SCARS Institute’s Encyclopedia of Scams™ Published Continuously for 25 Years

A SCARS Money Recovery Alert – U.S. Banking Change

Something Important Has Happened In U.S. Banking That Potentially Affects Scam Victims

United States Banking Regulation

A SCARS Insight

A Seismic Shift Has Happened In U.S. Banking Responsibility For Scams!

IF YOU SENT OR LOST MONEY TO A SCAMMER THROUGH A BANK TRANSACTION OR ACCOUNT YOU SHOULD READ THIS

What is the difference between a fraud and a scam? To consumers, there is no difference. But to banks, it’s a much different story.

Fraud is something banks are liable to reimburse customers for. But the bank customer bears the full loss because the customer got conned and gave out their banking details, and they are the responsible party.

For the most part, banks have been able to shift responsibility for preventing scams to their customers and ignore the problem.

According to The Knoble – a humans rights group dedicated to wiping out financial crimes that impact the vulnerable. [SCARS is a member organization of The Knoble]

A Seismic Shift In Scams Is Afoot

- There has been a seismic shift in scams here in the US and banks may not be able to ignore them any longer. There is simply too much at stake.

- 60 million Americans (about 1 in every 5) will be targeted by phone scams alone in 2021, and the massive losses that they are experiencing are now making their way into the banking system.

- This seismic shift has fraud experts concerned. So much so that they predict that scams will become the number one priority of banks over the next 18 months.

According to The Knoble

A Perfect Storm of Events Converge And It’s Changing The Way Scams Are Viewed

A perfect storm of events is behind the shift. And now scams, not fraud have become banks biggest concern.

- First, scams are hitting historic highs across the US victimizing more Americans than ever before. And many of those scams are perpetrated through the bank accounts of victims.

- Second, those rising rates of scams are causing government agencies like the CFPB to step in and provide more guidance to banks on when they should issue refunds to victims.

- And third, banks are starting to realize that their investment in fraud controls may have just shifted fraud to the weakest link in the chain – their customers.

Here is why this is a turning point for Scam Victims that will change banking forever!

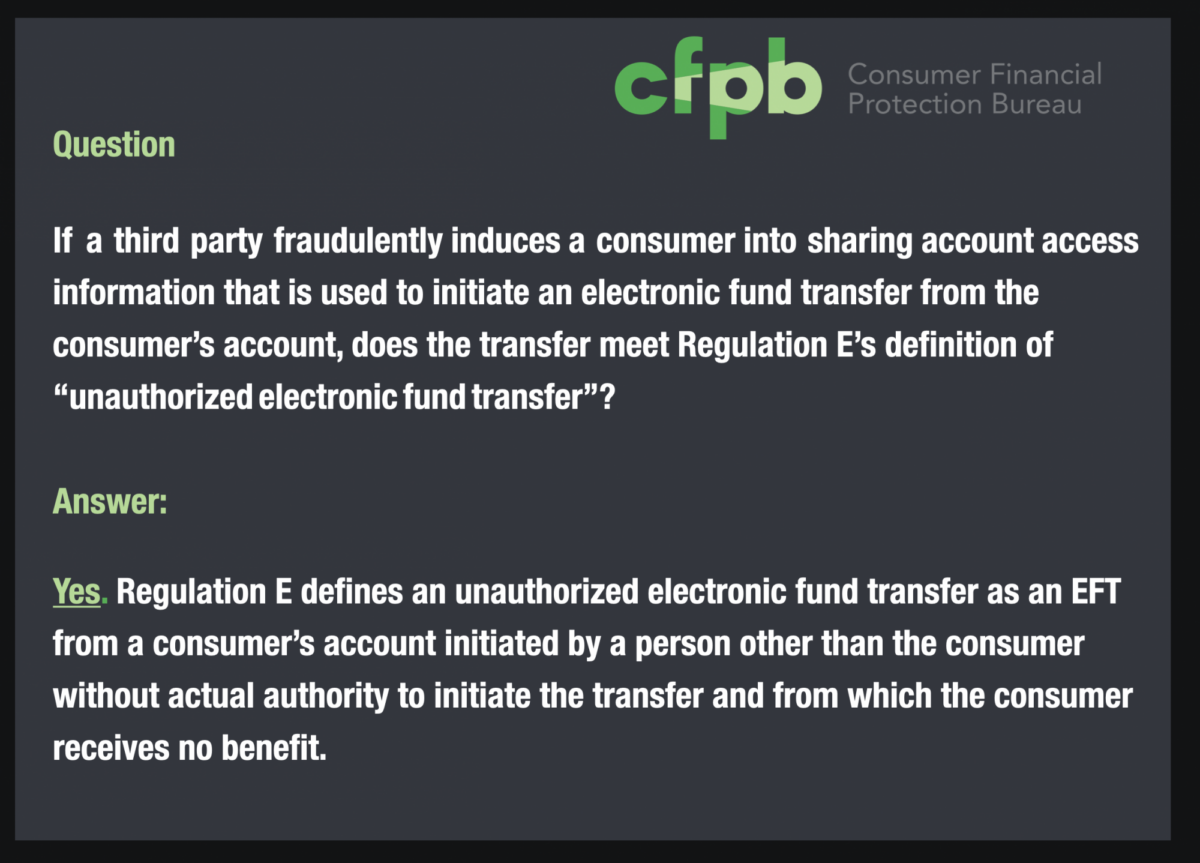

It is because The CFPB Now Applies Reg E To Victims of Some Scams

Something happened this June that could change everything about how banks will look at scams. The CFPB (a U.S. Government Agency) released a FAQ (see below) on electronic funds transfers, and it could very well change the way US Banks refund money to customers that have been victimized. The FAQ clarified that consumers who are induced into providing details about their accounts to fraudsters and scammers are covered under REG E, if any unauthorized activity occurs.

This new guidance by the CFPB seems to change all of that and place more responsibility on banks to accept those fraud claims even when the customer was negligent. This means victims of scams involving Zelle, Debit Cards, Echecks, and Electronic Funds Transfers where their accounts have been drained may now be entitled to get refunds even though they provided their details to the scammers.

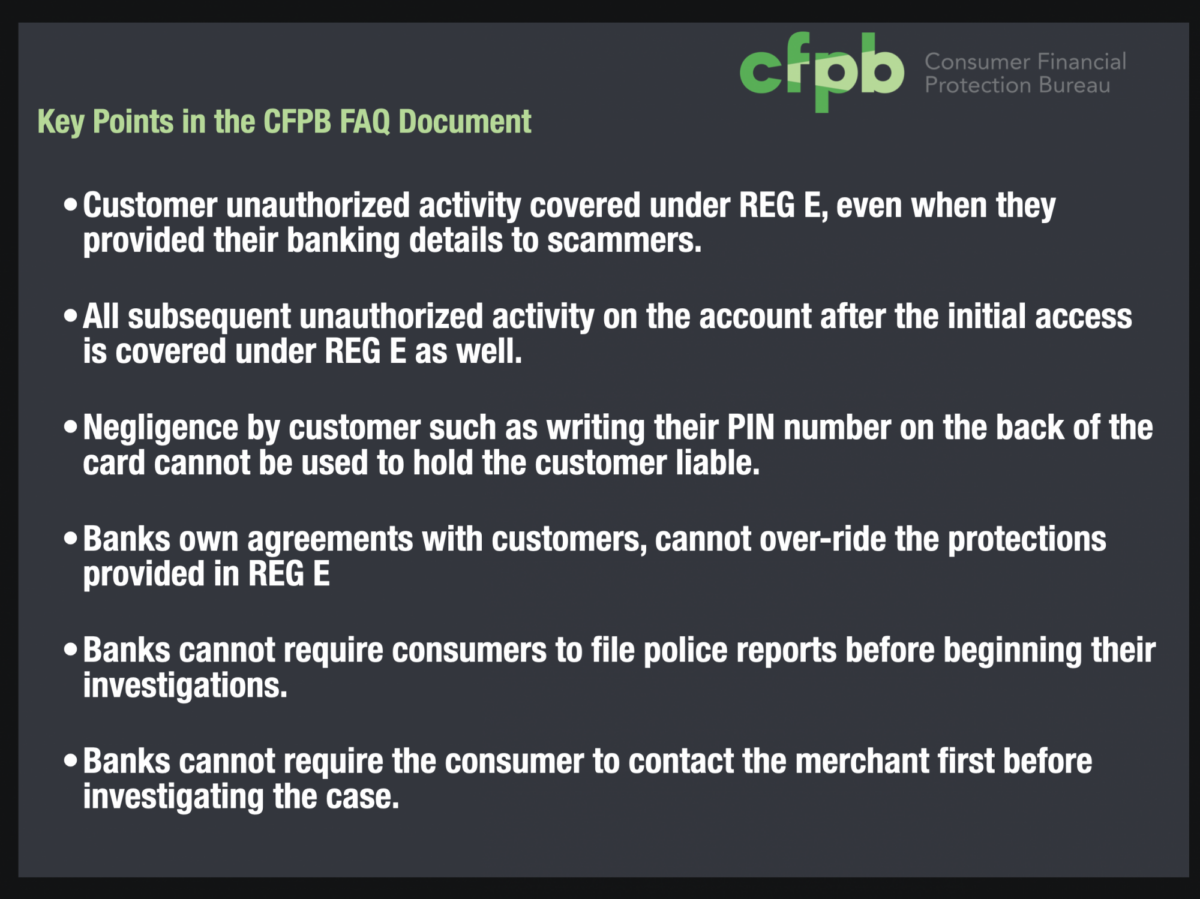

The Document Goes Even Further With Consumer Rights and Spells Out Even More Protections

Their document outlines more key areas where banks can’t necessarily put the onus on the customer.

- All subsequent transactions after the first fraudulent transaction are covered under Reg E.

- Banks can’t make a customer file a police report as a condition for investigating their fraud claim.

- Bank’s own agreements with customers can’t override Reg E protections.

- Banks can’t hold a customer liable for negligence such as writing the PIN number on the back of the card.

- Banks can’t require the customer to “work it out with the merchant” before they will accept the claim.

Requiring Refunds To Scam Victims is A Growing Trend

Governments across the world are taking more active measures to ensure that victims of scams are treated fairly by banks. And nowhere is that more evident than in the UK.

In May of 2019, a coalition of 19 consumer brands covering over 85% of bank transfers voluntarily signed up to reimburse customers when they were victims of advanced push payment fraud.

Banks that are part of the scheme include Barclays; HSBC including First Direct and M&S Bank; Lloyds Banking Group including Halifax, Bank of Scotland and Intelligent Finance; Metro Bank; NatWest, including RBS and Ulster Bank; Nationwide; Santander; Starling and The Co-operative Bank.

As of this year 2021, these banks have collectively reimbursed £147 million to their customers in the UK. And banks like Lloyds have reimbursed 99% of their scam victims’ claims according to the bank.

With this new guidance, American Banks look to follow the UK lead in this.

What You Should Now Do!

Because this is a guidance to an existing law, and not a new law, it may be retroactive and potentially cover all banking transactional or account scams.

However, this article is for the purpose of providing awareness and not a legal opinion. We recommend that all victims who were scammed and lost money contact a qualified attorney to review this law and the new FAQ to determine if you might be eligible for a refund from your bank. But even after making a determination, you should be aware that this may or may not be simple – it could involve letter writing and appeals to state regulators or it might involve litigation – these are all things to discuss with your attorney.

What to do now?

- Get yourself and your information well organized. Before you speak with an attorney, you have to have everything prepared that relates to the banking transactions or accounts. Not the chats and lies, just the real hard information. We recommend that you use the SCARS RED BOOK organizer for this (available at the SCARS Store).

- See an attorney that understands how to interact with financial institutions. Your attorney will help you make the determination if this can help you and the strategies that will work best.

- If needed the guidance FAQ and law are linked below.

- You also have the State Banking regulators on your side to help as well – but regardless, you will need an attorney.

Please, understand that SCARS cannot advise you if you qualify for this or not. You must speak with a licensed attorney. Because this is VERY new, you might be the first case that your attorney and bank will have had to face on this. This means that you should expect the banks to resist.

We wish you the very best of luck in this!

Resources

- CFPB Reg E FAQ

- Electronic Fund Transfers (Regulation E) Law

- Consumer Financial Protection Bureau (CFPB) U.S. Government website

- Source for portions of this article: https://frankonfraud.com/

-/ 30 /-

What do you think about this?

Please share your thoughts in a comment below!

Table of Contents

- Something Important Has Happened In U.S. Banking That Potentially Affects Scam Victims

- IF YOU SENT OR LOST MONEY TO A SCAMMER THROUGH A BANK TRANSACTION OR ACCOUNT YOU SHOULD READ THIS

- What is the difference between a fraud and a scam? To consumers, there is no difference. But to banks, it’s a much different story.

- A Seismic Shift In Scams Is Afoot

- A Perfect Storm of Events Converge And It’s Changing The Way Scams Are Viewed

- Here is why this is a turning point for Scam Victims that will change banking forever!

- Requiring Refunds To Scam Victims is A Growing Trend

- What to do now?

- We wish you the very best of luck in this!

LEAVE A COMMENT?

Recent Comments

On Other Articles

- Arwyn Lautenschlager on Love Bombing And How Romance Scam Victims Are Forced To Feel: “I was love bombed to the point that I would do just about anything for the scammer(s). I was told…” Feb 11, 14:24

- on Dani Daniels (Kira Lee Orsag): Another Scammer’s Favorite: “You provide a valuable service! I wish more people knew about it!” Feb 10, 15:05

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “We highly recommend that you simply turn away form the scam and scammers, and focus on the development of a…” Feb 4, 19:47

- on The Art Of Deception: The Fundamental Principals Of Successful Deceptions – 2024: “I experienced many of the deceptive tactics that romance scammers use. I was told various stories of hardship and why…” Feb 4, 15:27

- on Danielle Delaunay/Danielle Genevieve – Stolen Identity/Stolen Photos – Impersonation Victim UPDATED 2024: “Yes, I’m in that exact situation also. “Danielle” has seriously scammed me for 3 years now. “She” (he) doesn’t know…” Feb 4, 14:58

- on An Essay on Justice and Money Recovery – 2026: “you are so right I accidentally clicked on online justice I signed an agreement for 12k upfront but cd only…” Feb 3, 08:16

- on The SCARS Institute Top 50 Celebrity Impersonation Scams – 2025: “Quora has had visits from scammers pretending to be Keanu Reeves and Paul McCartney in 2025 and 2026.” Jan 27, 17:45

- on Scam Victims Should Limit Their Exposure To Scam News & Scammer Photos: “I used to look at scammers photos all the time; however, I don’t feel the need to do it anymore.…” Jan 26, 23:19

- on After A Scam, No One Can Tell You How You Will React: “This article was very informative, my scams happened 5 years ago; however, l do remember several of those emotions and/or…” Jan 23, 17:17

- on Situational Awareness and How Trauma Makes Scam Victims Less Safe – 2024: “I need to be more observant and I am practicing situational awareness. I’m saving this article to remind me of…” Jan 21, 22:55

ARTICLE META

Important Information for New Scam Victims

- Please visit www.ScamVictimsSupport.org – a SCARS Website for New Scam Victims & Sextortion Victims

- Enroll in FREE SCARS Scam Survivor’s School now at www.SCARSeducation.org

- Please visit www.ScamPsychology.org – to more fully understand the psychological concepts involved in scams and scam victim recovery

If you are looking for local trauma counselors please visit counseling.AgainstScams.org or join SCARS for our counseling/therapy benefit: membership.AgainstScams.org

If you need to speak with someone now, you can dial 988 or find phone numbers for crisis hotlines all around the world here: www.opencounseling.com/suicide-hotlines

A Note About Labeling!

We often use the term ‘scam victim’ in our articles, but this is a convenience to help those searching for information in search engines like Google. It is just a convenience and has no deeper meaning. If you have come through such an experience, YOU are a Survivor! It was not your fault. You are not alone! Axios!

A Question of Trust

At the SCARS Institute, we invite you to do your own research on the topics we speak about and publish, Our team investigates the subject being discussed, especially when it comes to understanding the scam victims-survivors experience. You can do Google searches but in many cases, you will have to wade through scientific papers and studies. However, remember that biases and perspectives matter and influence the outcome. Regardless, we encourage you to explore these topics as thoroughly as you can for your own awareness.

Statement About Victim Blaming

SCARS Institute articles examine different aspects of the scam victim experience, as well as those who may have been secondary victims. This work focuses on understanding victimization through the science of victimology, including common psychological and behavioral responses. The purpose is to help victims and survivors understand why these crimes occurred, reduce shame and self-blame, strengthen recovery programs and victim opportunities, and lower the risk of future victimization.

At times, these discussions may sound uncomfortable, overwhelming, or may be mistaken for blame. They are not. Scam victims are never blamed. Our goal is to explain the mechanisms of deception and the human responses that scammers exploit, and the processes that occur after the scam ends, so victims can better understand what happened to them and why it felt convincing at the time, and what the path looks like going forward.

Articles that address the psychology, neurology, physiology, and other characteristics of scams and the victim experience recognize that all people share cognitive and emotional traits that can be manipulated under the right conditions. These characteristics are not flaws. They are normal human functions that criminals deliberately exploit. Victims typically have little awareness of these mechanisms while a scam is unfolding and a very limited ability to control them. Awareness often comes only after the harm has occurred.

By explaining these processes, these articles help victims make sense of their experiences, understand common post-scam reactions, and identify ways to protect themselves moving forward. This knowledge supports recovery by replacing confusion and self-blame with clarity, context, and self-compassion.

Additional educational material on these topics is available at ScamPsychology.org – ScamsNOW.com and other SCARS Institute websites.

Psychology Disclaimer:

All articles about psychology and the human brain on this website are for information & education only

The information provided in this article is intended for educational and self-help purposes only and should not be construed as a substitute for professional therapy or counseling.

While any self-help techniques outlined herein may be beneficial for scam victims seeking to recover from their experience and move towards recovery, it is important to consult with a qualified mental health professional before initiating any course of action. Each individual’s experience and needs are unique, and what works for one person may not be suitable for another.

Additionally, any approach may not be appropriate for individuals with certain pre-existing mental health conditions or trauma histories. It is advisable to seek guidance from a licensed therapist or counselor who can provide personalized support, guidance, and treatment tailored to your specific needs.

If you are experiencing significant distress or emotional difficulties related to a scam or other traumatic event, please consult your doctor or mental health provider for appropriate care and support.

Also read our SCARS Institute Statement about Professional Care for Scam Victims – click here to go to our ScamsNOW.com website.

Thank you for your comment. You may receive an email to follow up. We never share your data with marketers.