SCARS Institute’s Encyclopedia of Scams™ Published Continuously for 25 Years

The Strange History of Nigerian Super-Scammer & Cybercriminal ‘Hushpuppy’

A Nigerian Super-Scammer & Cybercriminal Laundering Cash for North Korean Hackers and Dark Web Criminal Enterprise: The Case of Hushpuppi (Ramon Olorunwa Abbas)

Organized Crime – A SCARS Institute Insight

Author:

• SCARS Institute Encyclopedia of Scams Editorial Team – Society of Citizens Against Relationship Scams Inc.

• Portions Based on Research from Other sources

Article Abstract

Hushpuppi, born Ramon Abbas, was a Nigerian social media influencer known for flaunting a lavish lifestyle funded through major criminal activities. His crimes primarily involved Business Email Compromise (BEC) fraud, money laundering, and wire fraud.

He and his associates defrauded businesses and individuals globally, stealing over $24 million. Hushpuppi laundered illicit funds across international borders, concealing the origins of the money, before being arrested in Dubai in 2020. He was later extradited to the U.S., where he was convicted and sentenced for his crimes.

A Nigerian Super-Scammer & Cybercriminal Laundering Cash for North Korean Hackers and Dark Web Criminal Enterprise: The Case of Hushpuppi (Ramon Olorunwa Abbas)

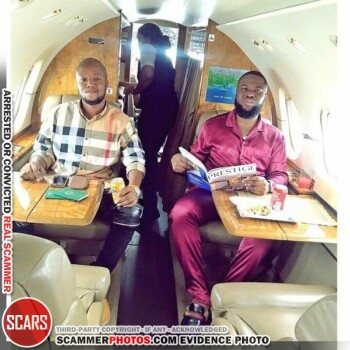

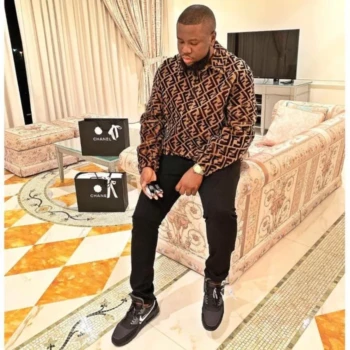

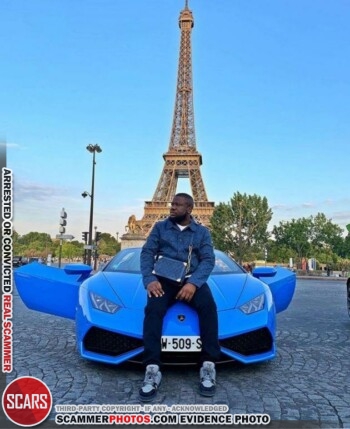

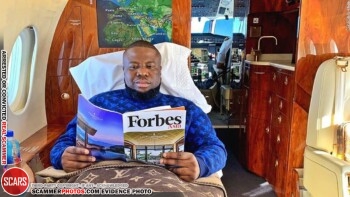

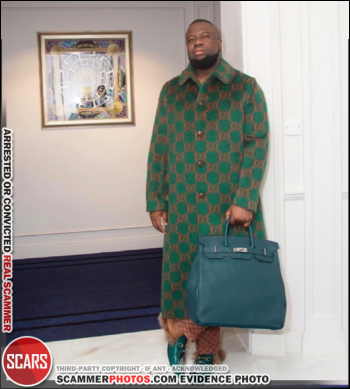

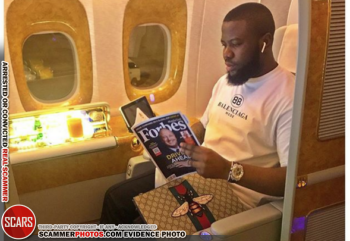

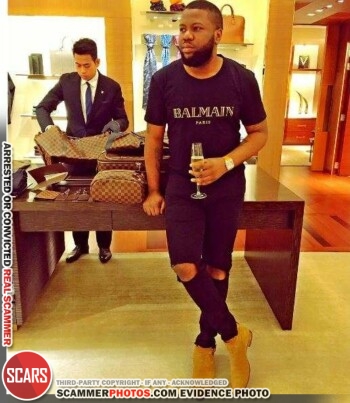

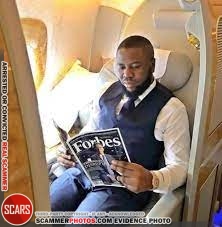

Ramon Olorunwa Abbas, widely known as Hushpuppi, was a Nigerian social media influencer, super-scammer and cybercriminal who flaunted a lavish lifestyle on platforms like Instagram. However, beneath the luxury cars, designer clothes, and international travel was a darker reality: Hushpuppi was involved in money laundering for hackers and cybercriminals. His role was to funnel millions of dollars from various fraudulent schemes, including business email compromise (BEC) scams, through complex financial networks.

Hushpuppi’s rise to Internet fame came from showcasing a lifestyle that included expensive tastes in fashion, watches, and luxury travel. His Instagram posts attracted millions of followers, eager to see glimpses of his high-end lifestyle. What many did not know was that this glamorous facade was funded through criminal activities. According to law enforcement, Hushpuppi was part of a large network of hackers and scammers who targeted businesses and individuals worldwide. These criminals employed tactics such as phishing and BEC attacks to deceive victims into transferring large sums of money.

As Hushpuppi’s wealth and influence grew, so did the attention of law enforcement agencies. His opulent displays of wealth were not only attracting social media followers but also raising suspicions. In 2020, he was arrested in Dubai by the FBI and Interpol in a coordinated operation. The investigation revealed that Hushpuppi had helped launder millions of dollars through cybercrime, including a fraudulent scheme that defrauded a Qatari businessman of $1.1 million.

The investigation also uncovered how Hushpuppi used his social media presence to recruit and collaborate with other criminals. He played a crucial role in laundering the proceeds of fraud through various means, including shell companies and bank accounts around the world.

Despite his attempts to evade capture, law enforcement had been tracking his movements for years. His arrest in 2020 marked a significant victory in the global fight against cybercrime. Hushpuppi’s case highlights the growing trend of social media influencers becoming involved in financial crimes, using their platforms to not only build personal brands but also engage in illicit activities behind the scenes.

In July 2021, Hushpuppi pleaded guilty to charges of money laundering and was sentenced to over 11 years in prison. His case is a stark reminder of the blurred lines between online personas and real-world criminal activities. While Hushpuppi is now behind bars, his case has shone a light on the role that influencers can play in aiding and abetting large-scale cybercrimes. As law enforcement agencies continue to adapt to the digital age, more cases like Hushpuppi’s are likely to emerge, where the facade of luxury and success conceals a darker, criminal underworld.

Criminal Biography of Hushpuppi (Ramon Olorunwa Abbas)

Ramon Olorunwa Abbas, better known as “Hushpuppi,” was a Nigerian social media influencer turned infamous for his involvement in large-scale cybercrime and money laundering schemes. Born in Lagos, Nigeria, Hushpuppi rose to prominence through his Instagram account, where he flaunted an extravagant lifestyle of luxury cars, private jets, designer clothing, and exotic travel. His posts attracted millions of followers but also raised the suspicions of international law enforcement agencies.

Hushpuppi was involved in numerous cybercrime activities, notably business email compromise (BEC) schemes. These schemes defrauded companies and individuals worldwide by tricking them into transferring large sums of money to fraudulent accounts. He worked with a network of hackers and cybercriminals, laundering millions of dollars through a complex web of bank accounts and shell companies across different countries.

In 2020, Hushpuppi was arrested in Dubai in a joint operation between the FBI and Interpol. Following his arrest, he was extradited to the United States, where he faced charges of money laundering, wire fraud, and other cyber-related crimes. The investigations revealed his involvement in laundering over $24 million and defrauding victims from various countries.

In July 2021, Hushpuppi pleaded guilty to the charges against him and was sentenced to 11 years in a U.S. federal prison. His case drew significant attention to the growing problem of cybercrime, the role of social media in facilitating these crimes, and the need for international collaboration in combating such global criminal networks.

Hushpuppi’s downfall marked a significant victory in the fight against cybercrime, but his legacy remains a reminder of how deeply digital platforms can intertwine with illicit financial activities.

Hushpuppi’s major crimes include:

- Business Email Compromise (BEC) Fraud: He was involved in schemes where cybercriminals impersonated executives or vendors to trick companies into transferring large sums of money into fraudulent accounts.

- Money Laundering: Hushpuppi laundered millions of dollars across international borders, concealing the origins of illicit funds from criminal activities.

- Wire Fraud: He facilitated and orchestrated fraudulent wire transfers, deceiving both businesses and individuals.

These crimes collectively defrauded victims worldwide of more than $24 million.

Hushpuppy Convicted

Nigerian Man Sentenced to Over 11 Years in Federal Prison for Conspiring to Launder Tens of Millions of Dollars from Online Scams

Criminal Known Online as ‘Ray Hushpuppi’ Laundered Proceeds of School Financing Scam, Business Email Compromise Fraud and Other Cyber SchemesLOS ANGELES – A prolific international fraudster who conspired to launder tens of millions of dollars through a series of online scams and flaunted his luxurious, crime-funded lifestyle on social media was sentenced today to 135 months in federal prison.

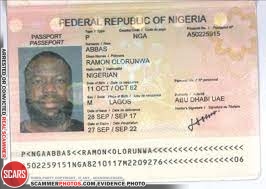

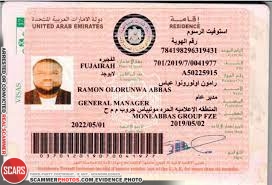

Ramon Olorunwa Abbas, a 40-year-old Nigerian national, also known by his Instagram handle, “Ray Hushpuppi,” was sentenced by United States District Judge Otis D. Wright II, who also ordered Abbas to pay $1,732,841 in restitution to two fraud victims.

Abbas pleaded guilty in April 2021 to one count of conspiracy to engage in money laundering. He was arrested in Dubai, United Arab Emirates, in June 2020 and has remained in federal custody since his expulsion from the UAE.

“Abbas bragged on social media about his lavish lifestyle – a lifestyle funded by his involvement in transnational fraud and money laundering conspiracies targeting victims around the world,” said United States Attorney Martin Estrada. “Money laundering and business email compromise scams are a massive international crime problem, and we will continue to work with our law enforcement and international partners to identify and prosecute those involved, wherever they may be.”

“Ramon Abbas, a.k.a. ‘Hushpuppi,’ targeted both American and international victims, becoming one of the most prolific money launderers in the world,” said Don Alway, the Assistant Director in Charge of the FBI’s Los Angeles Field Office. “Abbas leveraged his social media platforms – where he amassed a considerable following – to gain notoriety and to brag about the immense wealth he acquired by conducting business email compromise scams, online bank heists and other cyber-enabled fraud that financially ruined scores of victims and provided assistance to the North Korean regime. This significant sentence is the result of years’ worth of collaboration among law enforcement in multiple countries and should send a clear warning to international fraudsters that the FBI will seek justice for victims, regardless of whether criminals operate within or outside United States borders.”

Abbas conspired with Ghaleb Alaumary, 37, of Mississauga, Ontario, Canada, a convicted money launderer, to launder funds derived from various crimes, including bank cyber-heists, business email compromise (BEC) schemes and other online frauds. BEC schemes typically involve gaining unauthorized access to a business email account and attempting to trick a victim business into making an unauthorized wire transfer.

In January 2019, Abbas conspired with Alaumary to launder funds stolen from a bank in Malta by providing account information for banks in Romania and Bulgaria. The United States has charged North Korean hackers with committing the bank cyber-heist in Malta, and alleged that those funds were destined for the North Korean government. Abbas has admitted that the intended loss with respect to the Maltese bank was approximately $14.7 million.

In May 2019, Abbas conspired with Alaumary to launder millions of pounds stolen from a professional soccer club in the United Kingdom as well as a British company. In connection with that scheme, Abbas provided Alaumary with details for a bank account in Mexico that “could handle millions and not block,” according to court documents.

Abbas also fraudulently induced a New York-based law firm in October 2019 to transfer approximately $922,857 to an account that a co-conspirator controlled under someone else’s name.

Alaumary was charged separately and pleaded guilty in November 2020 to one count of conspiracy to engage in money laundering. He is serving a 140-month federal prison sentence and was ordered to pay more than $30 million in restitution.

Abbas also admitted in his plea agreement to conspiring with others to defraud an individual in Qatar who sought a loan of $15 million to build a school.

At today’s sentencing hearing, Judge Wright ordered Abbas to pay $922,857 in restitution to the law firm victim and $809,983 in restitution to the businessperson in Qatar.

Abbas and another conspirator duped the victim businessperson into paying approximately $330,000 to fund an “investor’s account” to facilitate the loan. Abbas specifically directed the victim to send $100,000 to a bank account controlled by a co-conspirator, and $230,000 to the bank account of a luxury watch seller. Abbas used those funds for his personal benefit, including purchasing a $230,000 Richard Mille RM11-03 watch, which he arranged to have brought to him from New York to Dubai. The watch made numerous appearances on Abbas’ wrist on his now-defunct Instagram account, often with the hashtag #RichardMille.

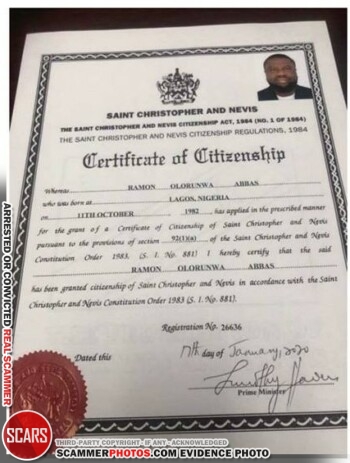

Approximately $50,000 of proceeds from the scheme were used to fraudulently acquire a St. Christopher (St. Kitts) and Nevis citizenship and a passport for Abbas through a sham marriage to a St. Kitts citizen.

In January and February 2020, Abbas and another conspirator corresponded with the victim businessperson, attempting to fraudulently induce a further payment of $575,000 in purported taxes to release the $15 million loan. In February 2020, the victim sent approximately $299,983 to Kenyan bank accounts specified by another conspirator. In March 2020, Abbas fraudulently induced the victim to send another $180,000 to U.S.-based bank accounts; those funds were subsequently laundered with assistance from several co-conspirators.

“By his own admission, during just an 18-month period defendant conspired to launder over $300 million,” prosecutors wrote in a sentencing memorandum. “While much of this intended loss did not ultimately materialize, [Abbas’] willingness and ability to participate in large-scale money laundering highlights the seriousness of his criminal conduct.”

The FBI investigated this matter as part of Operation Top Dog. The FBI thanks the government of the United Arab Emirates and the Dubai Police Department for their substantial assistance in this matter.

Assistant United States Attorney Khaldoun Shobaki of the Cyber and Intellectual Property Crimes Section prosecuted this case. The Justice Department Criminal Division’s Office of International Affairs provided substantial assistance in this matter.

Ghaleb Alaumary Falls

International Money Launderer Sentenced to over 11 Years in Federal Prison for Laundering Millions from Cyber Crime Schemes

SAVANNAH, Georgia – A Canadian man was sentenced today to 140 months in federal prison for conspiring to launder tens of millions of dollars stolen in various wire and bank fraud schemes, including a massive online banking theft by North Korean cyber criminals that is part of a pending case in Los Angeles.

Ghaleb Alaumary, 36, of Mississauga, Ontario, who is a dual Canadian and U.S. citizen, was sentenced after pleading guilty to two counts of conspiracy to commit money laundering in two cases, one of which was filed in Los Angeles. As part of his sentence that covers both cases, Alaumary was ordered to pay more than $30 million in restitution to victims.

According to court documents, Alaumary and his coconspirators used business email compromise schemes, ATM cash-outs, and bank cyber-heists to steal money from victims and then launder the money through bank accounts and digital currency.

In the Los Angeles case that was transferred to the Southern District of Georgia for his guilty plea and sentencing, Alaumary recruited and organized individuals to withdraw stolen cash from ATMs; he provided bank accounts that received funds from bank cyber-heists and fraud schemes; and, once the ill-gotten funds were in accounts he controlled, Alaumary further laundered the funds through wire transfers, cash withdrawals, and by exchanging the funds for cryptocurrency. The funds included those from North Korean-perpetrated crimes, including the 2019 cyber-heist of a Maltese bank and the 2018 ATM cash-out theft from BankIslami in Pakistan. Other victims of Alaumary’s crimes included a bank headquartered in India, as well as companies in the U.S. and U.K., individuals in the U.S., and a professional soccer club in the United Kingdom.

In the case filed by the Southern District of Georgia, Alaumary conspired with others who sent fraudulent “spoofed” emails to a university in Canada in 2017 to make it appear the emails were from a construction company requesting payment for a major building project. The university, believing it was paying the construction company, wired 11.8 million Canadian dollars (approximately 9.4 million U.S. dollars) to a bank account controlled by Alaumary and his coconspirators. Alaumary then arranged with individuals in the U.S. and elsewhere to launder the stolen funds through various financial institutions. Weeks later, Alaumary arranged for a coconspirator in the United States to make several trips to Texas to impersonate wealthy bank customers in a scheme to steal hundreds of thousands of dollars from victims’ accounts using the victims’ stolen personally identifiable information.

The investigations of Alaumary were conducted by the United States Secret Service’s Savannah Field Office, the FBI’s Los Angeles Field Office, and the United States Secret Service’s Los Angeles Field Office and Global Investigative Operations Center. The FBI’s Criminal Investigative Division also provided substantial assistance.

The Los Angeles case was handled by Assistant U.S. Attorney Khaldoun Shobaki of the Cyber and Intellectual Property Crimes Section.

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment below!

Table of Contents

- A Nigerian Super-Scammer & Cybercriminal Laundering Cash for North Korean Hackers and Dark Web Criminal Enterprise: The Case of Hushpuppi (Ramon Olorunwa Abbas)

- Article Abstract

- A Nigerian Super-Scammer & Cybercriminal Laundering Cash for North Korean Hackers and Dark Web Criminal Enterprise: The Case of Hushpuppi (Ramon Olorunwa Abbas)

- Criminal Biography of Hushpuppi (Ramon Olorunwa Abbas)

- Hushpuppy Convicted

- Ghaleb Alaumary Falls

LEAVE A COMMENT?

Recent Comments

On Other Articles

- velma faile on Finally Tax Relief for American Scam Victims is on the Horizon – 2026: “I just did my taxes for 2025 my tax account said so far for romances scam we cd not take…” Feb 25, 19:50

- on Reporting Scams & Interacting With The Police – A Scam Victim’s Checklist [VIDEO]: “Yes, this is a scam. For your own sanity, just block them completely.” Feb 25, 15:37

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “She goes by the name of Sanrda John now” Feb 25, 10:26

- on Reporting Scams & Interacting With The Police – A Scam Victim’s Checklist [VIDEO]: “So far I have not been scam out of any money because I was aware not to give the money…” Feb 25, 07:46

- on Love Bombing And How Romance Scam Victims Are Forced To Feel: “I was love bombed to the point that I would do just about anything for the scammer(s). I was told…” Feb 11, 14:24

- on Dani Daniels (Kira Lee Orsag): Another Scammer’s Favorite: “You provide a valuable service! I wish more people knew about it!” Feb 10, 15:05

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “We highly recommend that you simply turn away form the scam and scammers, and focus on the development of a…” Feb 4, 19:47

- on The Art Of Deception: The Fundamental Principals Of Successful Deceptions – 2024: “I experienced many of the deceptive tactics that romance scammers use. I was told various stories of hardship and why…” Feb 4, 15:27

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “Yes, I’m in that exact situation also. “Danielle” has seriously scammed me for 3 years now. “She” (he) doesn’t know…” Feb 4, 14:58

- on An Essay on Justice and Money Recovery – 2026: “you are so right I accidentally clicked on online justice I signed an agreement for 12k upfront but cd only…” Feb 3, 08:16

ARTICLE META

Important Information for New Scam Victims

- Please visit www.ScamVictimsSupport.org – a SCARS Website for New Scam Victims & Sextortion Victims

- Enroll in FREE SCARS Scam Survivor’s School now at www.SCARSeducation.org

- Please visit www.ScamPsychology.org – to more fully understand the psychological concepts involved in scams and scam victim recovery

If you are looking for local trauma counselors please visit counseling.AgainstScams.org or join SCARS for our counseling/therapy benefit: membership.AgainstScams.org

If you need to speak with someone now, you can dial 988 or find phone numbers for crisis hotlines all around the world here: www.opencounseling.com/suicide-hotlines

A Note About Labeling!

We often use the term ‘scam victim’ in our articles, but this is a convenience to help those searching for information in search engines like Google. It is just a convenience and has no deeper meaning. If you have come through such an experience, YOU are a Survivor! It was not your fault. You are not alone! Axios!

A Question of Trust

At the SCARS Institute, we invite you to do your own research on the topics we speak about and publish, Our team investigates the subject being discussed, especially when it comes to understanding the scam victims-survivors experience. You can do Google searches but in many cases, you will have to wade through scientific papers and studies. However, remember that biases and perspectives matter and influence the outcome. Regardless, we encourage you to explore these topics as thoroughly as you can for your own awareness.

Statement About Victim Blaming

SCARS Institute articles examine different aspects of the scam victim experience, as well as those who may have been secondary victims. This work focuses on understanding victimization through the science of victimology, including common psychological and behavioral responses. The purpose is to help victims and survivors understand why these crimes occurred, reduce shame and self-blame, strengthen recovery programs and victim opportunities, and lower the risk of future victimization.

At times, these discussions may sound uncomfortable, overwhelming, or may be mistaken for blame. They are not. Scam victims are never blamed. Our goal is to explain the mechanisms of deception and the human responses that scammers exploit, and the processes that occur after the scam ends, so victims can better understand what happened to them and why it felt convincing at the time, and what the path looks like going forward.

Articles that address the psychology, neurology, physiology, and other characteristics of scams and the victim experience recognize that all people share cognitive and emotional traits that can be manipulated under the right conditions. These characteristics are not flaws. They are normal human functions that criminals deliberately exploit. Victims typically have little awareness of these mechanisms while a scam is unfolding and a very limited ability to control them. Awareness often comes only after the harm has occurred.

By explaining these processes, these articles help victims make sense of their experiences, understand common post-scam reactions, and identify ways to protect themselves moving forward. This knowledge supports recovery by replacing confusion and self-blame with clarity, context, and self-compassion.

Additional educational material on these topics is available at ScamPsychology.org – ScamsNOW.com and other SCARS Institute websites.

Psychology Disclaimer:

All articles about psychology and the human brain on this website are for information & education only

The information provided in this article is intended for educational and self-help purposes only and should not be construed as a substitute for professional therapy or counseling.

While any self-help techniques outlined herein may be beneficial for scam victims seeking to recover from their experience and move towards recovery, it is important to consult with a qualified mental health professional before initiating any course of action. Each individual’s experience and needs are unique, and what works for one person may not be suitable for another.

Additionally, any approach may not be appropriate for individuals with certain pre-existing mental health conditions or trauma histories. It is advisable to seek guidance from a licensed therapist or counselor who can provide personalized support, guidance, and treatment tailored to your specific needs.

If you are experiencing significant distress or emotional difficulties related to a scam or other traumatic event, please consult your doctor or mental health provider for appropriate care and support.

Also read our SCARS Institute Statement about Professional Care for Scam Victims – click here to go to our ScamsNOW.com website.

Thank you for your comment. You may receive an email to follow up. We never share your data with marketers.