia Dudding

SCARS™ Editorial Team

Society of Citizens Against Relationship Scams Inc.

A Worldwide Crime Victims Assistance Nonprofit Organization

Visit: www.AgainstScams.org

Contact Us: Contact@AgainstScams.org

PLEASE SHARE OUR ARTICLES WITH YOUR FRIENDS & FAMILY

HELP OTHERS STAY SAFE ONLINE – YOUR KNOWLEDGE CAN MAKE THE DIFFERENCE!

The Latest SCARS Posts:

FIND MORE SCAM NEWS

«SCAMCRIME.COM»

JOIN US ON FACEBOOK

«CLICK HERE»

END

MORE INFORMATION

– – –

Tell us about your experiences with Romance Scammers in our

« Scams Discussion Forum on Facebook »

– – –

FAQ: How Do You Properly Report Scammers?

It is essential that law enforcement knows about scams & scammers, even though there is nothing (in most cases) that they can do.

Always report scams involving money lost or where you received money to:

- Local Police – ask them to take an “informational” police report – say you need it for your insurance

- U.S. State Police (if you live in the U.S.) – they will take the matter more seriously and provide you with more help than local police

- Your National Police or FBI « www.IC3.gov »

- The SCARS|CDN™ Cybercriminal Data Network – Worldwide Reporting Network on « www.Anyscam.com »

This helps your government understand the problem, and allows law enforcement to add scammers on watch lists worldwide.

– – –

To learn more about SCARS visit « www.AgainstScams.org »

Please be sure to report all scammers

on « www.Anyscam.com »

Disclaimer:

SCARS IS A DIGITAL PUBLISHER AND DOES NOT OFFER HEALTH OR MEDICAL ADVICE, LEGAL ADVICE, FINANCIAL ADVICE, OR SERVICES THAT SCARS IS NOT LICENSED OR REGISTERED TO PERFORM.

IF YOU’RE FACING A MEDICAL EMERGENCY, CALL YOUR LOCAL EMERGENCY SERVICES IMMEDIATELY, OR VISIT THE NEAREST EMERGENCY ROOM OR URGENT CARE CENTER. YOU SHOULD CONSULT YOUR HEALTHCARE PROVIDER BEFORE FOLLOWING ANY MEDICALLY RELATED INFORMATION PRESENTED ON OUR PAGES.

ALWAYS CONSULT A LICENSED ATTORNEY FOR ANY ADVICE REGARDING LEGAL MATTERS.

A LICENSED FINANCIAL OR TAX PROFESSIONAL SHOULD BE CONSULTED BEFORE ACTING ON ANY INFORMATION RELATING TO YOUR PERSONAL FINANCES OR TAX RELATED ISSUES AND INFORMATION.

This content and other material contained on the website, apps, newsletter, and products (“Content”), is general in nature and for informational purposes only and does not constitute medical, legal, or financial advice; the Content is not intended to be a substitute for licensed or regulated professional advice. Always consult your doctor or other qualified healthcare provider, lawyer, financial or tax professional with any questions you may have regarding the educational information contained herein. SCARS makes no guarantees about the efficacy of information described on or in SCARS’s Content. The information contained are subject to change and are not intended to cover all possible situations or effects. SCARS does not recommend or endorse any specific professional or care provider, product, service, or other information that may be mentioned in SCARS’s websites, apps, and Content unless explicitly identified as such.

The disclaimers herein are provided on this page for ease of reference. These disclaimers supplement and are a part of SCARS’s websites Terms of Use.

Legal Notices:

All original content is Copyright © 1991 – 2020 Society of Citizens Against Relationship Scams Inc. (D.B.A SCARS) All Rights Reserved Worldwide & Webwide. Third-party copyrights acknowledge.

SCARS, SCARS|INTERNATIONAL, SCARS, SCARS|SUPPORT, SCARS, RSN, Romance Scams Now, SCARS|WORLDWIDE, SCARS|GLOBAL, SCARS, Society of Citizens Against Relationship Scams, Society of Citizens Against Romance Scams, SCARS|ANYSCAM, Project Anyscam, Anyscam, SCARS|GOFCH, GOFCH, SCARS|CHINA, SCARS|CDN, SCARS|UK, SCARS|LATINOAMERICA, SCARS|MEMBER, SCARS|VOLUNTEER, SCARS Cybercriminal Data Network, Cobalt Alert, Scam Victims Support Group, are all trademarks of Society of Citizens Against Relationship Scams Inc.

Contact the law firm for the Society of Citizens Against Relationship Scams Incorporated by email at legal@AgainstScams.org

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment below!

Table of Contents

- Huntington Woman Indicted as Part of International Nigerian Fraud Scheme for Laundering Funds

- Ethereum ETHM Token Trap and Pig Butchering Scams – 2026

- New U.S. Law – S.3643 – 118th Congress – Will Dramatically Impact Scammers and Terrorists – 2026

- How Scam Survivors Can Survive Valentine’s Day – 2026

- U.S. Veterans Benefits Scams – 2026

- New AI Voice Cloning Phone Scams – 2026

- An Essay on Justice and Money Recovery – 2026

- Tell us about your experiences with Romance Scammers in our

« Scams Discussion Forum on Facebook » - FAQ: How Do You Properly Report Scammers?

- Please be sure to report all scammers

on « www.Anyscam.com »

LEAVE A COMMENT?

Recent Comments

On Other Articles

- Arwyn Lautenschlager on Love Bombing And How Romance Scam Victims Are Forced To Feel: “I was love bombed to the point that I would do just about anything for the scammer(s). I was told…” Feb 11, 14:24

- on Dani Daniels (Kira Lee Orsag): Another Scammer’s Favorite: “You provide a valuable service! I wish more people knew about it!” Feb 10, 15:05

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “We highly recommend that you simply turn away form the scam and scammers, and focus on the development of a…” Feb 4, 19:47

- on The Art Of Deception: The Fundamental Principals Of Successful Deceptions – 2024: “I experienced many of the deceptive tactics that romance scammers use. I was told various stories of hardship and why…” Feb 4, 15:27

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “Yes, I’m in that exact situation also. “Danielle” has seriously scammed me for 3 years now. “She” (he) doesn’t know…” Feb 4, 14:58

- on An Essay on Justice and Money Recovery – 2026: “you are so right I accidentally clicked on online justice I signed an agreement for 12k upfront but cd only…” Feb 3, 08:16

- on The SCARS Institute Top 50 Celebrity Impersonation Scams – 2025: “Quora has had visits from scammers pretending to be Keanu Reeves and Paul McCartney in 2025 and 2026.” Jan 27, 17:45

- on Scam Victims Should Limit Their Exposure To Scam News & Scammer Photos: “I used to look at scammers photos all the time; however, I don’t feel the need to do it anymore.…” Jan 26, 23:19

- on After A Scam, No One Can Tell You How You Will React: “This article was very informative, my scams happened 5 years ago; however, l do remember several of those emotions and/or…” Jan 23, 17:17

- on Situational Awareness and How Trauma Makes Scam Victims Less Safe – 2024: “I need to be more observant and I am practicing situational awareness. I’m saving this article to remind me of…” Jan 21, 22:55

ARTICLE META

Important Information for New Scam Victims

- Please visit www.ScamVictimsSupport.org – a SCARS Website for New Scam Victims & Sextortion Victims

- Enroll in FREE SCARS Scam Survivor’s School now at www.SCARSeducation.org

- Please visit www.ScamPsychology.org – to more fully understand the psychological concepts involved in scams and scam victim recovery

If you are looking for local trauma counselors please visit counseling.AgainstScams.org or join SCARS for our counseling/therapy benefit: membership.AgainstScams.org

If you need to speak with someone now, you can dial 988 or find phone numbers for crisis hotlines all around the world here: www.opencounseling.com/suicide-hotlines

A Note About Labeling!

We often use the term ‘scam victim’ in our articles, but this is a convenience to help those searching for information in search engines like Google. It is just a convenience and has no deeper meaning. If you have come through such an experience, YOU are a Survivor! It was not your fault. You are not alone! Axios!

A Question of Trust

At the SCARS Institute, we invite you to do your own research on the topics we speak about and publish, Our team investigates the subject being discussed, especially when it comes to understanding the scam victims-survivors experience. You can do Google searches but in many cases, you will have to wade through scientific papers and studies. However, remember that biases and perspectives matter and influence the outcome. Regardless, we encourage you to explore these topics as thoroughly as you can for your own awareness.

Statement About Victim Blaming

SCARS Institute articles examine different aspects of the scam victim experience, as well as those who may have been secondary victims. This work focuses on understanding victimization through the science of victimology, including common psychological and behavioral responses. The purpose is to help victims and survivors understand why these crimes occurred, reduce shame and self-blame, strengthen recovery programs and victim opportunities, and lower the risk of future victimization.

At times, these discussions may sound uncomfortable, overwhelming, or may be mistaken for blame. They are not. Scam victims are never blamed. Our goal is to explain the mechanisms of deception and the human responses that scammers exploit, and the processes that occur after the scam ends, so victims can better understand what happened to them and why it felt convincing at the time, and what the path looks like going forward.

Articles that address the psychology, neurology, physiology, and other characteristics of scams and the victim experience recognize that all people share cognitive and emotional traits that can be manipulated under the right conditions. These characteristics are not flaws. They are normal human functions that criminals deliberately exploit. Victims typically have little awareness of these mechanisms while a scam is unfolding and a very limited ability to control them. Awareness often comes only after the harm has occurred.

By explaining these processes, these articles help victims make sense of their experiences, understand common post-scam reactions, and identify ways to protect themselves moving forward. This knowledge supports recovery by replacing confusion and self-blame with clarity, context, and self-compassion.

Additional educational material on these topics is available at ScamPsychology.org – ScamsNOW.com and other SCARS Institute websites.

Psychology Disclaimer:

All articles about psychology and the human brain on this website are for information & education only

The information provided in this article is intended for educational and self-help purposes only and should not be construed as a substitute for professional therapy or counseling.

While any self-help techniques outlined herein may be beneficial for scam victims seeking to recover from their experience and move towards recovery, it is important to consult with a qualified mental health professional before initiating any course of action. Each individual’s experience and needs are unique, and what works for one person may not be suitable for another.

Additionally, any approach may not be appropriate for individuals with certain pre-existing mental health conditions or trauma histories. It is advisable to seek guidance from a licensed therapist or counselor who can provide personalized support, guidance, and treatment tailored to your specific needs.

If you are experiencing significant distress or emotional difficulties related to a scam or other traumatic event, please consult your doctor or mental health provider for appropriate care and support.

Also read our SCARS Institute Statement about Professional Care for Scam Victims – click here to go to our ScamsNOW.com website.

Thank you for your comment. You may receive an email to follow up. We never share your data with marketers.