SCARS Institute’s Encyclopedia of Scams™ Published Continuously for 25 Years

Landmark Case Changes Everything For Money Mules

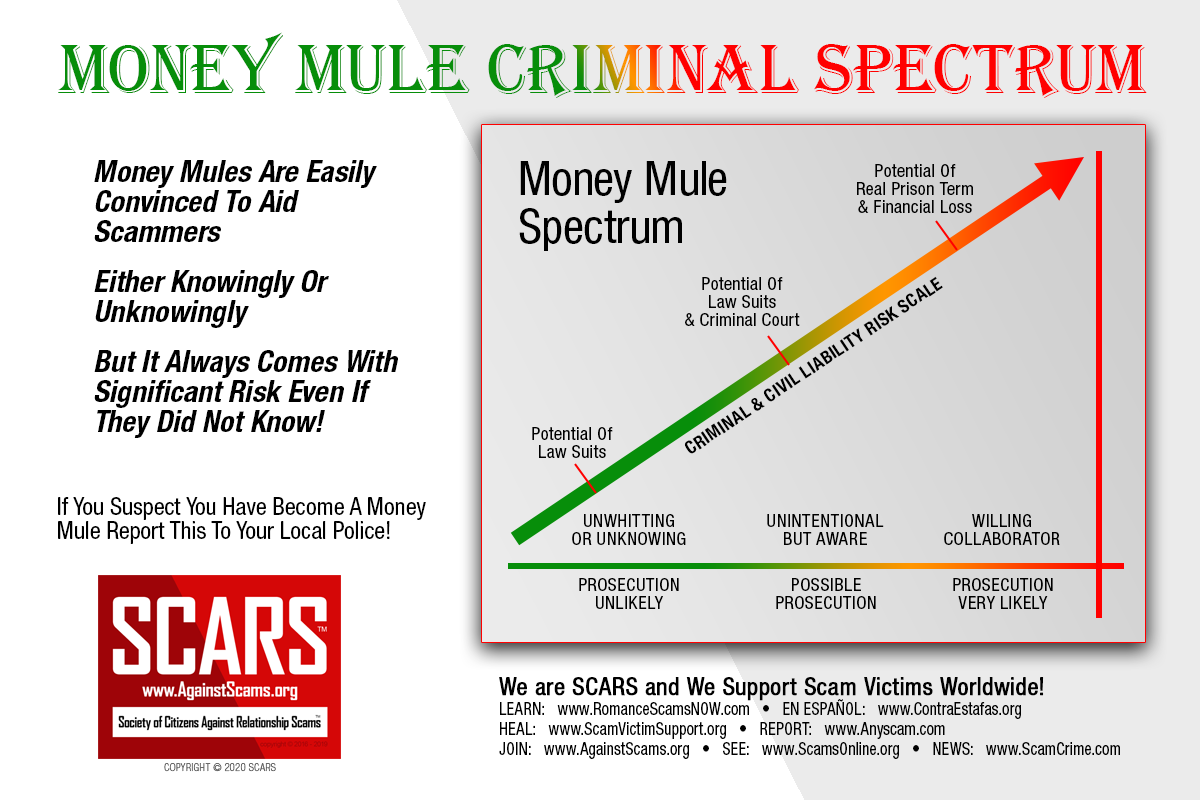

Impatience With Money Mules Is Driving Prosecution

Mules Have Limited Time To Report And Respond Before Prosecution Is Put On The Table

A SCARS Special Report

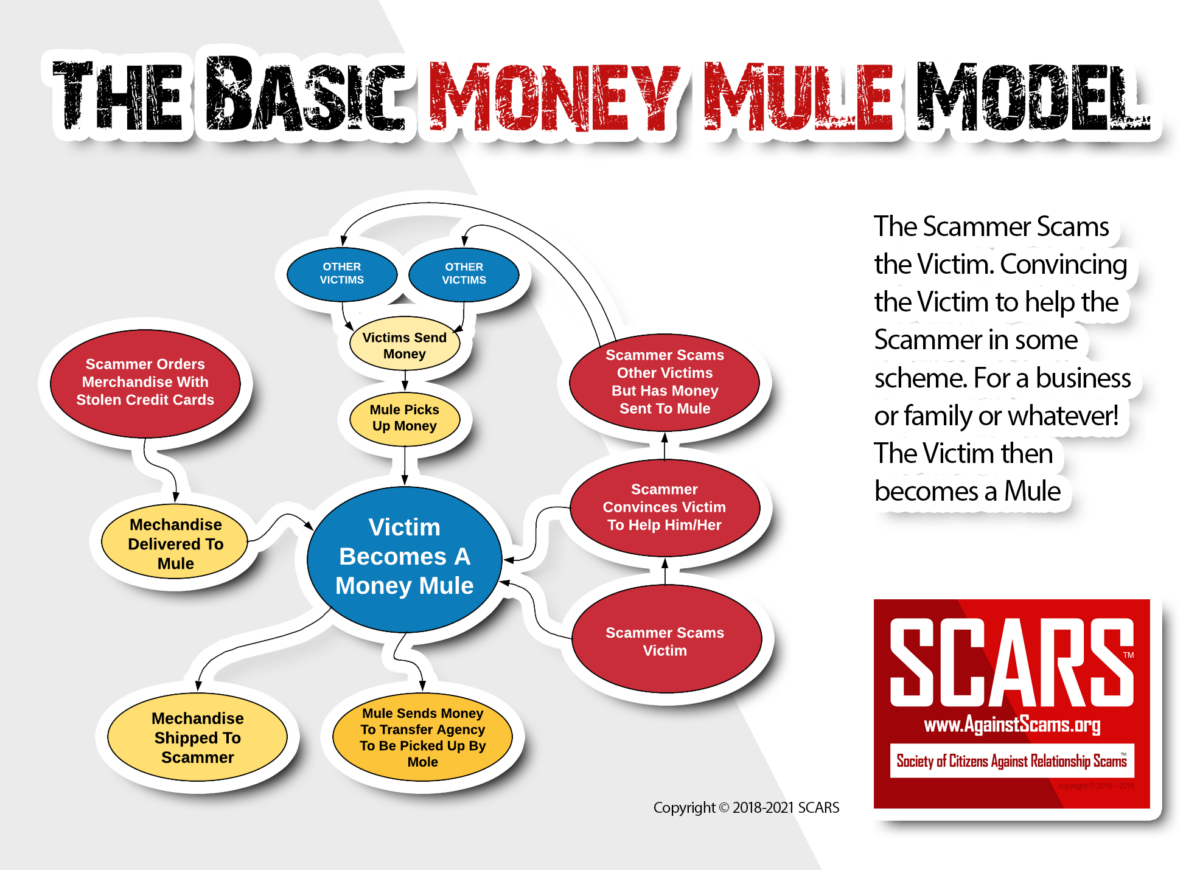

Money Mules Are The Backbone Of Online Criminal Enterprises

More and More, Police & Prosecutors Are Losing Patience with Mules that Do Not Come Forward to End the Criminality!

HERE ARE TWO EXAMPLES

CASE #1

Bristol Woman Pleads Guilty to Conspiracy to Defraud Financial Institutions

ABINGDON, Virginia – Kathleen Littleford, a Bristol, Virginia (U.S.A.) woman, who fraudulently opened several bank accounts, deposited counterfeit checks, and shipped large quantities of cash overseas in order to assistant a man with whom she was involved in an online relationship, pleaded guilty today in U.S. District Court to a federal conspiracy charge, Acting United States Attorney Daniel P. Bubar announced.

Littleford, 76, waived her right to be indicted and pleaded guilty today to one count of conspiracy to execute a scheme to defraud financial institutions to obtain money by false pretenses. At sentencing, Littleford faces up to 30 years in prison and/or a fine of up to $1 million. A sentencing hearing has been scheduled for April 6, 2021.

“Financial fraud cases like this are not victimless crimes,” Acting United States Attorney Bubar said today. “Thousands of Americans are targeted in similar online financial schemes, and when they willingly participate, the fraud is perpetuated. The Western District of Virginia is committed to investigating and prosecuting these kinds of online fraud schemes and we appreciate the good work of our federal and state partners in this case.”

According to court documents, beginning in 2018, Littleford opened a series of bank accounts for the purpose of depositing counterfeit checks and receiving fraudulent transfers of funds from other banking institutions. She did so to assist a man she met online calling himself Frank Peterson. Beginning with his introduction and continuing to the present day, Littleford engaged in an amorous relationship with Peterson, engaging in frequent emailing, text messaging, Facebook messaging, and phone call communications.

“Peterson” made representations to Littleford over the course of their relationship that he made a lot of money in a trade deal in Dubai, that those funds were encumbered by the IRS due to taxes he owed, that he had a lot of money tied up in stocks, and that he needed Littleford’s help receiving funds from banking institutions because he could not transfer money himself, due to the IRS claims on his accounts.

Littleford admitted today that premised on Peterson’s representations and enticed by a reciprocal love and devotion he showed her, Littleford undertook extraordinary measures to comply with Peterson’s fraudulent financial requests. Littleford knew what she was doing was wrong, but knowingly and willfully engaged in the conduct anyway.

Over the course of the scheme, Littleford opened accounts with at least five local banks and fraudulently received move than $190,000 in funds to which she was not entitled.

The investigation of the case was conducted by the Internal Revenue Service and the Russell County Sheriff’s Office. Assistant United States Attorney Daniel J. Murphy is prosecuting the case for the United States.

Here is her LinkedIn Profile: Kathleen Littleford | LinkedIn

Case #2

U.S. State of Arkansas Attorney general sues woman for alleged ‘money mule’ role in online scam

State Attorney Rutledge said the Hot Springs woman “essentially helped to funnel money, estimated at perhaps upwards of $6-million, to scheme operators in Jamaica.”

State Attorney General Leslie Rutledge is suing a Hot Springs Arkansas woman and accusing her of being a “money mule” who facilitated a fake online lottery scam for thieves in Jamaica.

“Jean Butler has been acting as a money mule and facilitating a multi-million dollar sweepstakes scheme,” the Republican attorney general said during a Wednesday news conference. “She essentially helped to funnel money, estimated at perhaps upwards of $6-million, to scheme operators in Jamaica.”

Butler, 73, allegedly served as the American midpoint in addition to being the mule.

Typically, in scams targeting the elderly, the caller says you won a huge prize if you just pay us a fee. Rutledge says Butler didn’t make the calls, but instead, opened the bank accounts for the victims to deposit money into, which thieves in the island nation would then plunder.

“They were simply having to ‘pay the taxes’ or having to pay a fee associated with that prize,” Rutledge said. “Jean Butler would then allow someone in Jamaica to withdraw those monies.”

The civil lawsuit says as many as 50 victims came from across the country and Canada. A woman in Missoula, Mont., first mentioned a specific person in Hot Springs to authorities, triggering the Arkansas investigation.

Other victims came from Nebraska, Kansas, and Ontario.

Rutledge hinted that Butler may have been lured into the scheme by online or e-mail ads that offer easy “work from home” jobs, but she vehemently stressed that she believes Butler knew what she was doing.

“Jean Butler knew exactly what she was doing,” she said. “Jean Butler accepted these checks, she opened up bank accounts, and when the bank accounts by the bank, she would open up another bank account.”

The attorney general shared other details from the investigation, including Butler allegedly telling banks she would be traveling to Jamaica, and so there was no need to flag any suspicious transactions.

“Customs has informed us she does not even have a passport, much less traveled to Jamaica,” Rutledge said.

The case is a civil lawsuit, but Rutledge says the FBI has a criminal investigation underway. A phone number connected to Butler’s address is disconnected. The summons was set to be served Wednesday, so court records did not list a lawyer for Butler that evening.

It will eventually go before Judge Wendell Griffen in Pulaski County Circuit Court.

How To Stop Being A Mule?

As we have said many times, a Mule must report the crimes and their involvement to the local police immediately. However, we also strongly recommend that they contact a criminal defense attorney first to explore the case and have the attorney negotiate their cooperation to minimize the potential consequences.

Historically, money mules that were lured into helping a criminal as a part of a romance scam have not been prosecuted, as long as they came forward voluntarily. When the police discover a mule through investigation and find that they have remained silent then that is a different story, with a much more tragic potential outcome.

A SINGLE MONEY MULE CAN BE RESPONSIBLE FOR THE VICTIMIZATION OF THOUSANDS OF VICTIMS.

Stopping money mules is key to reducing scams and fraud schemes worldwide.

Every money mule has the choice to stop and to report the crime.

Not reporting is a choice, they then become an accessory.

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment below!

Table of Contents

- Impatience With Money Mules Is Driving Prosecution

- More and More, Police & Prosecutors Are Losing Patience with Mules that Do Not Come Forward to End the Criminality!

- Bristol Woman Pleads Guilty to Conspiracy to Defraud Financial Institutions

- U.S. State of Arkansas Attorney general sues woman for alleged ‘money mule’ role in online scam

- A SINGLE MONEY MULE CAN BE RESPONSIBLE FOR THE VICTIMIZATION OF THOUSANDS OF VICTIMS.

- Every money mule has the choice to stop and to report the crime.

- Not reporting is a choice, they then become an accessory.

- Did You Receive Money From A Scammer, Or Give A Scammer Access To Your Accounts?

LEAVE A COMMENT?

Recent Comments

On Other Articles

- Arwyn Lautenschlager on Love Bombing And How Romance Scam Victims Are Forced To Feel: “I was love bombed to the point that I would do just about anything for the scammer(s). I was told…” Feb 11, 14:24

- on Dani Daniels (Kira Lee Orsag): Another Scammer’s Favorite: “You provide a valuable service! I wish more people knew about it!” Feb 10, 15:05

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “We highly recommend that you simply turn away form the scam and scammers, and focus on the development of a…” Feb 4, 19:47

- on The Art Of Deception: The Fundamental Principals Of Successful Deceptions – 2024: “I experienced many of the deceptive tactics that romance scammers use. I was told various stories of hardship and why…” Feb 4, 15:27

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “Yes, I’m in that exact situation also. “Danielle” has seriously scammed me for 3 years now. “She” (he) doesn’t know…” Feb 4, 14:58

- on An Essay on Justice and Money Recovery – 2026: “you are so right I accidentally clicked on online justice I signed an agreement for 12k upfront but cd only…” Feb 3, 08:16

- on The SCARS Institute Top 50 Celebrity Impersonation Scams – 2025: “Quora has had visits from scammers pretending to be Keanu Reeves and Paul McCartney in 2025 and 2026.” Jan 27, 17:45

- on Scam Victims Should Limit Their Exposure To Scam News & Scammer Photos: “I used to look at scammers photos all the time; however, I don’t feel the need to do it anymore.…” Jan 26, 23:19

- on After A Scam, No One Can Tell You How You Will React: “This article was very informative, my scams happened 5 years ago; however, l do remember several of those emotions and/or…” Jan 23, 17:17

- on Situational Awareness and How Trauma Makes Scam Victims Less Safe – 2024: “I need to be more observant and I am practicing situational awareness. I’m saving this article to remind me of…” Jan 21, 22:55

ARTICLE META

Important Information for New Scam Victims

- Please visit www.ScamVictimsSupport.org – a SCARS Website for New Scam Victims & Sextortion Victims

- Enroll in FREE SCARS Scam Survivor’s School now at www.SCARSeducation.org

- Please visit www.ScamPsychology.org – to more fully understand the psychological concepts involved in scams and scam victim recovery

If you are looking for local trauma counselors please visit counseling.AgainstScams.org or join SCARS for our counseling/therapy benefit: membership.AgainstScams.org

If you need to speak with someone now, you can dial 988 or find phone numbers for crisis hotlines all around the world here: www.opencounseling.com/suicide-hotlines

A Note About Labeling!

We often use the term ‘scam victim’ in our articles, but this is a convenience to help those searching for information in search engines like Google. It is just a convenience and has no deeper meaning. If you have come through such an experience, YOU are a Survivor! It was not your fault. You are not alone! Axios!

A Question of Trust

At the SCARS Institute, we invite you to do your own research on the topics we speak about and publish, Our team investigates the subject being discussed, especially when it comes to understanding the scam victims-survivors experience. You can do Google searches but in many cases, you will have to wade through scientific papers and studies. However, remember that biases and perspectives matter and influence the outcome. Regardless, we encourage you to explore these topics as thoroughly as you can for your own awareness.

Statement About Victim Blaming

SCARS Institute articles examine different aspects of the scam victim experience, as well as those who may have been secondary victims. This work focuses on understanding victimization through the science of victimology, including common psychological and behavioral responses. The purpose is to help victims and survivors understand why these crimes occurred, reduce shame and self-blame, strengthen recovery programs and victim opportunities, and lower the risk of future victimization.

At times, these discussions may sound uncomfortable, overwhelming, or may be mistaken for blame. They are not. Scam victims are never blamed. Our goal is to explain the mechanisms of deception and the human responses that scammers exploit, and the processes that occur after the scam ends, so victims can better understand what happened to them and why it felt convincing at the time, and what the path looks like going forward.

Articles that address the psychology, neurology, physiology, and other characteristics of scams and the victim experience recognize that all people share cognitive and emotional traits that can be manipulated under the right conditions. These characteristics are not flaws. They are normal human functions that criminals deliberately exploit. Victims typically have little awareness of these mechanisms while a scam is unfolding and a very limited ability to control them. Awareness often comes only after the harm has occurred.

By explaining these processes, these articles help victims make sense of their experiences, understand common post-scam reactions, and identify ways to protect themselves moving forward. This knowledge supports recovery by replacing confusion and self-blame with clarity, context, and self-compassion.

Additional educational material on these topics is available at ScamPsychology.org – ScamsNOW.com and other SCARS Institute websites.

Psychology Disclaimer:

All articles about psychology and the human brain on this website are for information & education only

The information provided in this article is intended for educational and self-help purposes only and should not be construed as a substitute for professional therapy or counseling.

While any self-help techniques outlined herein may be beneficial for scam victims seeking to recover from their experience and move towards recovery, it is important to consult with a qualified mental health professional before initiating any course of action. Each individual’s experience and needs are unique, and what works for one person may not be suitable for another.

Additionally, any approach may not be appropriate for individuals with certain pre-existing mental health conditions or trauma histories. It is advisable to seek guidance from a licensed therapist or counselor who can provide personalized support, guidance, and treatment tailored to your specific needs.

If you are experiencing significant distress or emotional difficulties related to a scam or other traumatic event, please consult your doctor or mental health provider for appropriate care and support.

Also read our SCARS Institute Statement about Professional Care for Scam Victims – click here to go to our ScamsNOW.com website.

Thank you for your comment. You may receive an email to follow up. We never share your data with marketers.