SCARS Institute’s Encyclopedia of Scams™ Published Continuously for 25 Years

How Do Scammers & Thieves Get You Personal & Financial Information?

A SCARS Insight

Scammers & Identity Thieves Are Not Stupid!

Scammers and Identity Thieve Steal the Information from Millions of Victims Every Year!

ACCORDING TO SOME REPORTS THERE IS A

1 OUT OF 2 CHANCE OF YOU BECOMING AN IDENTITY THEFT VICTIM

Identity theft occurs when someone fraudulently uses your personal information to obtain credit, take out a loan, open accounts, get identification or otherwise use your information in an unauthorized way. Estimates from the Federal Trade Commission suggest that identity theft is on the rise. In fact, identity theft is the fastest growing crime in the country—a crime that affects Coloradans and their credit histories.

Identity theft often tops the list of consumer fraud reports that are filed with the U.S. FTC and other enforcement agencies. While the FTC does not have criminal jurisdiction, it supports the criminal investigation and prosecution of identity theft by serving as a clearinghouse for identity theft reports, part of the FTC’s Consumer Sentinel report database.

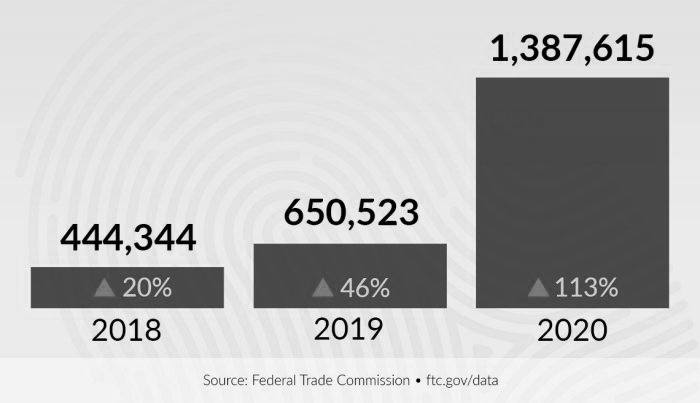

THE NUMBER OF IDENTITY THEFT CASES MORE THAN DOUBLED IN 2020 FROM 2019

How They Get Your Information

Here are some of the ways identity thieves steal your personal and financial information:

- Computer hackers “breaking into” business or personal computers to steal private files and personal financial information, commonly known as a data breach.

- Stealing your purse or wallet to obtain social security cards, credit cards, driver’s licenses, etc.

- Stealing mail being delivered to your home or left out for pick-up.

- Diverting your mail to another mailbox using a false “change-of-address” request.

- “Dumpster diving”— thieves dig through dumpsters or garbage cans behind homes or businesses looking for discarded checks or bank statements, credit card or other account bills, medical records, pre-approved credit applications, etc.

- “Shoulder surfing”— thieves watch over your shoulder as you enter your PIN into an ATM.

- “Pretext calls”— thieves call to “verify” account information or to “confirm” an enrollment or subscription by having you repeat bank or credit card account numbers.

- Using false or misleading Internet sites to collect personal and financial information.

- Purchasing personal information from unscrupulous employees at companies with which you do business.

- Burglarizing homes and businesses looking for purses, wallets, computers and digital devices, files containing personal and financial information.

- Phony e-mail or “pop-up” messages known as clickbait, phishing, and spam that appear to be from your credit card company, Internet Service Provider or other entity you do business with. These phony messages claim some problem with your account and direct you to another website where you will be asked to supply a credit card and other personal information or download malicious software or malware.

- ATM skimming involves the placement of a mechanical card reader over or into the actual card reader on an ATM machine. These fake card readers will capture your account number and possibly even your PIN code, which are then used to produce counterfeit credit or debit cards.

What Do They Want That Information For?

- Collect government benefits in your name by using your SSN or ID# to apply for a job or to obtain a tax return refund.

- Drain your bank account with electronic transfers, counterfeit checks, or your debit card.

- Open a bank or credit account in your name and write bad checks, make charges that never get paid off, which gets reflected on your credit report.

- Use your name if they get arrested or for conducting illegal activity such as drug purchases that could result in warrants being issued in your name or go on your permanent record.

- Obtain a driver’s license or a job with your personal information.

- Buy a car or property and use your information and credit history to get a loan for it.

- Obtain utility services in your name, such as phone or Internet.

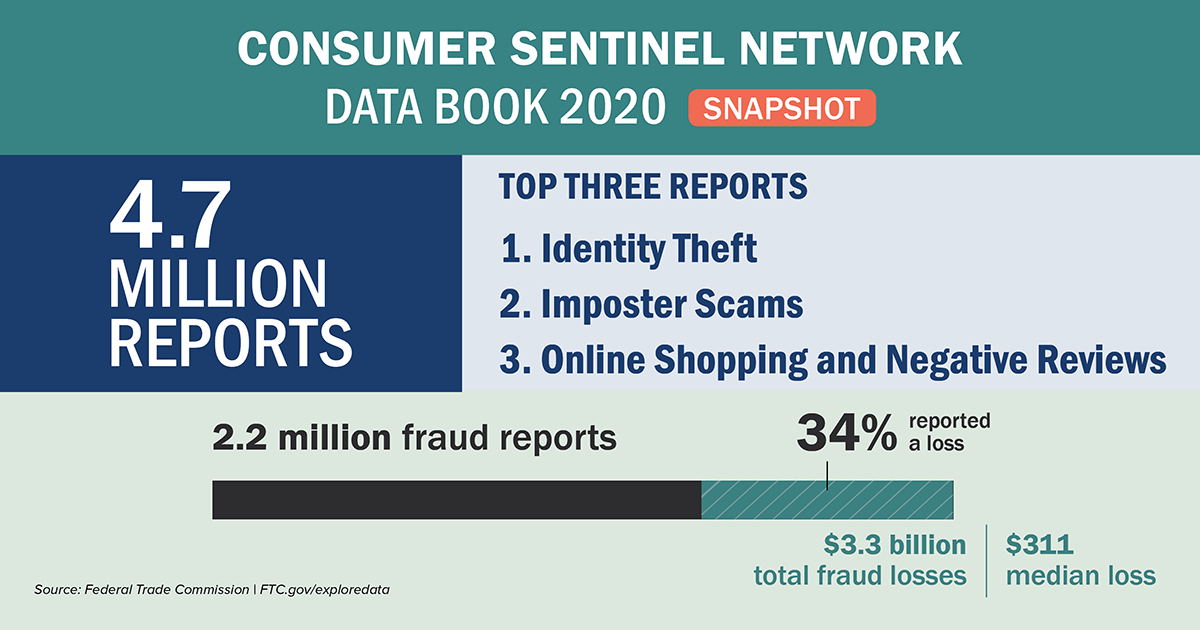

Key Fraud Indications In 2020:

- There were 2.18 million reports of fraud, and impostor scams (meaning identity theft) were the most common type of fraud. Howevere, it is estimated that less that 5% of all victims every report these crimes.

- These involve criminals posing as others to steal money or personal information from victims.

- Frauds grew from 1.72 million reports in 2019, and year-over-year losses climbed to more than $3.3 billion in 2020 from $1.8 billion a year earlier. Consider that this may be less that 3% of the actual.

- Not everyone who reports fraud actually lost money: Only 18 percent of those age 80 and older said the fraud deprived them of assets. The elderly were largest average loss of any group at over $1,300.

- Average fraud losses were $635 for victims age 70 to 79; $436 for those 60 to 69; $325 for those 50 to 59; $278 for those 40 to 49; $250 for those 30 to 39; $324 for those 20 to 29; and $180 for those 19 and younger. Those below the age of 30 almost never report these crimes.

Who Is Most At Risk For Identity Theft?

Most identity thefts are crimes of opportunity. Identity thieves often target those who don’t regularly check for identity theft warning signs and are unlikely to report irregular activity on their credit reports.

CHILDREN AND SENIORS

Everyone with a Social Security number is at risk for identity theft, but two demographics are targeted aggressively and often: the very young and the very old.

- Children are targeted because identity thieves can use a child’s Social Security numbers to establish a fraudulent “clean slate.” Identity theft experts recommend parents monitor their children’s credit reports to check for identity theft as often as their own.

- Seniors are targeted most often over the telephone and through internet phishing scams. Some studies suggest that people become more trusting as they age, which explains why it’s more difficult for older adults to detect fraudsters.

THE MILITARY

While deployed, active-duty members of the armed services are particularly vulnerable to identity theft because they may not notice mistakes on their credit reports or receive calls from debt collectors regarding a fraudulent charge. According to FTC reports, military consumers are most affected by credit card and bank fraud.

- 2018 total military consumer credit card fraud reports: 10,590

- 2018 total military consumer bank fraud reports: 5,723

- Military consumers’ reports of employment or tax-related fraud increased by 85% between 2017 and 2018.

- Military members are also increasingly affected by loan or lease fraud.

2018 Military Consumer Loan Or Lease Fraud Reports

| Fraud type | Total reports | % Difference from previous year |

|---|---|---|

| Business/personal loan | 1,168 | +19% |

| Auto loan/lease | 832 | +40% |

| Real estate loan | 385 | +36% |

| Apartment or house rented | 380 | +79% |

| Non-federal student loan | 257 | +18% |

| Federal student loan | 192 | +22% |

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment below!

Table of Contents

LEAVE A COMMENT?

Thank you for your comment. You may receive an email to follow up. We never share your data with marketers.

Recent Comments

On Other Articles

- Arwyn Lautenschlager on Love Bombing And How Romance Scam Victims Are Forced To Feel: “I was love bombed to the point that I would do just about anything for the scammer(s). I was told…” Feb 11, 14:24

- on Dani Daniels (Kira Lee Orsag): Another Scammer’s Favorite: “You provide a valuable service! I wish more people knew about it!” Feb 10, 15:05

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “We highly recommend that you simply turn away form the scam and scammers, and focus on the development of a…” Feb 4, 19:47

- on The Art Of Deception: The Fundamental Principals Of Successful Deceptions – 2024: “I experienced many of the deceptive tactics that romance scammers use. I was told various stories of hardship and why…” Feb 4, 15:27

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “Yes, I’m in that exact situation also. “Danielle” has seriously scammed me for 3 years now. “She” (he) doesn’t know…” Feb 4, 14:58

- on An Essay on Justice and Money Recovery – 2026: “you are so right I accidentally clicked on online justice I signed an agreement for 12k upfront but cd only…” Feb 3, 08:16

- on The SCARS Institute Top 50 Celebrity Impersonation Scams – 2025: “Quora has had visits from scammers pretending to be Keanu Reeves and Paul McCartney in 2025 and 2026.” Jan 27, 17:45

- on Scam Victims Should Limit Their Exposure To Scam News & Scammer Photos: “I used to look at scammers photos all the time; however, I don’t feel the need to do it anymore.…” Jan 26, 23:19

- on After A Scam, No One Can Tell You How You Will React: “This article was very informative, my scams happened 5 years ago; however, l do remember several of those emotions and/or…” Jan 23, 17:17

- on Situational Awareness and How Trauma Makes Scam Victims Less Safe – 2024: “I need to be more observant and I am practicing situational awareness. I’m saving this article to remind me of…” Jan 21, 22:55

ARTICLE META

Important Information for New Scam Victims

- Please visit www.ScamVictimsSupport.org – a SCARS Website for New Scam Victims & Sextortion Victims

- Enroll in FREE SCARS Scam Survivor’s School now at www.SCARSeducation.org

- Please visit www.ScamPsychology.org – to more fully understand the psychological concepts involved in scams and scam victim recovery

If you are looking for local trauma counselors please visit counseling.AgainstScams.org or join SCARS for our counseling/therapy benefit: membership.AgainstScams.org

If you need to speak with someone now, you can dial 988 or find phone numbers for crisis hotlines all around the world here: www.opencounseling.com/suicide-hotlines

A Note About Labeling!

We often use the term ‘scam victim’ in our articles, but this is a convenience to help those searching for information in search engines like Google. It is just a convenience and has no deeper meaning. If you have come through such an experience, YOU are a Survivor! It was not your fault. You are not alone! Axios!

A Question of Trust

At the SCARS Institute, we invite you to do your own research on the topics we speak about and publish, Our team investigates the subject being discussed, especially when it comes to understanding the scam victims-survivors experience. You can do Google searches but in many cases, you will have to wade through scientific papers and studies. However, remember that biases and perspectives matter and influence the outcome. Regardless, we encourage you to explore these topics as thoroughly as you can for your own awareness.

Statement About Victim Blaming

SCARS Institute articles examine different aspects of the scam victim experience, as well as those who may have been secondary victims. This work focuses on understanding victimization through the science of victimology, including common psychological and behavioral responses. The purpose is to help victims and survivors understand why these crimes occurred, reduce shame and self-blame, strengthen recovery programs and victim opportunities, and lower the risk of future victimization.

At times, these discussions may sound uncomfortable, overwhelming, or may be mistaken for blame. They are not. Scam victims are never blamed. Our goal is to explain the mechanisms of deception and the human responses that scammers exploit, and the processes that occur after the scam ends, so victims can better understand what happened to them and why it felt convincing at the time, and what the path looks like going forward.

Articles that address the psychology, neurology, physiology, and other characteristics of scams and the victim experience recognize that all people share cognitive and emotional traits that can be manipulated under the right conditions. These characteristics are not flaws. They are normal human functions that criminals deliberately exploit. Victims typically have little awareness of these mechanisms while a scam is unfolding and a very limited ability to control them. Awareness often comes only after the harm has occurred.

By explaining these processes, these articles help victims make sense of their experiences, understand common post-scam reactions, and identify ways to protect themselves moving forward. This knowledge supports recovery by replacing confusion and self-blame with clarity, context, and self-compassion.

Additional educational material on these topics is available at ScamPsychology.org – ScamsNOW.com and other SCARS Institute websites.

Psychology Disclaimer:

All articles about psychology and the human brain on this website are for information & education only

The information provided in this article is intended for educational and self-help purposes only and should not be construed as a substitute for professional therapy or counseling.

While any self-help techniques outlined herein may be beneficial for scam victims seeking to recover from their experience and move towards recovery, it is important to consult with a qualified mental health professional before initiating any course of action. Each individual’s experience and needs are unique, and what works for one person may not be suitable for another.

Additionally, any approach may not be appropriate for individuals with certain pre-existing mental health conditions or trauma histories. It is advisable to seek guidance from a licensed therapist or counselor who can provide personalized support, guidance, and treatment tailored to your specific needs.

If you are experiencing significant distress or emotional difficulties related to a scam or other traumatic event, please consult your doctor or mental health provider for appropriate care and support.

Also read our SCARS Institute Statement about Professional Care for Scam Victims – click here to go to our ScamsNOW.com website.

SOCIAL MEDIA USERS

It’s relatively easy for cybercriminals to discover a person’s name, date of birth, phone number, hometown and other sensitive information through social media and networking sites. With this information, an identity thief can target victims for phishing and imposter scams.

REPEAT VICTIMS

People who have previously been affected by identity theft are at a greater risk for future identity theft and fraud. According to the Center for Victim Research, 7-10% of the U.S. population are victims of identity fraud each year, and 21% of those experience multiple incidents of identity fraud.

For more information about how victims of identity theft can protect themselves from future fraud, read about the identity theft recovery process.

THE DECEASED

Identity thieves can target the recently departed with information gleaned from public obituaries and access the deceased Social Security number through the Social Security Administration’s Master Death File. Stealing a dead person’s identity is commonly referred to as “ghosting.” Ghosting often goes unnoticed by surviving family members for months or years.