SCARS Institute’s Encyclopedia of Scams™ Published Continuously for 25 Years

Stolen Photos & Identity Theft

According to estimates from the federal Bureau of Justice Statistics, nearly 17 million people experienced at least one incident of identity theft in 2012 (last year data available), causing financial losses totaling almost $25 billion. In 2013, the Federal Trade Commission (FTC) reported that identity theft complaints are the most common consumer complaint, affecting Americans of all ages and backgrounds.

Unfortunately, all too often people post their most secret information on social media. From Date of birth, to parents, to social security numbers, people do not think through how much is accessible to scammers and identity thieves.

To address the growing threat of identity theft, in 2008, the United States Congress passed the Identity Theft Enforcement and Restitution Act (ITHERA), a federal law that seeks to strengthen efforts to prosecute identity theft while also improving restitution available to victims.

The Identity Theft Enforcement and Restitution Act

What Does The Act Do?

Identity theft was not a federal crime until Congress passed the Identity Theft Assumption Deterrence Act in 1998. However, under that law, certain federal charges could only be brought where the offense involved interstate or foreign communications and, in cases of computer fraud, where the victim suffered at least $5,000 in damages.

When it was passed in 2008, the Identity Theft Assumption and Deterrence Act removed some of these barriers and further promoted prosecutions of identity theft by:

- Allowing prosecution of cases that do not involve interstate or foreign communications

- Removing the requirement to show $5,000 in damages

- Making it a felony to damage, in a one year period, 10 or more computers used by the federal government or financial institutions

- Expanding the definition of cyber-extortion

- Prohibiting conspiracies to commit computer fraud

- Expanding interstate and foreign jurisdiction for prosecution of computer fraud offenses

- Imposing criminal and civil forfeitures of property used to commit computer fraud offenses

- In addition, the Act sought to more fully compensate victims of identity theft by authorizing courts to issue restitution orders that require payments to victims not just for the actual harm caused, but also for the time they spent fixing the damage caused by the theft of their identities.

What Can I Do If My Identity Has Been Stolen?

Along with protecting all of your financial assets, it is important to immediately report any identity theft to the proper authorities. This can help to protect you from further harm and will also enable the authorities to track down the perpetrators before they can harm anyone else.

To report identity theft, contact your local police department or sheriff’s office. You should also file a complaint with the Federal Trade Commission. You can also file a report with your local FBI Office, which investigates violations of federal identity theft laws.

Keep in mind that, with the increased restitution available to victims under the Identity Theft Enforcement and Restitution Act, you may be able to recover not just for your actual losses, but for the time spent in trying to fix all of the damage done. That being said, it is important to keep track of all of your efforts and time spent remedying the harm caused by the theft of your identity.

Additional Resources

If you’ve been a victim of identity theft, you may also want to speak with a consumer protection attorney in your area to ensure that your rights are protected and to determine what additional remedies may be available to you under federal or state law.

Stolen Identity? What to Do Next

Identity theft victims often don’t know their personal information has been compromised until the damage already has been done. Responding early to a stolen identity is key but it’s never too late to take action if you have been a victim of identity theft, including the use of your photos for impersonation.

Victims spend an average of $1,200 in out-of-pocket expenses and anywhere between 175 and 600 hours over months or years recovering from identity theft, according to the Federal Trade Commission. But left unchecked, identity theft victims lose an average of $10,000 per attack.

Follow these steps if you believe you are a victim of stolen identity, while taking detailed notes of actions and conversations and making copies of all written correspondence.

1. Review & Place a Fraud Alert on Your Credit Reports

The following information applies to United States residents, but similar services exist elsewhere.

- There are three companies that maintain credit reports, also called credit bureaus. Each is legally required to contact the other two once a fraud alert has been made, but contact any credit reporting companies that fail to provide a confirmation of your fraud alert.

- TransUnion: 1-800-680-7289; www.transunion.com; Fraud Victim Assistance Division, P.O. Box 6790, Fullerton, CA 92834-6790

- Equifax: 1-800-525-6285; www.equifax.com; P.O. Box 740241, Atlanta, GA 30374-0241

- Experian: 1-888-EXPERIAN (397-3742); www.experian.com; P.O. Box 9554, Allen, TX 75013Each of the three credit reporting companies is required to provide a free copy of your credit report once a fraud alert has been made. Review them carefully, looking for inquiries from companies you haven’t contacted, accounts you haven’t opened and debts on current accounts that don’t make sense.

- Get any inaccurate or fraudulent information, such as a misspelled name or incorrect Social Security number, removed. The FTC has instructions for doing this. Use an Identity Theft Report to protect your rights and recover from the crime.

- The initial fraud alert, recommended for those who think they may have been an identity theft victim, lasts for 90 days. This freezes the issuance of any new cards or credit increases for existing accounts and blocks any new credit applications. An extended fraud alert may be obtained by sending the credit reporting bureau a copy of your Identity Theft Report (see link above) and remains in place for up to seven years.

- Check your credit reports often to detect any additional signs of identity theft.

2. Close All Accounts That May Have Been Tampered or Opened Fraudulently

- Contact each company or bank and speak with someone in the fraud or security department, following up in writing (this is important). Include copies of relevant supporting documents but keep the originals in a file. Send letters by certified mail, return receipt requested, so you can document what each company received and when.

- Ask the company for forms to dispute any transactions, such as debits or charges to your existing accounts, made by the identity thief. If they don’t provide such forms, use the FTC’s sample letter (DOC) to help you draft a formal dispute. Address the letter to the company’s “billing inquiries” department, not the address for payments.

- For new unauthorized accounts, file your dispute directly with the company or file a police report (see #4) first and then provide a copy of the “Identity Theft Report” to the company. Filing such an official police report first often gives you greater protection, since companies presented with an Identity Theft Report are required to stop reporting fraudulent information.

- But if you would rather just file a dispute directly with the company first, ask if the company accepts the “ID Theft Affidavit” (PDF) provided by the FTC. If not, ask a company representative for its fraud dispute forms.

- After resolving your identity theft dispute, ask for written confirmation that the company has closed the fraudulent accounts and discharged fraudulent debts. Keep this in your records as proof against any potential future errors in your credit report.

- Use new PIN numbers and passwords when opening new accounts, avoiding personal information such as your birth date or mother’s maiden name.

3. File a Complaint with the Federal Trade Commission (FTC)

- Filing an identity theft complaint with the FTC not only helps you recover from the crime but also assists law enforcement officials track down and apprehend identity thieves. You may file your complaint online, by telephone or by mail.

- 1-877-ID-THEFT (438-4338), TYY: 1-866-653-4261; www.ftccomplaintassistant.gov; Identity Theft Clearinghouse, Federal Trade Commission, 600 Pennsylvania Avenue NW, Washington, DC 20580.

You may update your complaint by calling the Identity Theft Hotline above.- Your printed FTC ID Theft Complaint form can be used to: (1) block fraudulent information from appearing on your credit report; (2) prevent fraudulent debts from reappearing on your credit report; (3) prevent companies from attempting to collect debts resulting from identity theft and (4) expedite the process of placing an extended fraud alert on your credit report.

4. File a Police Report

- Contact your local police department or sheriff’s office and file an official report about your identity theft. Most law enforcement agencies will let you file the report over the phone or via the internet if you’re unable to file it in person. If the police are reluctant to take your report, contact another jurisdiction such as your state police department. You can also check your state Attorney General’s office to see if your state requires police departments to file identity theft reports.

- Bring a printed copy of your FTC ID Theft Complaint form and any supporting information if you file your report in person, as these will help expedite the process.

- Ask the officer to include the ID Theft Complaint with the police report and ask for a copy of the Identity Theft Report (the police report) in order to better help you dispute fraudulent accounts or charges. If the officer is unable to give a copy of the police report (as is the case in some jurisdictions), as him or her to sign your ID Theft Complaint and write the police report number in the “Law Enforcement Report” section of the FTC document.

5. Additional Actions

- Stop payment on checks if an identity thief stole checks or opened bank accounts in your name. Contact one of the following check verification companies to report fraudulent activity: Telecheck (800-710-9898), Certegy (800-437-5120).

- If debt collectors contact you about fraudulent debts, inform them in by phone and in writing that your identity has been stolen. Include supporting documentation, such as a police report, in your letter.

- Contact your local postal inspector if you believe mail in your name is being sent to another address and ask to have it sent to your correct address.

- Contact the Social Security Administration (SSA) if you believe your Social Security number has been used to fraudulently obtain benefits: 800-269-0271, www.socialsecurity.gov/oig.

- If your passport was stolen or you suspect someone has obtained a passport in your name, contact the US State Department: 877-487-2778, www.travel.state.gov.

- Contact your local department of motor vehicles if your driver’s license was stolen or you suspect someone has fraudulently used your driver’s license number. Most states allow identity theft victims to place a fraud alert on their license.

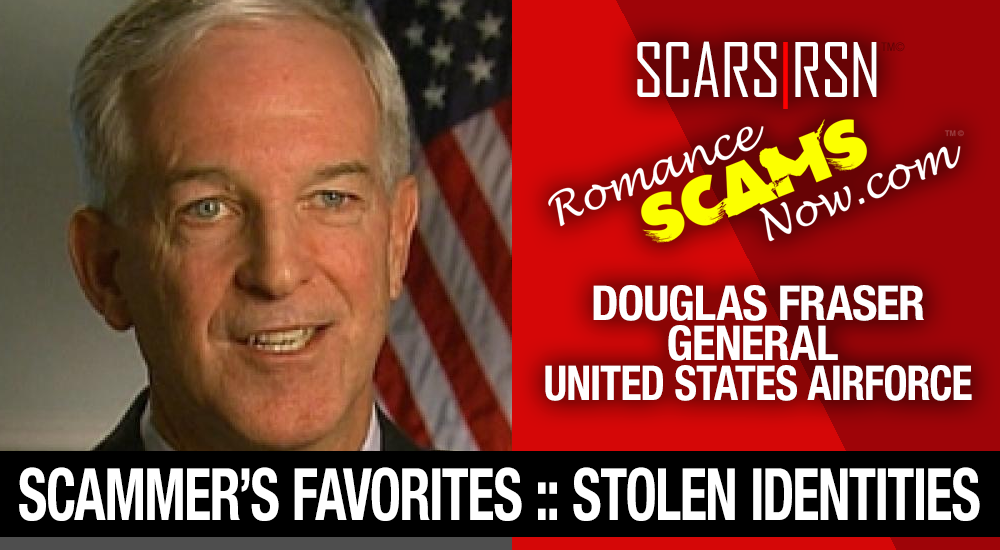

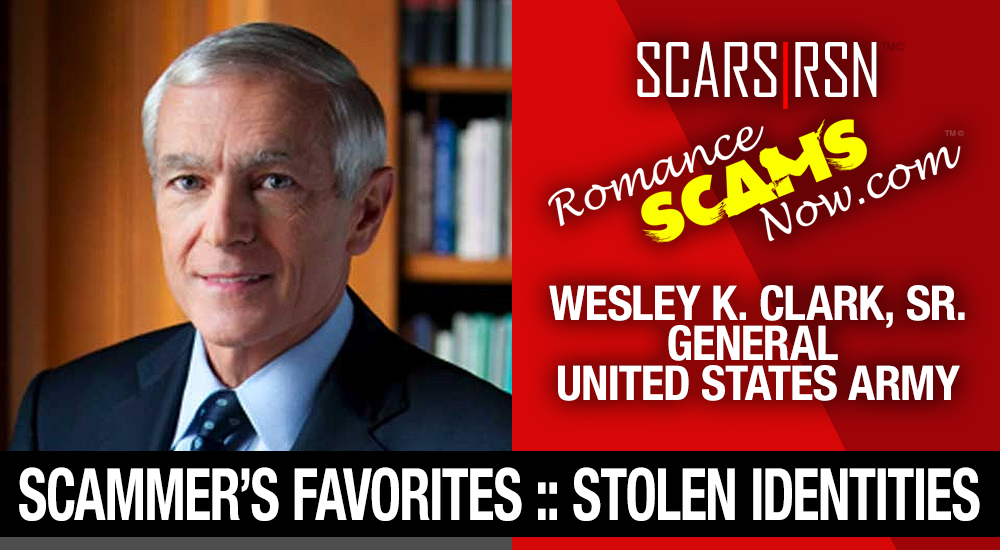

6. Photo Theft & Impersonation

- First determine which photos have been stolen and where they are being used. Document each case – printout or do a screen grab.

- Second, notify the websites, social media, or services where your stolen photos are appearing.

- In most cases a claim of impersonation or identity theft will be sufficient to have them removed. However, in select cases you may have to follow a copyright complaint using a Digital Millennium Copyright Act “Take Down” notice. These can be found online and modified for your purposes. You would address the DMCA notice to the website owners, Hosting Company, and any others that have the ability to remove your photos. A failure to properly respond by removing the photos can result in significant additional liability for the website owner.

- Declare the unlawful use of your photos to your family and friends, so that if they see them they will both be aware and can alert you to additional locations.

- This may be a long process, and if your photos are in the hands of African Fraudsters, it may be a never ending one since they reuse archived photos thousands of times,

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment below!

Table of Contents

LEAVE A COMMENT?

Thank you for your comment. You may receive an email to follow up. We never share your data with marketers.

Recent Comments

On Other Articles

- on Love Bombing And How Romance Scam Victims Are Forced To Feel: “I was love bombed to the point that I would do just about anything for the scammer(s). I was told…” Feb 11, 14:24

- on Dani Daniels (Kira Lee Orsag): Another Scammer’s Favorite: “You provide a valuable service! I wish more people knew about it!” Feb 10, 15:05

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “We highly recommend that you simply turn away form the scam and scammers, and focus on the development of a…” Feb 4, 19:47

- on The Art Of Deception: The Fundamental Principals Of Successful Deceptions – 2024: “I experienced many of the deceptive tactics that romance scammers use. I was told various stories of hardship and why…” Feb 4, 15:27

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “Yes, I’m in that exact situation also. “Danielle” has seriously scammed me for 3 years now. “She” (he) doesn’t know…” Feb 4, 14:58

- on An Essay on Justice and Money Recovery – 2026: “you are so right I accidentally clicked on online justice I signed an agreement for 12k upfront but cd only…” Feb 3, 08:16

- on The SCARS Institute Top 50 Celebrity Impersonation Scams – 2025: “Quora has had visits from scammers pretending to be Keanu Reeves and Paul McCartney in 2025 and 2026.” Jan 27, 17:45

- on Scam Victims Should Limit Their Exposure To Scam News & Scammer Photos: “I used to look at scammers photos all the time; however, I don’t feel the need to do it anymore.…” Jan 26, 23:19

- on After A Scam, No One Can Tell You How You Will React: “This article was very informative, my scams happened 5 years ago; however, l do remember several of those emotions and/or…” Jan 23, 17:17

- on Situational Awareness and How Trauma Makes Scam Victims Less Safe – 2024: “I need to be more observant and I am practicing situational awareness. I’m saving this article to remind me of…” Jan 21, 22:55

ARTICLE META

Important Information for New Scam Victims

- Please visit www.ScamVictimsSupport.org – a SCARS Website for New Scam Victims & Sextortion Victims

- Enroll in FREE SCARS Scam Survivor’s School now at www.SCARSeducation.org

- Please visit www.ScamPsychology.org – to more fully understand the psychological concepts involved in scams and scam victim recovery

If you are looking for local trauma counselors please visit counseling.AgainstScams.org or join SCARS for our counseling/therapy benefit: membership.AgainstScams.org

If you need to speak with someone now, you can dial 988 or find phone numbers for crisis hotlines all around the world here: www.opencounseling.com/suicide-hotlines

A Note About Labeling!

We often use the term ‘scam victim’ in our articles, but this is a convenience to help those searching for information in search engines like Google. It is just a convenience and has no deeper meaning. If you have come through such an experience, YOU are a Survivor! It was not your fault. You are not alone! Axios!

A Question of Trust

At the SCARS Institute, we invite you to do your own research on the topics we speak about and publish, Our team investigates the subject being discussed, especially when it comes to understanding the scam victims-survivors experience. You can do Google searches but in many cases, you will have to wade through scientific papers and studies. However, remember that biases and perspectives matter and influence the outcome. Regardless, we encourage you to explore these topics as thoroughly as you can for your own awareness.

Statement About Victim Blaming

SCARS Institute articles examine different aspects of the scam victim experience, as well as those who may have been secondary victims. This work focuses on understanding victimization through the science of victimology, including common psychological and behavioral responses. The purpose is to help victims and survivors understand why these crimes occurred, reduce shame and self-blame, strengthen recovery programs and victim opportunities, and lower the risk of future victimization.

At times, these discussions may sound uncomfortable, overwhelming, or may be mistaken for blame. They are not. Scam victims are never blamed. Our goal is to explain the mechanisms of deception and the human responses that scammers exploit, and the processes that occur after the scam ends, so victims can better understand what happened to them and why it felt convincing at the time, and what the path looks like going forward.

Articles that address the psychology, neurology, physiology, and other characteristics of scams and the victim experience recognize that all people share cognitive and emotional traits that can be manipulated under the right conditions. These characteristics are not flaws. They are normal human functions that criminals deliberately exploit. Victims typically have little awareness of these mechanisms while a scam is unfolding and a very limited ability to control them. Awareness often comes only after the harm has occurred.

By explaining these processes, these articles help victims make sense of their experiences, understand common post-scam reactions, and identify ways to protect themselves moving forward. This knowledge supports recovery by replacing confusion and self-blame with clarity, context, and self-compassion.

Additional educational material on these topics is available at ScamPsychology.org – ScamsNOW.com and other SCARS Institute websites.

Psychology Disclaimer:

All articles about psychology and the human brain on this website are for information & education only

The information provided in this article is intended for educational and self-help purposes only and should not be construed as a substitute for professional therapy or counseling.

While any self-help techniques outlined herein may be beneficial for scam victims seeking to recover from their experience and move towards recovery, it is important to consult with a qualified mental health professional before initiating any course of action. Each individual’s experience and needs are unique, and what works for one person may not be suitable for another.

Additionally, any approach may not be appropriate for individuals with certain pre-existing mental health conditions or trauma histories. It is advisable to seek guidance from a licensed therapist or counselor who can provide personalized support, guidance, and treatment tailored to your specific needs.

If you are experiencing significant distress or emotional difficulties related to a scam or other traumatic event, please consult your doctor or mental health provider for appropriate care and support.

Also read our SCARS Institute Statement about Professional Care for Scam Victims – click here to go to our ScamsNOW.com website.

![SCARS™ Special Report: Help Wanted Scams [Updated] job scams SCARS™ Special Report: Help Wanted Scams [Updated] job scams](https://romancescamsnow.com/wp-content/uploads/2020/03/job-scams.png)

I have been trying to tell someone that a Minks Dean is on Facebook using Gregory Phillips identity. The police can’t even get him so he would stop.

you are not trying very hard, we have a whole reporting section on our website connected to the SCARS network. Use that.

no usar tinder cuatro persobas que conoci eran falsas identisades

This is great especially the photo theft law holding the thief and the website liable.