SCARS™ Scam Alert: Tax Identity Thieves And IRS Imposters Are Ready For Tax Season

Tax identity thieves and IRS imposters are ready for tax season, whether you are or not. Join the FTC and its partners for Tax Identity Theft Awareness Week to find out how to protect yourself, and what to do if you or someone you know runs into problems.

What is tax identity theft? It happens when someone uses your Social Security number (SSN) to file a phony tax return and collect your refund. You may not find out it has happened until you try to file your real tax return and the IRS rejects it as a duplicate filing.

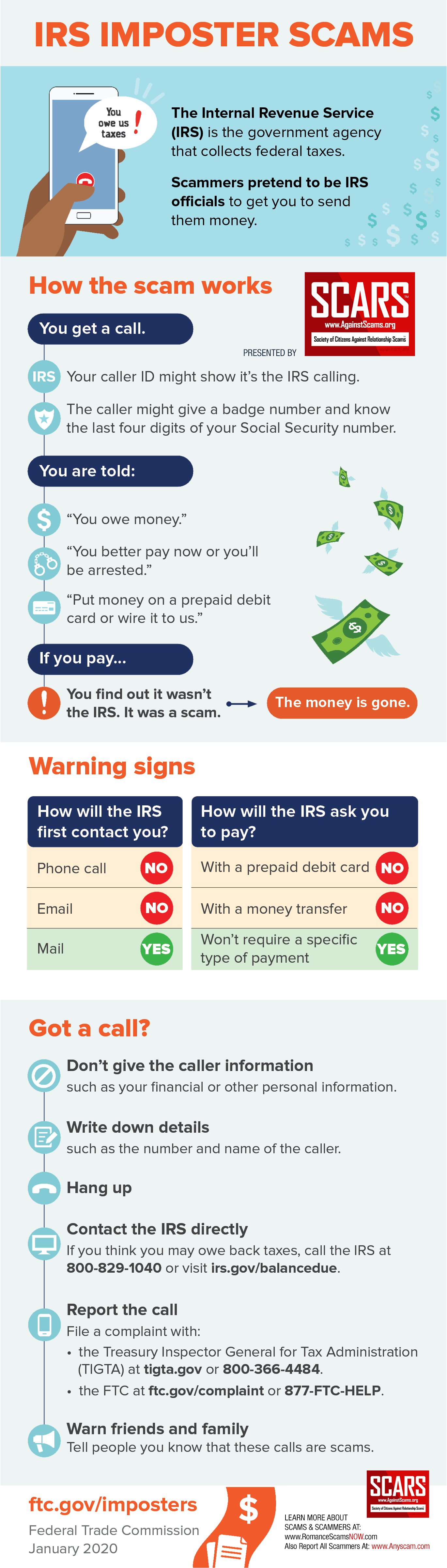

IRS imposters are scammers who pretend they’re calling from the IRS. They claim you owe taxes and demand that you pay right now, usually with a gift card or prepaid debit card. They threaten you’ll be arrested or face other bad consequences if you don’t pay. But it’s all a lie. If you send the money, it’s gone.

Join the FTC and its partners for free webinars and other events during Tax Identity Theft Awareness Week. Learn how to reduce your chance of tax identity theft, the red flag warning signs of IRS imposters, and what to do if fraud happens to you. All of the events will have information for everyone. Some also will highlight special resources for active duty service members, veterans, older adults and small businesses. Ask questions too. Check out the Calendar below to find the event that’s best for you.

To start fighting tax identity theft right away, remember:

- Protect your SSN throughout the year. Don’t give it out unless there’s a good reason and you’re sure who you’re giving it to.

- File your tax return as early in the tax season as you can.

- Use a secure internet connection if you file electronically, or mail your tax return directly from the post office.

- Research a tax preparer thoroughly before you hand over personal information.

- Check your credit report at least once a year for free at annualcreditreport.com. Make sure no one has opened a new account in your name.

Tax-Related Identity Theft

An identity thief may use your Social Security number (SSN) to get a tax refund or a job. This is tax-related identity theft. You may not know it has happened until:

- the IRS sends you a letter by mail saying they have gotten a suspicious tax return that uses your SSN, or

- you try to efile your return but it’s rejected as a duplicate because a return already has been filed using your SSN

If the IRS sends you a letter, follow the instructions in the letter. Then visit IdentityTheft.gov to report the identity theft to both the IRS and the FTC and get a recovery plan.

- Uncovering Tax-Related Identity Theft

- Dealing With Tax-Related Identity Theft

- Other Steps to Repair Identity Theft

Uncovering Tax-Related Identity Theft

If someone uses your SSN to file for a tax refund before you do, here’s what happens: When you file your return, IRS records will show that someone else has already filed and gotten a refund. If you file by mail, the IRS will send you a notice or letter in the mail saying that more than one return was filed for you. If you try to efile, the IRS will reject your tax return as a duplicate filing.

If someone uses your SSN to get a job, the employer may report that person’s income to the IRS using your SSN. When you file your tax return, you wouldn’t have included those earnings. IRS records will show you failed to report all your income. The agency will send you a notice saying you had wages that you didn’t report. But the IRS doesn’t know those wages were reported by an employer you don’t know, for work performed by someone else.

IRS notices about tax-related identity theft are sent by mail. The IRS doesn’t initiate contact with a taxpayer by sending an email, text, or social media message that asks for personal or financial information. The IRS also does not call taxpayers with threats of lawsuits or arrests. And, the IRS will never ask you to wire money, pay with a gift card or prepaid debit card, or share your credit card information over the phone.

If you get an email, text, or other electronic message that claims to be from the IRS, do not reply or click on any links. Instead, forward it to phishing@irs.gov. And report IRS imposters to the US Treasury Inspector General for Tax Administration at tigta.gov.

Dealing With Tax-Related Identity Theft

If the IRS sends you a notice or letter saying that someone used your SSN to get a tax refund, or saying there’s another problem, respond quickly and follow the instructions in the letter.

- Call the IRS using the telephone number given in the letter. You’ll need the letter and a copy of your prior year’s tax return when you call to help verify your identity. Visit the IRS’s guide, IRS Identity Theft Victim Assistance: How It Works, for more information.

If you think someone used your SSN to file for a tax refund, but you haven’t gotten a letter from the IRS, use IdentityTheft.gov to report it to the IRS and FTC and get a recovery plan.

- Visit IdentityTheft.gov to complete an IRS Identity Theft Affidavit (IRS Form 14039) and submit it to the IRS online so that the IRS can begin resolving your case. You’ll also be reporting the identity theft to the FTC.

- File your tax return, and pay any taxes you owe. If you can’t efile your tax return, you may need to mail a paper return.

Other Steps to Repair Identity Theft

Next, it’s important to limit the potential damage from identity theft.

- Put a fraud alert on your credit reports.

- Order your free credit reports and close any new accounts opened in your name.

- Consider placing a credit freeze on your credit reports.

Visit IdentityTheft.gov for help with these important steps.

Calendar of Anti-Scam Events

Each event is scheduled for an hour unless otherwise stated. Click the links to learn how to participate.

Wednesday, January 29, 1 p.m. ET

The FTC, Veterans Administration (VA), and U.S. Postal Inspection Service host a webinar on identity theft, tax identity theft, and more. Find out about special services available to veterans and active duty service members while getting a few days’ start on Tax Identity Theft Awareness Week.

Monday, February 3, 2 p.m. ET

The first of two 30-minute webinars hosted by the FTC and the Identity Theft Resource Center. The February 3 webinar focuses on identity theft, its impact on victims, tax identity theft, and recovering from identity theft. The second webinar, on February 6, focuses on IRS imposters and other government imposter scams.

Tuesday, February 4, 2 p.m. ET

Protecting Sensitive Business and Customer Information: Practical Data Security Practices for Your Business. Experts from the FTC and IRS discuss:

- Protecting your business, customers, and employees against tax identity theft

- Imposter scams that target small businesses

- Practical cybersecurity practices, and

- Responding to a data breach

Wednesday, February 5, 10 a.m. ET and 1 p.m. ET

AARP, the FTC, and the U.S. Treasury Department will hold two telephone Town Hall meetings, at 10 a.m. ET and 1 p.m. ET. Learn about tax identity theft, government impostor scams, recovering from fraud, and where to get help. Please join us at the meeting time that’s convenient for you.

Thursday, February 6, 2 p.m. ET

The FTC and the Identity Theft Resource Center co-host a 30-minute webinar on government imposter scams. We’ll talk about IRS, Social Security Administration, and U.S. Census Bureau imposters, red flag warnings, protecting yourself, and how to recover if fraud happens to you.

Thursday, February 6, 3 p.m. ET

Join experts from the FTC, the Identity Theft Resource Center, and others for an #IDTheftChat on Twitter. We’ll offer tips on protecting yourself from tax identity theft and government imposters. Join the conversation at #IDTheftChat.

TAGS: SCARS, Important Article, Information About Scams, Anti-Scam, Scam Alert, Tax Identity Theft, Tax Identity Thieves, IRS Imposters, Ready For Tax Season, FTC, Federal Trade Commission, Internal Revenue Service, Anti-Scam Events, Fraud Alert

PLEASE SHARE OUR ARTICLES WITH YOUR CONTACTS

HELP OTHERS STAY SAFE ONLINE

SCARS™ Team

Society of Citizens Against Relationship Scams Inc.

A U.S. Based Crime Victims Assistance Nonprofit Organization

The Latest SCARS Posts:

FIND MORE SCAM NEWS

«SCAMCRIME.COM»

JOIN US ON FACEBOOK

«CLICK HERE»

END

MORE INFORMATION

– – –

Tell us about your experiences with Romance Scammers in our

« Scams Discussion Forum on Facebook »

– – –

FAQ: How Do You Properly Report Scammers?

It is essential that law enforcement knows about scams & scammers, even though there is nothing (in most cases) that they can do.

Always report scams involving money lost or where you received money to:

- Local Police – ask them to take an “informational” police report – say you need it for your insurance

- U.S. State Police (if you live in the U.S.) – they will take the matter more seriously and provide you with more help than local police

- Your National Police or FBI « www.IC3.gov »

- The SCARS|CDN™ Cybercriminal Data Network – Worldwide Reporting Network on « www.Anyscam.com »

This helps your government understand the problem, and allows law enforcement to add scammers on watch lists worldwide.

– – –

To learn more about SCARS visit « www.AgainstScams.org »

Please be sure to report all scammers

on « www.Anyscam.com »

Disclaimer:

SCARS IS A DIGITAL PUBLISHER AND DOES NOT OFFER HEALTH OR MEDICAL ADVICE, LEGAL ADVICE, FINANCIAL ADVICE, OR SERVICES THAT SCARS IS NOT LICENSED OR REGISTERED TO PERFORM.

IF YOU’RE FACING A MEDICAL EMERGENCY, CALL YOUR LOCAL EMERGENCY SERVICES IMMEDIATELY, OR VISIT THE NEAREST EMERGENCY ROOM OR URGENT CARE CENTER. YOU SHOULD CONSULT YOUR HEALTHCARE PROVIDER BEFORE FOLLOWING ANY MEDICALLY RELATED INFORMATION PRESENTED ON OUR PAGES.

ALWAYS CONSULT A LICENSED ATTORNEY FOR ANY ADVICE REGARDING LEGAL MATTERS.

A LICENSED FINANCIAL OR TAX PROFESSIONAL SHOULD BE CONSULTED BEFORE ACTING ON ANY INFORMATION RELATING TO YOUR PERSONAL FINANCES OR TAX RELATED ISSUES AND INFORMATION.

This content and other material contained on the website, apps, newsletter, and products (“Content”), is general in nature and for informational purposes only and does not constitute medical, legal, or financial advice; the Content is not intended to be a substitute for licensed or regulated professional advice. Always consult your doctor or other qualified healthcare provider, lawyer, financial or tax professional with any questions you may have regarding the educational information contained herein. SCARS makes no guarantees about the efficacy of information described on or in SCARS’s Content. The information contained are subject to change and are not intended to cover all possible situations or effects. SCARS does not recommend or endorse any specific professional or care provider, product, service, or other information that may be mentioned in SCARS’s websites, apps, and Content unless explicitly identified as such.

The disclaimers herein are provided on this page for ease of reference. These disclaimers supplement and are a part of SCARS’s websites Terms of Use.

Legal Notices:

All original content is Copyright © 1991 – 2020 Society of Citizens Against Relationship Scams Inc. (D.B.A SCARS) All Rights Reserved Worldwide & Webwide. Third-party copyrights acknowledge.

SCARS, SCARS|INTERNATIONAL, SCARS, SCARS|SUPPORT, SCARS, RSN, Romance Scams Now, SCARS|WORLDWIDE, SCARS|GLOBAL, SCARS, Society of Citizens Against Relationship Scams, Society of Citizens Against Romance Scams, SCARS|ANYSCAM, Project Anyscam, Anyscam, SCARS|GOFCH, GOFCH, SCARS|CHINA, SCARS|CDN, SCARS|UK, SCARS|LATINOAMERICA, SCARS|MEMBER, SCARS|VOLUNTEER, SCARS Cybercriminal Data Network, Cobalt Alert, Scam Victims Support Group, are all trademarks of Society of Citizens Against Relationship Scams Inc.

Contact the law firm for the Society of Citizens Against Relationship Scams Incorporated by email at legal@AgainstScams.org

Leave A Comment