SCARS Institute’s Encyclopedia of Scams™ Published Continuously for 25 Years

SCARS™ Insight: U.S. Government Study Finds Millennials Are 25 Percent More Likely To Report Scams

Even So, That Raises It From About 5% To 7% Of Them

The Federal Trade Commission Says Millennials Are 25 Percent More Likely To Report That They Have Lost Money To Fraud Than Consumers Aged 40 And Over!

However, that is not a glaring endorsement of Millenials since they fall for scams at a far higher rate than older adults.

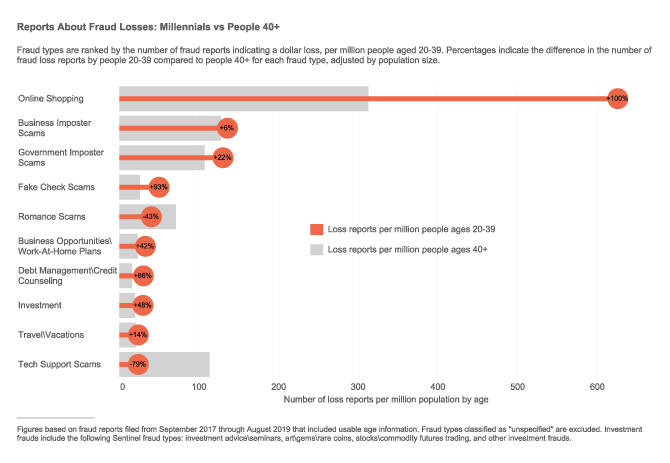

The FTC’s latest Consumer Protection Data spotlights that millennials—those ages 20-39—are twice as likely to report losing money to online shopping fraud than those 40 and over. Online shopping fraud reports include complaints about items that are never delivered or are not as they were advertised. Millennials reported losing $71 million to online shopping fraud—out of the nearly $450 million they reported losing to all types of fraud—in the last two years.

Other categories where millennials are much more likely to report losing money to fraud than consumers 40 and over include fake check scams, offers that promise to help fix debt-related problems or offers promising income through jobs, investments, or business opportunities.

People sometimes think scams mostly affect older adults, but reports to Consumer Sentinel tell a different story. People in their 20s and 30s, a cohort that roughly tracks the so-called Millennial generation, are 25% more likely to report losing money to fraud than people 40 and over generally,1 and much more likely to report a loss on certain types of fraud.

REMEMBER THAT ALL SCAMS REPORTED ARE STILL LESS THAN 5% OF THE ACTUAL NUMBER OF CRIMES COMMITTED

The top five frauds to which Millennials report losing money are online shopping frauds, business imposters, government imposters, fake check scams, and romance scams. People 40+ report those same scams, too, but the data suggest that, with the exception of romance scams, Millennials may be less likely to avoid them or may encounter them more often. For example, Millennials are twice as likely as people 40+ to report losing money while shopping online. Frequently, shopping-related reports to the FTC are about items that are never delivered or aren’t as advertised. Millennials are also more likely than their older counterparts to report fraud losses on scams that promise to fix debt-related problems or that promise money through jobs, investments, or business opportunities.2 Millennials are 93% more likely than people 40+ to report losing money to fake check scams, which also often look like a way to earn money.

The likelihood of losing money is just part of the story—how much people lose is also important. The median individual amount Millennials report losing to fraud is $400, much lower than what people 40+ report.4 But those individual losses add up: Millennials have reported losing nearly $450 million to fraud in just the past two years. Of that, online shopping accounted for $71 million in reported losses, and government imposter scams were close behind, with $61 million in reported losses.

The likelihood of reporting a loss varies by how people are first contacted by a scammer, and there are age differences here, too. While phone calls are the top contact method reported for people of all ages, Millennials report losing money to phone scams at slightly lower rates than people 40+. But Millennials are more likely to report losing money to frauds that start in other ways —most notably, Millennials are 77% more likely than their older counterparts to say they lost money to a scam that started with an email.

The most important takeaway: fraud affects every generation. If someone has contacted you to demand money or your personal information – stop. Talk to someone you trust. And check out the request.

PLEASE SHARE OUR ARTICLES WITH YOUR CONTACTS

HELP OTHERS STAY SAFE ONLINE

SCARS™ Team

A SCARS Division

Miami Florida U.S.A.

TAGS: SCARS, Important Article, Information About Scams, Anti-Scam, U.S. Government Study, Millennials Scammed, More Likely To Report Scams, Scam Reporting, Reported Scams, FTC, Federa; Trade Commission

The Latest SCARS|RSN Posts

FIND MORE SCAM NEWS

«SCAMCRIME.COM»

CHAT WITH SCARS™

«CLICK HERE»

END

MORE INFORMATION

– – –

Tell us about your experiences with Romance Scammers in our

« Scams Discussion Forum on Facebook »

– – –

FAQ: How Do You Properly Report Scammers?

It is essential that law enforcement knows about scams & scammers, even though there is nothing (in most cases) that they can do.

Always report scams involving money lost or where you received money to:

- Local Police – ask them to take an “informational” police report – say you need it for your insurance

- Your National Police or FBI « www.IC3.gov »

- The SCARS|CDN™ Cybercriminal Data Network – Worldwide Reporting Network « HERE » or on « www.Anyscam.com »

This helps your government understand the problem, and allows law enforcement to add scammers on watch lists worldwide.

– – –

Visit our NEW Main SCARS Facebook page for much more information about scams and online crime: « www.facebook.com/SCARS.News.And.Information »

To learn more about SCARS visit « www.AgainstScams.org »

Please be sure to report all scammers

« HERE » or on « www.Anyscam.com »

Legal Notices:

All original content is Copyright © 1991 – 2020 SCARS All Rights Reserved Worldwide & Webwide. Third-party copyrights acknowledge.

SCARS, RSN, Romance Scams Now, SCARS|WORLDWIDE, SCARS|GLOBAL, SCARS, Society of Citizens Against Relationship Scams, Society of Citizens Against Romance Scams, SCARS|ANYSCAM, Project Anyscam, Anyscam, SCARS|GOFCH, GOFCH, SCARS|CHINA, SCARS|CDN, SCARS|UK, SCARS Cybercriminal Data Network, Cobalt Alert, Scam Victims Support Group, are all trademarks of Society of Citizens Against Relationship Scams Incorporated.

Contact the law firm for the Society of Citizens Against Relationship Scams Incorporated by email at legal@AgainstScams.org

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment below!

Table of Contents

- Even So, That Raises It From About 5% To 7% Of Them

- REMEMBER THAT ALL SCAMS REPORTED ARE STILL LESS THAN 5% OF THE ACTUAL NUMBER OF CRIMES COMMITTED

- The Latest SCARS|RSN Posts

- Ethereum ETHM Token Trap and Pig Butchering Scams – 2026

- New U.S. Law – S.3643 – 118th Congress – Will Dramatically Impact Scammers and Terrorists – 2026

- How Scam Survivors Can Survive Valentine’s Day – 2026

- U.S. Veterans Benefits Scams – 2026

- New AI Voice Cloning Phone Scams – 2026

- An Essay on Justice and Money Recovery – 2026

- Tell us about your experiences with Romance Scammers in our

« Scams Discussion Forum on Facebook » - FAQ: How Do You Properly Report Scammers?

- Please be sure to report all scammers

« HERE » or on « www.Anyscam.com » - Legal Notices:

LEAVE A COMMENT?

Recent Comments

On Other Articles

- Arwyn Lautenschlager on Love Bombing And How Romance Scam Victims Are Forced To Feel: “I was love bombed to the point that I would do just about anything for the scammer(s). I was told…” Feb 11, 14:24

- on Dani Daniels (Kira Lee Orsag): Another Scammer’s Favorite: “You provide a valuable service! I wish more people knew about it!” Feb 10, 15:05

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “We highly recommend that you simply turn away form the scam and scammers, and focus on the development of a…” Feb 4, 19:47

- on The Art Of Deception: The Fundamental Principals Of Successful Deceptions – 2024: “I experienced many of the deceptive tactics that romance scammers use. I was told various stories of hardship and why…” Feb 4, 15:27

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “Yes, I’m in that exact situation also. “Danielle” has seriously scammed me for 3 years now. “She” (he) doesn’t know…” Feb 4, 14:58

- on An Essay on Justice and Money Recovery – 2026: “you are so right I accidentally clicked on online justice I signed an agreement for 12k upfront but cd only…” Feb 3, 08:16

- on The SCARS Institute Top 50 Celebrity Impersonation Scams – 2025: “Quora has had visits from scammers pretending to be Keanu Reeves and Paul McCartney in 2025 and 2026.” Jan 27, 17:45

- on Scam Victims Should Limit Their Exposure To Scam News & Scammer Photos: “I used to look at scammers photos all the time; however, I don’t feel the need to do it anymore.…” Jan 26, 23:19

- on After A Scam, No One Can Tell You How You Will React: “This article was very informative, my scams happened 5 years ago; however, l do remember several of those emotions and/or…” Jan 23, 17:17

- on Situational Awareness and How Trauma Makes Scam Victims Less Safe – 2024: “I need to be more observant and I am practicing situational awareness. I’m saving this article to remind me of…” Jan 21, 22:55

ARTICLE META

Important Information for New Scam Victims

- Please visit www.ScamVictimsSupport.org – a SCARS Website for New Scam Victims & Sextortion Victims

- Enroll in FREE SCARS Scam Survivor’s School now at www.SCARSeducation.org

- Please visit www.ScamPsychology.org – to more fully understand the psychological concepts involved in scams and scam victim recovery

If you are looking for local trauma counselors please visit counseling.AgainstScams.org or join SCARS for our counseling/therapy benefit: membership.AgainstScams.org

If you need to speak with someone now, you can dial 988 or find phone numbers for crisis hotlines all around the world here: www.opencounseling.com/suicide-hotlines

A Note About Labeling!

We often use the term ‘scam victim’ in our articles, but this is a convenience to help those searching for information in search engines like Google. It is just a convenience and has no deeper meaning. If you have come through such an experience, YOU are a Survivor! It was not your fault. You are not alone! Axios!

A Question of Trust

At the SCARS Institute, we invite you to do your own research on the topics we speak about and publish, Our team investigates the subject being discussed, especially when it comes to understanding the scam victims-survivors experience. You can do Google searches but in many cases, you will have to wade through scientific papers and studies. However, remember that biases and perspectives matter and influence the outcome. Regardless, we encourage you to explore these topics as thoroughly as you can for your own awareness.

Statement About Victim Blaming

SCARS Institute articles examine different aspects of the scam victim experience, as well as those who may have been secondary victims. This work focuses on understanding victimization through the science of victimology, including common psychological and behavioral responses. The purpose is to help victims and survivors understand why these crimes occurred, reduce shame and self-blame, strengthen recovery programs and victim opportunities, and lower the risk of future victimization.

At times, these discussions may sound uncomfortable, overwhelming, or may be mistaken for blame. They are not. Scam victims are never blamed. Our goal is to explain the mechanisms of deception and the human responses that scammers exploit, and the processes that occur after the scam ends, so victims can better understand what happened to them and why it felt convincing at the time, and what the path looks like going forward.

Articles that address the psychology, neurology, physiology, and other characteristics of scams and the victim experience recognize that all people share cognitive and emotional traits that can be manipulated under the right conditions. These characteristics are not flaws. They are normal human functions that criminals deliberately exploit. Victims typically have little awareness of these mechanisms while a scam is unfolding and a very limited ability to control them. Awareness often comes only after the harm has occurred.

By explaining these processes, these articles help victims make sense of their experiences, understand common post-scam reactions, and identify ways to protect themselves moving forward. This knowledge supports recovery by replacing confusion and self-blame with clarity, context, and self-compassion.

Additional educational material on these topics is available at ScamPsychology.org – ScamsNOW.com and other SCARS Institute websites.

Psychology Disclaimer:

All articles about psychology and the human brain on this website are for information & education only

The information provided in this article is intended for educational and self-help purposes only and should not be construed as a substitute for professional therapy or counseling.

While any self-help techniques outlined herein may be beneficial for scam victims seeking to recover from their experience and move towards recovery, it is important to consult with a qualified mental health professional before initiating any course of action. Each individual’s experience and needs are unique, and what works for one person may not be suitable for another.

Additionally, any approach may not be appropriate for individuals with certain pre-existing mental health conditions or trauma histories. It is advisable to seek guidance from a licensed therapist or counselor who can provide personalized support, guidance, and treatment tailored to your specific needs.

If you are experiencing significant distress or emotional difficulties related to a scam or other traumatic event, please consult your doctor or mental health provider for appropriate care and support.

Also read our SCARS Institute Statement about Professional Care for Scam Victims – click here to go to our ScamsNOW.com website.

Thank you for your comment. You may receive an email to follow up. We never share your data with marketers.