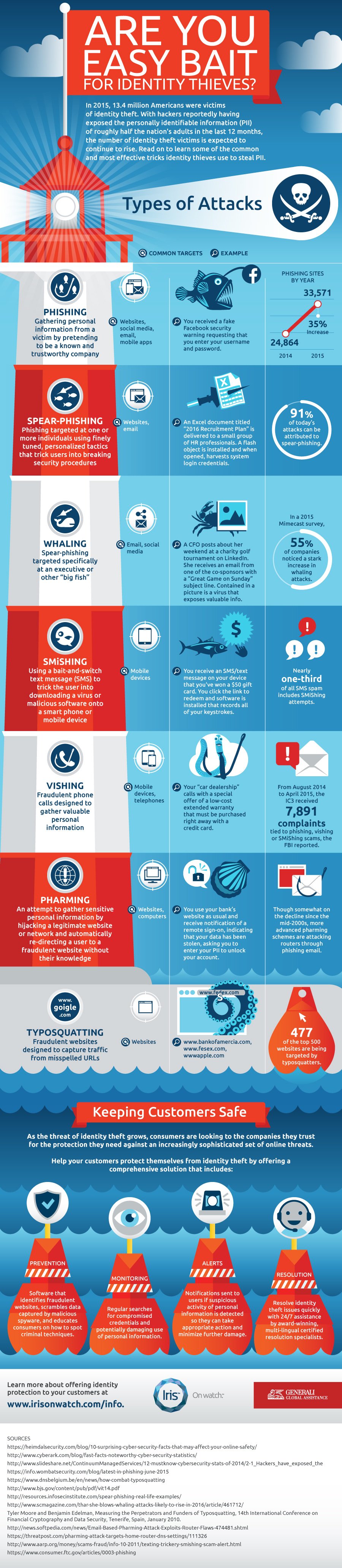

RSN™ Infographic – Are You Easy Bait For Identity Thieves?

Do You Know All The Ways An Identity Thief Can Target Victims Online?

There were over 15 million victims of identity fraud in 2016, and it is estimated that it doubled in 2017.

Javelin Research reports that overall fraud incidence rose 16% in 2016 to affect 6.15% of U.S. consumers, from 5.30% in 2015 — the highest on record.

Smart thieves are using new and increasingly convincing social engineering tactics to obtain the confidential information they need to steal identities. Read the infographic below to learn some of the lesser known but still very common tactics an identity thief can use to access data and how you and your customers can avoid becoming their next victims!

Scams have evolved to become much more than just loss of money for victims: scams often involve the loss of personally identifiable information (PII), which can give way to identity fraud. And identity fraud is nothing to shrug off. In fact, U.S. consumers – 29% to be exact – are now more concerned about fraud than they were just three years ago. Today, the risks are well-known and your customers are looking for protection.

We know “identity theft” and “identity fraud” are serious matters, but if asked, many people would have a tough time differentiating. Often, the two words are used interchangeably, by both experts and consumers alike. So let’s dive into the details.

Identity theft is the actual act of stealing other people’s PII, such as their address, birth date, Social Security Number (SSN), credit card numbers, driver’s license number, or any combination of these, usually with the intention of assuming an identity or reselling the stolen PII for financial benefit (as is most often the case in data breaches). Identity fraud, on the other hand, is when the criminal takes this information, without authorization, and defrauds the person (i.e., makes unauthorized withdrawals from an existing bank account or takes out a loan in their name). Thus, it can be generally said that identity theft precedes identity fraud.

RSN™ Team

a division of SCARS™

Miami Florida U.S.A.

END

WESTERN UNION REPAYMENT PROGRAM NEWS

FOR THE LATEST INFORMATION ABOUT THE WESTERN UNION REPAYMENT / REMISSION PROGRAM CLICK HERE – IT IS STILL OPEN FOR A PETITIONS FOR REPAYMENT

– – –

Tell us about your experiences with Romance Scammers in our Scams Discussion Forum on Facebook »

FAQ: How Do You Properly Report Scammers?

It is essential that law enforcement knows about scams & scammers, even though there is nothing (in most cases) that they can do.

Always report scams involving money lost or where you received money to:

- Local Police – ask them to take an “informational” police report – say you need it for your insurance

- Your National Police or FBI (www.IC3.gov)

- The Scars Worldwide Reporting Network HERE or on www.Anyscam.com

This helps your government understand the problem, and allows law enforcement to add scammers on watch lists worldwide.

Visit our NEW Main SCARS™ News & Information Facebook page for much more information about scams and online crime: www.facebook.com/SCARS.News.And.Information

To learn more about SCARS visit www.AgainstScams.org

Please be sure to report all scammers HERE or on www.Anyscam.com

All original content is Copyright © 1991 – 2018 SCARS All Rights Reserved Worldwide & Webwide – RSN/Romance Scams Now & SCARS/Society of Citizens Against Romance Scams are all trademarks of Society of Citizens Against Romance Scams Inc.

Ho trascorso 5 mesi a chattare con Antonio David Flores…poi ha avuto un problema mentre costruiva una stazione di servizio in Spagna. Mi ha chiesto denaro…e li mi sono documentata…chiuso il rapporto.