What Is Skimming?

First let us say that this is not an online form of fraud, however, because of the huge impact that it has it is important for everyone to understand how this works and what to watch out for!

Skimming occurs when devices illegally installed on ATMs, point-of-sale (POS) terminals or fuel pumps capture data or record cardholders’ PINs. Criminals use the data to create fake debit or credit cards and then steal from victims’ accounts. It is estimated that skimming costs financial institutions and consumers more than $10 billion each year.

Gasoline Station Fuel Pump Skimming

Fuel pump skimmers are usually attached in the internal wiring of the machine and aren’t visible to the customer.

The skimming devices store data to be downloaded or wirelessly transferred later.

Tips When Using a Fuel Pump

Choose a fuel pump that is closer to the store and in direct view of the attendant. These pumps are less likely to be targets for skimmers.

Run your debit card as a credit card. If that’s not an option, cover the keypad when you enter your PIN.

Consider paying inside with the attendant, not outside at the pump.

Report: If you think you’ve been a victim of skimming, contact your financial institution immediately (first) then your local police.

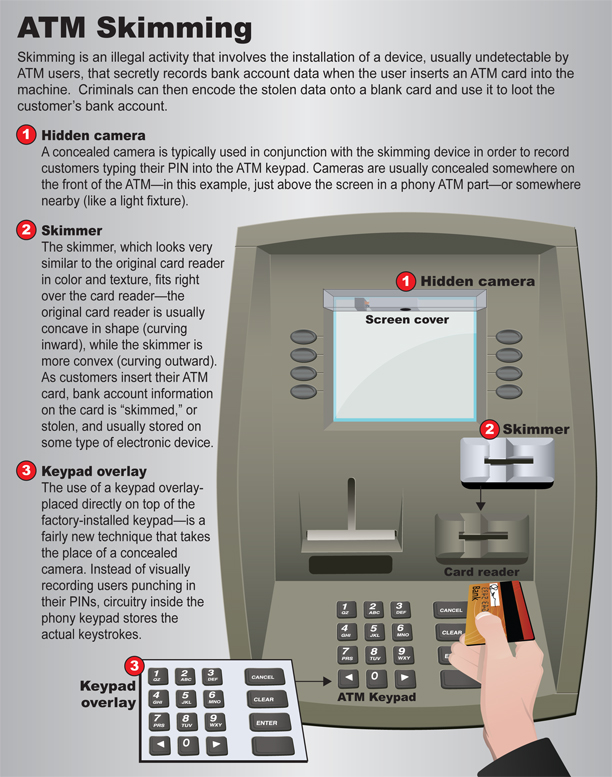

ATM and POS Terminal Skimming

ATM skimmer devices usually fit over the original card reader.

Some ATM skimmers are inserted in the card reader, placed in the terminal, or situated along exposed cables.

Pinhole cameras installed on ATMs record a customer entering their PIN. Please note that pinhole camera placement varies widely.

In some cases, keypad overlays are used instead of pinhole cameras to record PINs. Keypad overlays record a customer’s keystrokes.

Skimming devices store data to be downloaded or wirelessly transferred later.

Tips When Using an ATM or POS Terminal

- Inspect ATMs, POS terminals, and other card readers before using. Look for anything loose, crooked, damaged, or scratched. Don’t use any card reader if you notice anything unusual.

- Pull at the edges of the keypad before entering your PIN. Then, cover the keypad when you enter your PIN to prevent cameras from recording your entry.

- Use ATMs in a well-lit, indoor location, which are less vulnerable targets.

- Be alert for skimming devices in tourist areas, which are popular targets.

- Use debit and credit cards with chip technology. In the U.S., there are fewer devices that steal chip data versus magnetic strip data.

- Avoid using your debit card when you have linked accounts. Use a credit card instead.

- Contact your financial institution if the ATM doesn’t return your card after you end or cancel a transaction.

Leave A Comment