SCARS™ Insight: U.S. Government Study Finds Millennials Are 25 Percent More Likely To Report Scams

Even So, That Raises It From About 5% To 7% Of Them

The Federal Trade Commission Says Millennials Are 25 Percent More Likely To Report That They Have Lost Money To Fraud Than Consumers Aged 40 And Over!

However, that is not a glaring endorsement of Millenials since they fall for scams at a far higher rate than older adults.

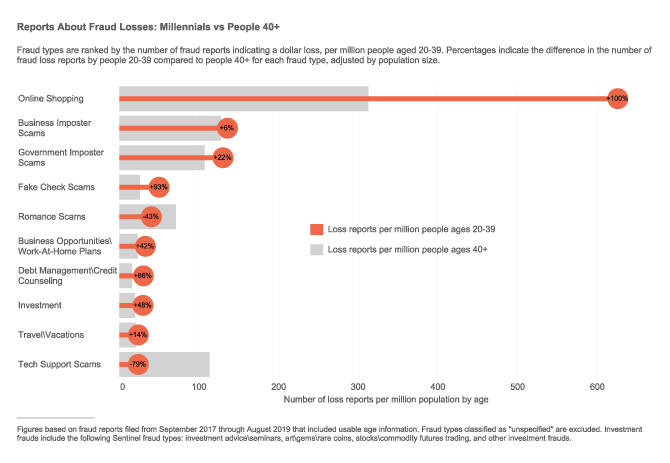

The FTC’s latest Consumer Protection Data spotlights that millennials—those ages 20-39—are twice as likely to report losing money to online shopping fraud than those 40 and over. Online shopping fraud reports include complaints about items that are never delivered or are not as they were advertised. Millennials reported losing $71 million to online shopping fraud—out of the nearly $450 million they reported losing to all types of fraud—in the last two years.

Other categories where millennials are much more likely to report losing money to fraud than consumers 40 and over include fake check scams, offers that promise to help fix debt-related problems or offers promising income through jobs, investments, or business opportunities.

People sometimes think scams mostly affect older adults, but reports to Consumer Sentinel tell a different story. People in their 20s and 30s, a cohort that roughly tracks the so-called Millennial generation, are 25% more likely to report losing money to fraud than people 40 and over generally,1 and much more likely to report a loss on certain types of fraud.

REMEMBER THAT ALL SCAMS REPORTED ARE STILL LESS THAN 5% OF THE ACTUAL NUMBER OF CRIMES COMMITTED

The top five frauds to which Millennials report losing money are online shopping frauds, business imposters, government imposters, fake check scams, and romance scams. People 40+ report those same scams, too, but the data suggest that, with the exception of romance scams, Millennials may be less likely to avoid them or may encounter them more often. For example, Millennials are twice as likely as people 40+ to report losing money while shopping online. Frequently, shopping-related reports to the FTC are about items that are never delivered or aren’t as advertised. Millennials are also more likely than their older counterparts to report fraud losses on scams that promise to fix debt-related problems or that promise money through jobs, investments, or business opportunities.2 Millennials are 93% more likely than people 40+ to report losing money to fake check scams, which also often look like a way to earn money.

The likelihood of losing money is just part of the story—how much people lose is also important. The median individual amount Millennials report losing to fraud is $400, much lower than what people 40+ report.4 But those individual losses add up: Millennials have reported losing nearly $450 million to fraud in just the past two years. Of that, online shopping accounted for $71 million in reported losses, and government imposter scams were close behind, with $61 million in reported losses.

The likelihood of reporting a loss varies by how people are first contacted by a scammer, and there are age differences here, too. While phone calls are the top contact method reported for people of all ages, Millennials report losing money to phone scams at slightly lower rates than people 40+. But Millennials are more likely to report losing money to frauds that start in other ways —most notably, Millennials are 77% more likely than their older counterparts to say they lost money to a scam that started with an email.

The most important takeaway: fraud affects every generation. If someone has contacted you to demand money or your personal information – stop. Talk to someone you trust. And check out the request.

PLEASE SHARE OUR ARTICLES WITH YOUR CONTACTS

HELP OTHERS STAY SAFE ONLINE

SCARS™ Team

A SCARS Division

Miami Florida U.S.A.

TAGS: SCARS, Important Article, Information About Scams, Anti-Scam, U.S. Government Study, Millennials Scammed, More Likely To Report Scams, Scam Reporting, Reported Scams, FTC, Federa; Trade Commission

The Latest SCARS|RSN Posts

FIND MORE SCAM NEWS

«SCAMCRIME.COM»

CHAT WITH SCARS™

«CLICK HERE»

END

MORE INFORMATION

– – –

Tell us about your experiences with Romance Scammers in our

« Scams Discussion Forum on Facebook »

– – –

FAQ: How Do You Properly Report Scammers?

It is essential that law enforcement knows about scams & scammers, even though there is nothing (in most cases) that they can do.

Always report scams involving money lost or where you received money to:

- Local Police – ask them to take an “informational” police report – say you need it for your insurance

- Your National Police or FBI « www.IC3.gov »

- The SCARS|CDN™ Cybercriminal Data Network – Worldwide Reporting Network « HERE » or on « www.Anyscam.com »

This helps your government understand the problem, and allows law enforcement to add scammers on watch lists worldwide.

– – –

Visit our NEW Main SCARS Facebook page for much more information about scams and online crime: « www.facebook.com/SCARS.News.And.Information »

To learn more about SCARS visit « www.AgainstScams.org »

Please be sure to report all scammers

« HERE » or on « www.Anyscam.com »

Legal Notices:

All original content is Copyright © 1991 – 2020 SCARS All Rights Reserved Worldwide & Webwide. Third-party copyrights acknowledge.

SCARS, RSN, Romance Scams Now, SCARS|WORLDWIDE, SCARS|GLOBAL, SCARS, Society of Citizens Against Relationship Scams, Society of Citizens Against Romance Scams, SCARS|ANYSCAM, Project Anyscam, Anyscam, SCARS|GOFCH, GOFCH, SCARS|CHINA, SCARS|CDN, SCARS|UK, SCARS Cybercriminal Data Network, Cobalt Alert, Scam Victims Support Group, are all trademarks of Society of Citizens Against Relationship Scams Incorporated.

Contact the law firm for the Society of Citizens Against Relationship Scams Incorporated by email at legal@AgainstScams.org

Leave A Comment