SCARS™ Advocacy: Are You Using Match.com? FTC Finally Brings Action!

The Federal Government Takes Action Against Match.com For Their Failure To Maintain Safety For Their Users

[lwptoc]

Online Dating Sites Are A Common Way People Seek Romance – But What If, Instead Of A Potential Match, You Find A Scammer?

Today, the FTC announced a lawsuit against Match.com, challenging several of Match’s business practices, including ones that the FTC says exposed customers to romance scammers.

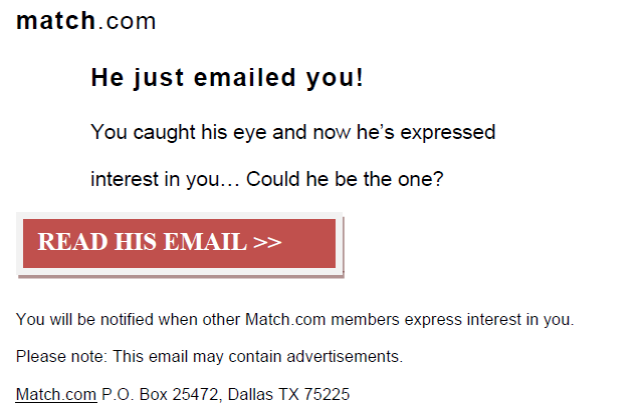

If you had a free Match account and got a message from another user, Match would send you a notice like this one to encourage you to “read his email” (or hers)…which required you to subscribe and pay?

But The Person Whose Eye You Caught?

Match Had Already Identified Many Of Them As Likely Scammers.

So if you paid Match to read that message, you might have found either a scammer or an empty inbox, instead of, possibly, “the one” Match advertised. That’s deceptive, the FTC says.

Even worse, says the FTC, is that Match had blocked some of these suspicious accounts from sending messages to its paying subscribers, but didn’t give the same protection to free account users. The people who then subscribed in response to these messages could have been exposed to scammers. The FTC says that practice is unfair, placing people at risk of romance scams so that Match could make more money.

FTC data show that romance scams are on the rise. So how to protect yourself if you’re still looking for love in online places?

- Listen for details that don’t add up, and do a reverse-image search on profile pictures. If those pics show up with someone else’s name, you’ve found a scammer.

- If an online sweetheart you haven’t met in person asks you for money, stop. That’s always a scam.

- Talk to someone you trust about this love interest – and pay attention if friends or family are concerned.

If you think you’ve encountered a romance scammer on an online dating site, report it to the website and to ftc.gov/complaint. Watch this video to learn more about romance scams.

HERE IS THE FULL TEXT OF THE FTC ANNOUNCEMENT

FTC Sues Owner of Online Dating Service Match.com for Using Fake Love Interest Ads To Trick Consumers into Paying for a Match.com Subscription

Match Group, Inc. also unfairly exposed consumers to the risk of fraud and engaged in other allegedly deceptive and unfair practices

The Federal Trade Commission sued online dating service Match Group, Inc. (Match), the owner of Match.com, Tinder, OKCupid, PlentyOfFish, and other dating sites, alleging that the company used fake love interest advertisements to trick hundreds of thousands of consumers into purchasing paid subscriptions on Match.com.

The agency also alleges that Match has unfairly exposed consumers to the risk of fraud and engaged in other allegedly deceptive and unfair practices. For instance, the FTC alleges Match offered false promises of “guarantees,” failed to provide services to consumers who unsuccessfully disputed charges, and made it difficult for users to cancel their subscriptions.

“We believe that Match.com conned people into paying for subscriptions via messages the company knew were from scammers,” said Andrew Smith, Director of the FTC’s Bureau of Consumer Protection. “Online dating services obviously shouldn’t be using romance scammers as a way to fatten their bottom line.”

Match Touts Fake Love Interest Advertisements, Often From Scammers

Match allows users to create Match.com profiles free of charge, but prohibits users from responding to messages without upgrading to a paid subscription. According to the FTC’s complaint, Match sent emails to nonsubscribers stating that someone had expressed an interest in that consumer. Specifically, when nonsubscribers with free accounts received likes, favorites, emails, and instant messages on Match.com, they also received emailed ads from Match encouraging them to subscribe to Match.com to view the identity of the sender and the content of the communication.

(example of ad touting message)The FTC alleges that millions of contacts that generated Match’s “You caught his eye” notices came from accounts the company had already flagged as likely to be fraudulent. By contrast, Match prevented existing subscribers from receiving email communications from a suspected fraudulent account.

Many consumers purchased subscriptions because of these deceptive ads, hoping to meet a real user who might be “the one.” The FTC alleges that instead, these consumers often would have found a scammer on the other end. According to the FTC’s complaint, consumers came into contact with the scammer if they subscribed before Match completed its fraud review process. If Match completed its review process and deleted the account as fraudulent before the consumer subscribed, the consumer received a notification that the profile was “unavailable.” In either event, the consumer was left with a paid subscription to Match.com, as a result of a false advertisement.

Consumers who considered purchasing a Match.com subscription generally were unaware that as many as 25 to 30 percent of Match.com members who register each day are using Match.com to attempt to perpetrate scams, including romance scams, phishing schemes, fraudulent advertising, and extortion scams. In some months between 2013 and 2016, more than half of the instant messages and favorites that consumers received came from accounts that Match identified as fraudulent, according to the complaint.

Hundreds of thousands of consumers subscribed to Match.com shortly after receiving communications from fake profiles. According to the FTC’s complaint, from June 2016 to May 2018, for example, Match’s own analysis found that consumers purchased 499,691 subscriptions within 24 hours of receiving an advertisement touting a fraudulent communication.

Online dating services, including Match.com, often are used to find and contact potential romance scam victims. Fraudsters create fake profiles, establish trusting relationships, and then trick consumers into giving or loaning them money. Just last year, romance scams ranked number one on the FTC’s list of total reported losses to fraud. The Commission’s Consumer Sentinel complaint database received more than 21,000 reports about romance scams, and people reported losing a total of $143 million in 2018.

Match Deceived Consumers with Inconspicuous, Hard to Understand Disclosures

The FTC also alleges Match deceptively induced consumers to subscribe to Match.com by promising them a free six-month subscription if they did not “meet someone special,” without adequately disclosing that consumers must meet numerous requirements before the company would honor the guarantee.

Specifically, the FTC alleges Match failed to disclose adequately that consumers must:

- Secure and maintain a public profile with a primary photo approved by Match within the first seven days of purchase;

- Message five unique Match.com subscribers per month; and

- Use a progress page to redeem the free six months during the final week of the initial six-month subscription period.

The FTC alleges consumers often were unaware they would need to comply with additional terms to receive the free six months Match promised. As a result, consumers were often billed for a six-month subscription to Match.com at the end of the initial six months, instead of receiving the free six months of service they expected.

Unfair Billing Dispute and Failure to Provide Simple Subscription Cancellation Practices

Due to Match’s allegedly deceptive advertising, billing, and cancellation practices, consumers often disputed charges through their financial institutions. The complaint alleges that Match then banned these users from accessing the services they paid for.

Finally, the FTC alleges that Match violated the Restore Online Shoppers’ Confidence Act (ROSCA) by failing to provide a simple method for a consumer to stop recurring charges from being placed on their credit card, debit card, bank account, or other financial account. Each step of the online cancellation process—from the password entry to the retention offer to the final survey pages—confused and frustrated consumers and ultimately prevented many consumers from canceling their Match.com subscriptions, the FTC contends. The complaint states that Match’s own employees described the cancellation process as “hard to find, tedious, and confusing” and noted that “members often think they’ve cancelled when they have not and end up with unwanted renewals.”

The Commission vote authorizing the staff to file the complaint was 4-0-1, with Chairman Joseph Simons recused. The complaint was filed in the U.S. District Court for the Northern District of Texas.

NOTE: The Commission files a complaint when it has “reason to believe” that the law has been or is being violated and it appears to the Commission that a proceeding is in the public interest. The case will be decided by the court.

PLEASE SHARE OUR ARTICLES WITH YOUR CONTACTS

HELP OTHERS STAY SAFE ONLINE

SCARS™ Team

A SCARS Division

Miami Florida U.S.A.

TAGS: SCARS, Important Article, Information About Scams, Anti-Scam, Deceptive/Misleading Conduct, Bureau of Consumer Protection, Consumer Protection, Online Dating, FTC, Federal Trade Commission Law Suit

The Latest SCARS|RSN Posts

FIND MORE SCAM NEWS

«SCAMCRIME.COM»

CHAT WITH SCARS™

«CLICK HERE»

END

MORE INFORMATION

– – –

Tell us about your experiences with Romance Scammers in our

« Scams Discussion Forum on Facebook »

– – –

FAQ: How Do You Properly Report Scammers?

It is essential that law enforcement knows about scams & scammers, even though there is nothing (in most cases) that they can do.

Always report scams involving money lost or where you received money to:

- Local Police – ask them to take an “informational” police report – say you need it for your insurance

- Your National Police or FBI « www.IC3.gov »

- The SCARS|CDN™ Cybercriminal Data Network – Worldwide Reporting Network « HERE » or on « www.Anyscam.com »

This helps your government understand the problem, and allows law enforcement to add scammers on watch lists worldwide.

– – –

Visit our NEW Main SCARS Facebook page for much more information about scams and online crime: « www.facebook.com/SCARS.News.And.Information »

To learn more about SCARS visit « www.AgainstScams.org »

Please be sure to report all scammers

« HERE » or on « www.Anyscam.com »

Legal Notices:

All original content is Copyright © 1991 – 2020 SCARS All Rights Reserved Worldwide & Webwide. Third-party copyrights acknowledge.

SCARS, RSN, Romance Scams Now, SCARS|WORLDWIDE, SCARS|GLOBAL, SCARS, Society of Citizens Against Relationship Scams, Society of Citizens Against Romance Scams, SCARS|ANYSCAM, Project Anyscam, Anyscam, SCARS|GOFCH, GOFCH, SCARS|CHINA, SCARS|CDN, SCARS|UK, SCARS Cybercriminal Data Network, Cobalt Alert, Scam Victims Support Group, are all trademarks of Society of Citizens Against Relationship Scams Incorporated.

Contact the law firm for the Society of Citizens Against Relationship Scams Incorporated by email at legal@AgainstScams.org

Leave A Comment