SCARS Institute’s Encyclopedia of Scams™ Published Continuously for 25 Years

On December 16, 2021 SCARS Was Invited By The U.S. Federal Trade Commission To Testify

On that day, the FTC held a meeting to vote on new rulemaking to outlaw certain impersonation scams. SCARS was there in the meeting to support the new regulation and to give testimony on other issues.

SCARS Director Dr. Tim McGuinness presented testimony in support of the proposed rulemaking on the elimination of impersonation scams, and on two other very important issues for all scam victims: 1) the ways that social media restricts information sharing about online scams and the role that social media plays in fostering them, and 2) the ways that social media engages in fraud by sustaining vast quantities of fake or false user accounts or profiles, and then uses those as the basis of establishing pricing for advertisers and valuation for their shareholders. We also asked the FTC to work with the Consumer Product Safety Commission to regulate social media as an unsafe product.

The Commission said that:

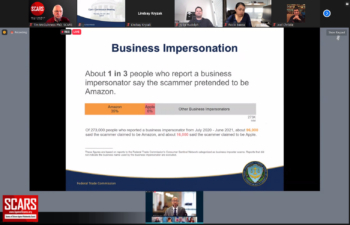

Impersonation fraud in general—including business, government, friend and family, romance, and tech support impersonation—has increased during the pandemic, with reported total losses of $2 billion between October 2020 and September 2021 (up 85% year over year). Since the pandemic began, COVID-specific scam reports have included 12,491 complaints of government impersonation and 8,794 complaints of business impersonation. The incidence of business impersonation climbed higher during the pandemic as commerce shifted significantly online: There were 273,000 complaints about business impersonation during the period of July 2020 through June 2021, of which roughly one-third—over 96,000—identify Amazon. Consumers reported losing more than $27 million to Amazon impersonation alone.

[SCARS NOTE: Remember that reports are typically only about 1% of the actual crimes. Thus, if the FTC reports US$2 billion, then the actual amount can be well over US$200 billion]

This represents a significant move forward, especially considering the previous U.S. Administration’s executive orders on cybercrime that were canceled by the current administration.

The FTC believes that this will have a chilling effect on impersonation scams, since it will impose sanctions against service providers that enable these scams.

FTC Commission Meeting Photo Gallery

SCARS Meeting Summary By Dr. Tim McGuinness

FTC Launches Rulemaking to Combat Sharp Spike in Impersonation Fraud

The Full FTC Announcement:

The Federal Trade Commission launched a rulemaking today aimed at combatting government and business impersonation fraud, a pernicious and prevalent problem that has grown worse during the pandemic. Impersonators use all methods of communication to trick their targets into trusting that they are the government or an established business and then trade on this trust to steal their identity or money.

The COVID-19 pandemic has spurred a sharp spike in impersonation fraud, as scammers capitalize on confusion and concerns around shifts in the economy stemming from the pandemic. Incorporating new data from the Social Security Administration, reported costs have increased an alarming 85 percent year-over year, with $2 billion in total losses between October 2020 and September 2021. Notably, since the pandemic began, COVID-specific scam reports have included 12,491 complaints of government impersonation and 8,794 complaints of business impersonation.

“It is reprehensible that scammers are preying on people during this pandemic by pretending to be someone they can trust,” said Samuel Levine, Director of the FTC’s Bureau of Consumer Protection. “The sharp spike in impersonation scams has cost our country billions and undermined response and relief efforts. The FTC is prepared to use every tool in our toolbox to deter government and business impersonation fraud, penalize wrongdoers, and return money to those harmed.”

Government and business impersonators can take many forms, posing as, for example, a lottery official, a government official or employee, or a representative from a well-known business or charity. Impersonators may also use implicit representations, such as misleading domain names and URLs and “spoofed” contact information, to create an overall net impression of legitimacy. These scammers are fishing for information they can use to commit identity theft or seek monetary payment, often requesting funds via wire transfer, gift cards, or increasingly cryptocurrency.

Government impersonators typically assert an air of authority to stage their scam. These impersonators sometimes threaten their target with severe consequences such as a discontinuation of benefits, enforcement of tax liability, and even arrest or prosecution. Government impersonators have also been known to deceive consumers into paying for services that would otherwise be free, or to lure them with promises of government grants, prizes, or loan forgiveness.

Business impersonators typically get consumers’ attention with emails, telephone calls or text messages about suspicious activity on consumers’ accounts or computers or supposed good news about a refund or prize in hopes of gaining trust and receiving personal information. The harm is substantial, as people who lose money on the leading business impersonator scams report an individual median loss of $1,000.

In the Advance Notice of Proposed Rulemaking (ANPR), the FTC is seeking comment from the public on a wide range of questions about these schemes. The ANPR outlines the extensive data the Commission has collected related to these types of impersonation scams, drawn largely from the FTC’s Consumer Sentinel Network database of fraud reports, and its law enforcement experience in this area.

The FTC has brought numerous cases against government and business impersonation schemes through the years under its existing authorities, but the ANPR notes that the Commission’s authority to seek consumer redress or civil penalties in these cases is currently very limited. The provisions related to impersonation under the Telemarketing Sales Rule and Mortgage Assistance Relief Services Rule cover only specific sectors or methods of scams.

This is the first rulemaking initiated under the Commission’s streamlined rulemaking procedures. A potential rule resulting from the ANPR could allow the FTC to seek strong relief for consumers across a broad array of government and business impersonation cases, which is especially important following the Supreme Court’s ruling in AMG Capital Management LLC v. FTC. If, after reviewing the public comments in response to the ANPR, the Commission decides to proceed with proposing such a trade regulation rule, its next step would be to issue a notice of proposed rulemaking.

The Commission vote to approve the Federal Register notice announcing the ANPR was 4-0. Chair Lina M. Khan issued a statementand Commissioner Christine S. Wilson released her remarks. The notice will be published in the Federal Register soon. Instructions for filing comments appear in the notice. Comments must be received 30 days from the publication date of the Notice.

The Federal Trade Commission works to promote competition, stop deceptive and unfair business practices and scams, and educate consumers. Report fraud, scams, or bad business practices at ReportFraud.ftc.gov. Get consumer advice at consumer.ftc.gov. Also, follow the FTC on social media, subscribe to press releases, and read the FTC’s blogs.

According to the FTC Chair Lina M. Khan

Regarding the Advance Notice of Proposed Rulemaking

on Government & Business Impersonation

Commission File No. R207000 – December 16, 2021Government and business impersonation schemes cheat American consumers and small businesses out of billions of dollars every year. These scammers often pretend to be working for government institutions—like the Social Security Administration, the IRS, or law enforcement—and tell targets that if they don’t hand over money or submit sensitive personal information, they could lose a government benefit, face a tax liability—or even be arrested. Sometimes these fraudsters pull off these schemes instead by pretending to be working for a well-known brand or company.

Both our enforcement work and consumer data suggest that government and business impersonation scams appear highly prevalent and increasingly harmful. These scams have been the top category of fraud reports and the largest source of total reported consumer financial losses for several years.

Impersonation fraud in general has skyrocketed during the pandemic—with impersonation fraudsters scamming Americans out of around $2 billion between October of last year and September of this year, an 85% increase year-over-year. Government and business impersonators have shamelessly capitalized on the health, safety, and financial worries catalyzed by the COVID-19 crisis—not only tricking Americans into handing over their money or sensitive personal information, but also impeding access to needed goods, services, and benefits.

While these scams affect consumers from all walks of life, our data show that scammers often specifically target the most vulnerable, including senior citizens, communities of color, and small businesses.

The FTC routinely prosecutes these scams and has returned millions of dollars to defrauded consumers. In the last fiscal year alone, FTC’s law enforcement work delivered more than $403 million back to consumers. However, the recent Supreme Court decision in AMG Capital Management, LLC v. FTC has significantly curbed our ability to recover money for the victims of these schemes.

To ensure that we can continue to protect Americans from these fraudsters, our staff has recommended that we initiate a rulemaking proceeding to codify a prohibition on impersonator fraud. I strongly support the issuance of this Advance Notice of Proposed Rulemaking. It is critical that our 13(b) authority be restored. It is also incumbent on the Commission to use the full range of tools that Congress has given us to ensure that Americans are protected from these fraudsters.

A rulemaking in this area could likely have a market-wide impact and serve as a deterrent for bad actors, given that a rule here would subject first-time violators to civil penalties.

It could also enable the Commission to obtain redress for the people who lose money to these impersonation scams. This effort is particularly critical post-AMG and would represent one of the most significant anti-fraud initiatives at the agency in decades.

I urge my colleagues to support this ANPR and broader efforts to use our full authority to protect Americans from government and business impersonation scams. I will look forward to public comments and engagement during our rulemaking proceeding to inform this effort.

The decision to adopt the rule-making was unanimous by the Commission.

The New Regulation Against Impersonation Scams

16 CFR Part 461: Trade Regulation Rule on Impersonation of Government and Businesses

The new regulation was approved unanimously by the FTC, but there is a process of public comment and a time delay before it becomes effective.

Text of the New Rule as Published

SUMMARY:

The Federal Trade Commission (“Commission”) proposes to commence a rulemaking proceeding to address certain deceptive or unfair acts or practices of impersonation. The Commission is soliciting written comment, data, and arguments concerning the need for such a rulemaking to prevent persons, entities, and organizations from impersonating government agencies or staff and businesses or their agents.

SUPPLEMENTARY INFORMATION:

I. General Background Information

The Commission is publishing this document pursuant to Section 18 of the Federal Trade Commission (“FTC”) Act, 15 U.S.C. 57a; the provisions of Part 1, Subpart B, of the Commission’s Rules of Practice, 16 CFR 1.7 through 1.20; and 5 U.S.C. 553. This authority permits the Commission to promulgate, modify, and repeal trade regulation rules that define with specificity acts or practices that are unfair or deceptive in or affecting commerce within the meaning of Section 5(a)(1) of the FTC Act, 15 U.S.C. 45(a)(1).

II. Objectives the Commission Seeks To Achieve and Possible Regulatory Alternatives

A. Background

Impersonation scams are a leading source of consumer fraud reported to the Commission, with the highest total financial loss for consumers. Impersonation scams can take many forms, but they generally involve scammers pretending to be a trusted source who convinces their targets to send money or to disclose personal information.[1] In the first three quarters of 2021, more than 788,000 impersonation scams were reported to the Commission, with a total reported monetary loss of about $1.6 billion dollars.[2] These scams often specifically target older consumers and communities of color [3] as well as small businesses.[4] Two prevalent categories of impersonation scams most frequently reported by consumers are government impersonators and business impersonators.[5]

Government and business impersonators are fishing for information they can use to commit identity theft or seek monetary payment, often requesting funds via wire transfer, gift cards, or (increasingly) cryptocurrency.[6] The impersonator can take many forms, posing as, for example, a lottery official, a government official or employee, or a representative from a well-known business or charity. Impersonators may also use implicit representations, such as misleading domain names and URLs and “spoofed” contact information, to create an overall net impression of legitimacy.

Government impersonators typically assert an air of authority to stage their scam, and they use all methods of communication to reach their targets. These scammers sometimes threaten a target with severe consequences such as a discontinuation of benefits,[8] enforcement of tax liability,[9] and even arrest or prosecution.[10] Another observed tactic of government impersonators is to deceive consumers into paying for services that would otherwise be free,[11] or to lure them with promises of government grants, prizes, or loan forgiveness.[12] Business impersonators typically get consumers’ attention with emails, telephone calls, or text messages about suspicious activity on consumers’ accounts or computers or supposed good news about a refund or prize in hopes of gaining trust and receiving personal information.[13]

Data reported to the FTC and the Commission’s law enforcement experience indicate strongly that government impersonation scams are highly prevalent and increasingly harmful. From January 1, 2017 through September 30, 2021, consumers reported 1,362,996 instances of government impersonation and associated total losses of roughly $922,739,109.[14] The most common such schemes involved Social Security Administration (SSA) impersonators, with more than 308,000 complaints alleging SSA impersonation, followed by the IRS (124,000) and Health and Human Services/Medicare programs (125,000).[15] There were also several thousand reports of scammers impersonating government grant-makers (19,000); FBI, police, or sheriff personnel (11,500); the FTC (9,500); the Treasury Department (14,000); and the U.S. Postal Service (6,500).[16]

Scammers have been quick to capitalize on the COVID-19 pandemic by exploiting consumers’ concerns about their health and safety, public misinformation and confusion surrounding the crisis, and the government’s response, which has fueled various COVID-related impersonation scams.[17]

Business impersonation scams cause a similarly enormous amount of financial harm to the public. From January 1, 2017 through September 30, 2021, consumers reported being defrauded of roughly $852 million in 753,555 business impersonation incidents.[18] For business impersonation frauds reported in the FTC’s Consumer Sentinel Network, consumers most frequently identified impersonators of Amazon and Apple. Other common impersonations include Publisher’s Clearing House, tech companies such as Microsoft and Facebook, retail banks (Bank of America, Wells Fargo, Citigroup, and JPMorgan), utilities (Comcast, Verizon, and AT&T), and consumer goods brands such as Costco and Walmart.[19]

Impersonation fraud in general—including business, government, friend and family, romance, and tech support impersonation—has increased during the pandemic, with reported total losses of $2 billion between October 2020 and September 2021 (up 85% year over year).[20] Since the pandemic began, COVID-specific scam reports have included 12,491 complaints of government impersonation and 8,794 complaints of business impersonation.[21] The incidence of business impersonation climbed higher during the pandemic as commerce shifted significantly online: There were 273,000 complaints about business impersonation during the period of July 2020 through June 2021, of which roughly one third—over 96,000—identify Amazon.[22] Consumers reported losing more than $27 million to Amazon impersonation alone.[23]

Although the Commission has brought many cases involving impersonator scams under Section 5 of the FTC ACT, 15 U.S.C. 45, its current remedial authority is limited. The U.S. Supreme Court recently held that equitable monetary relief, including consumer redress, is not available under Section 13(b) of the FTC Act.[24] Additionally, consumer redress under Section 19(b), 15 U.S.C. 57b(a) through (b), is limited and challenging to obtain without a rule violation. The Commission believes a rule addressing certain types of unfair or deceptive acts or practices involving impersonation, including affiliation and endorsement, of government and businesses could help reduce the level of fraud in this area and serve as an additional deterrent for bad actors in the future because such a trade regulation rule would subject first-time violators to civil penalties.[25] It would also enable the Commission to obtain redress for consumers who lost money to impersonation scams.

Click here to view the regulation as published with footnotes and supplemental information

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment below!

Table of Contents

- This is the first significant action to help protect consumers since 2020

- The Commission said that:

- FTC Commission Meeting Photo Gallery

- The Full FTC Announcement:

- According to the FTC Chair Lina M. Khan

- 16 CFR Part 461: Trade Regulation Rule on Impersonation of Government and Businesses

- Text of the New Rule as Published

LEAVE A COMMENT?

Recent Comments

On Other Articles

- Arwyn Lautenschlager on Love Bombing And How Romance Scam Victims Are Forced To Feel: “I was love bombed to the point that I would do just about anything for the scammer(s). I was told…” Feb 11, 14:24

- on Dani Daniels (Kira Lee Orsag): Another Scammer’s Favorite: “You provide a valuable service! I wish more people knew about it!” Feb 10, 15:05

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “We highly recommend that you simply turn away form the scam and scammers, and focus on the development of a…” Feb 4, 19:47

- on The Art Of Deception: The Fundamental Principals Of Successful Deceptions – 2024: “I experienced many of the deceptive tactics that romance scammers use. I was told various stories of hardship and why…” Feb 4, 15:27

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “Yes, I’m in that exact situation also. “Danielle” has seriously scammed me for 3 years now. “She” (he) doesn’t know…” Feb 4, 14:58

- on An Essay on Justice and Money Recovery – 2026: “you are so right I accidentally clicked on online justice I signed an agreement for 12k upfront but cd only…” Feb 3, 08:16

- on The SCARS Institute Top 50 Celebrity Impersonation Scams – 2025: “Quora has had visits from scammers pretending to be Keanu Reeves and Paul McCartney in 2025 and 2026.” Jan 27, 17:45

- on Scam Victims Should Limit Their Exposure To Scam News & Scammer Photos: “I used to look at scammers photos all the time; however, I don’t feel the need to do it anymore.…” Jan 26, 23:19

- on After A Scam, No One Can Tell You How You Will React: “This article was very informative, my scams happened 5 years ago; however, l do remember several of those emotions and/or…” Jan 23, 17:17

- on Situational Awareness and How Trauma Makes Scam Victims Less Safe – 2024: “I need to be more observant and I am practicing situational awareness. I’m saving this article to remind me of…” Jan 21, 22:55

ARTICLE META

Important Information for New Scam Victims

- Please visit www.ScamVictimsSupport.org – a SCARS Website for New Scam Victims & Sextortion Victims

- Enroll in FREE SCARS Scam Survivor’s School now at www.SCARSeducation.org

- Please visit www.ScamPsychology.org – to more fully understand the psychological concepts involved in scams and scam victim recovery

If you are looking for local trauma counselors please visit counseling.AgainstScams.org or join SCARS for our counseling/therapy benefit: membership.AgainstScams.org

If you need to speak with someone now, you can dial 988 or find phone numbers for crisis hotlines all around the world here: www.opencounseling.com/suicide-hotlines

A Note About Labeling!

We often use the term ‘scam victim’ in our articles, but this is a convenience to help those searching for information in search engines like Google. It is just a convenience and has no deeper meaning. If you have come through such an experience, YOU are a Survivor! It was not your fault. You are not alone! Axios!

A Question of Trust

At the SCARS Institute, we invite you to do your own research on the topics we speak about and publish, Our team investigates the subject being discussed, especially when it comes to understanding the scam victims-survivors experience. You can do Google searches but in many cases, you will have to wade through scientific papers and studies. However, remember that biases and perspectives matter and influence the outcome. Regardless, we encourage you to explore these topics as thoroughly as you can for your own awareness.

Statement About Victim Blaming

SCARS Institute articles examine different aspects of the scam victim experience, as well as those who may have been secondary victims. This work focuses on understanding victimization through the science of victimology, including common psychological and behavioral responses. The purpose is to help victims and survivors understand why these crimes occurred, reduce shame and self-blame, strengthen recovery programs and victim opportunities, and lower the risk of future victimization.

At times, these discussions may sound uncomfortable, overwhelming, or may be mistaken for blame. They are not. Scam victims are never blamed. Our goal is to explain the mechanisms of deception and the human responses that scammers exploit, and the processes that occur after the scam ends, so victims can better understand what happened to them and why it felt convincing at the time, and what the path looks like going forward.

Articles that address the psychology, neurology, physiology, and other characteristics of scams and the victim experience recognize that all people share cognitive and emotional traits that can be manipulated under the right conditions. These characteristics are not flaws. They are normal human functions that criminals deliberately exploit. Victims typically have little awareness of these mechanisms while a scam is unfolding and a very limited ability to control them. Awareness often comes only after the harm has occurred.

By explaining these processes, these articles help victims make sense of their experiences, understand common post-scam reactions, and identify ways to protect themselves moving forward. This knowledge supports recovery by replacing confusion and self-blame with clarity, context, and self-compassion.

Additional educational material on these topics is available at ScamPsychology.org – ScamsNOW.com and other SCARS Institute websites.

Psychology Disclaimer:

All articles about psychology and the human brain on this website are for information & education only

The information provided in this article is intended for educational and self-help purposes only and should not be construed as a substitute for professional therapy or counseling.

While any self-help techniques outlined herein may be beneficial for scam victims seeking to recover from their experience and move towards recovery, it is important to consult with a qualified mental health professional before initiating any course of action. Each individual’s experience and needs are unique, and what works for one person may not be suitable for another.

Additionally, any approach may not be appropriate for individuals with certain pre-existing mental health conditions or trauma histories. It is advisable to seek guidance from a licensed therapist or counselor who can provide personalized support, guidance, and treatment tailored to your specific needs.

If you are experiencing significant distress or emotional difficulties related to a scam or other traumatic event, please consult your doctor or mental health provider for appropriate care and support.

Also read our SCARS Institute Statement about Professional Care for Scam Victims – click here to go to our ScamsNOW.com website.

Thank you for your comment. You may receive an email to follow up. We never share your data with marketers.